~ Charlie Munger

Oct 30, 2022

Charlie Munger on mistakes

I like people admitting they were complete horses' asses. I know I'll perform better if I rub my nose in my mistakes. This is a wonderful trick to learn.

Labels:

failure,

learning,

mistakes,

people - Munger; Charles

Oct 27, 2022

Warren Buffett on compounding

Life is like a snowball. The important thing is finding wet snow and a really long hill.

~ Warren Buffett

Frederic Bastiat on taxation

Your principle has placed these words above the entrance of the legislative chamber: “whosoever acquires any influence here can obtain his share of legal plunder.” And what has been the result? All classes have flung themselves upon the doors of the chamber crying: “A share of the plunder for me, for me!

~ Frederic Bastiat

E.B Tucker on economic stimulus vs. gold

I want to give people something they can disrupt every dinner party they go to this weekend. There's twelve trillion dollars worth of gold in the entire world, according to Pierre Lassonde's World Gold Council. That's all the gold ever mined in history. The U.S. spent over six trillion dollars this year and all we heard about was "We need more. We're going to starve without the stimulus. We need more." And what did we spend all that money on? Dental shields, plastic coverings, airline bailouts, checks to people so that they could put the money into Robinhood accounts. Ok, that money's all gone. Forget about it. It's not coming back.

~ E.B. Tucker, interview with Daniela Cambone, Stansberry Research, 2:25 mark, November 5, 2020

Labels:

economic stimulus,

gold,

people - Tucker; E.B.

Oct 20, 2022

The Wall Street Journal on the resignation of UK prime minister Liz Truss and the death of stimulus

The rapid rise and fall of Mr. Truss marks a stark lesson for global leaders over the risks of trying to boost their economies with stimulus packages during a period of rising inflation and interest rates.

Ms. Truss’s advisers said balancing the books held back the government’s ability to juice the economy by funding tax cuts with debt, leaving Western nations that are already stuck in a cycle of low growth and ever-rising taxation to fund the U.K.’s public services. Ms. Truss’s team worked on the basis that markets would absorb the debt the U.K. government offered in return for the prospect of 2.5% annual growth.

~ Max Colchester, "U.K. Prime Minister Liz Truss Resigns After Six Weeks; Truss to become shortest-serving prime minister in British history," The Wall Street Journal, October 20, 2022

Labels:

economic stimulus,

people - Truss; Liz,

resignations

Oct 14, 2022

Oct 13, 2022

John Kenneth Galbraith on confirmation bias

Faced with the choice between changing one's mind and proving that there is no need to do so, almost everyone gets busy on the proof.

~ John Kenneth Galbraith

Oct 12, 2022

Joe Biden on the possibility of recession (2022)

I don’t think there will be a recession. If it is, it will be a very slight recession. Look, it’s possible. I don’t anticipate it.

~ President Joe Biden, interview with CNN’s Jake Tapper, October 11, 2022

(Biden’s take came as the International Monetary Fund, a global lender, downgraded its outlook for the world economy and warned of “storm clouds” gathering — among them “persistent” inflation, the fallout from the Ukraine war and a slowdown in China’s property market impacting the global economy.)

Oct 10, 2022

William James on purpose

The great use of life is to spend it doing something that will outlast it.

~ William James, father of American psychology

Phil Grant on Ben Bernanke being awarded the 2022 Nobel Prize in economics

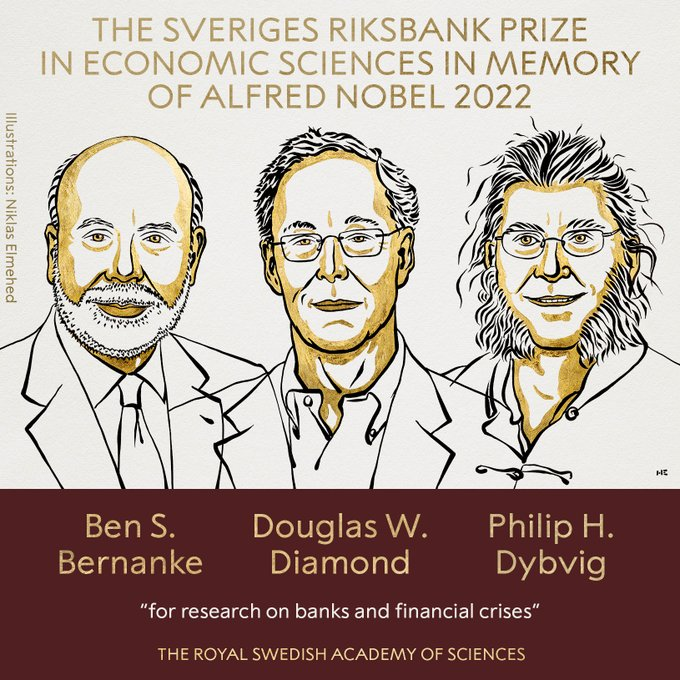

This morning, the Royal Swedish Academy of Sciences announced it will award the 2022 Nobel Prize in economics to a trio of economists including Ben Bernanke, Fed chair from 2006 to 2015 and author of the central bank’s zero rate-cum-asset purchase response to the global financial crisis. Recall that, in response to a query from 60 Minutes in 2010, Bernanke expressed “100 percent” faith in the Fed’s ability to keep a lid on inflation, adding that: "We could raise interest rates in 15 minutes if we have to."

More broadly, Bernanke’s longstanding advocacy for the discretionary, “Ph.D. standard” of monetary management remains a stance worth scrutinizing. In a February 2004 speech, the then-Fed governor extolled the virtues of the “great moderation,” i.e., a decline in volatility across both inflation and economic growth metrics that prevailed since Paul Volcker tamed inflation in the early 1980’s. Among his conclusions:

The historical pattern of changes in the volatilities of output growth and inflation gives some credence to the idea that better monetary policy may have been a major contributor to increased economic stability.Few disagree that monetary policy has played a large part in stabilizing inflation, and so the fact that output volatility has declined in parallel with inflation volatility, both in the United States and abroad, suggests that monetary policy may have helped moderate the variability of output as well.

Everything in moderation, even moderation.

~ Philip Grant, "Crowd Control," Almost Daily Grant's, October 10, 2022

Tom Woods on the World War I blockade against Germany

Think back to World War I, when the Allies continued their starvation blockade of Germany for four months after that country surrendered. Estimates of the consequences of that policy range from 750,000 to 1 million German civilians dead from hunger.

Within a generation, as you will recall, a rather distasteful political party emerged there, whose members, generally young, remembered having nearly been starved to death as children. Resentment over past injustices has been a powerful and destructive force in recent history.

Tom Woods on sanctions on Iraq and inevitable reprisals "in the form of terrorist attacks" (2001)

In general, a policy of sanctions hurts only the civilian population, leaving the government more or less untouched.

If anything, sanctions may even tend to strengthen popular support for the government inasmuch as the leader can now portray himself and his nation as the besieged victims of a vindictive U.S.

Especially disconcerting about the Clinton-Albright policy [of sanctions on Iraq] was its blithe disregard of any long-term consequences for the U.S. essentially starving a helpless country to death.

Set aside the morality of the question for a moment, as Clinton and Albright did, and think only of U.S. interests. The Gulf War has been over for 10 years, and American students still can't distinguish Baghdad from Wagga Wagga on a map. But do you suppose the Iraqi people have forgotten, or ever will?

If the U.S. continues on its present course, it is next to impossible to imagine that we can forever avoid the terrible reprisals, in the form of terrorist attacks - nuclear, chemical or otherwise - that our policy makes almost inevitable.

~ Thomas E. Woods, Jr., "Lift U.S. Sanctions: They Choke The Tyrannized More Than The Tyrants," Investor's Business Daily, March 19, 2001

Dale Carnegie on risk taking

The person who goes farthest is generally the one who is willing to do and dare. The sure-thing boat never gets far from shore.

~ Dale Carnegie

Henry Ward Beecher on failure

One's best success comes after his greatest disappointments.

~ Henry Ward Beecher, American clergyman and writer

Labels:

failure,

people - Beecher; Henry Ward,

success

Frank Lloyd Wright on success

I know the price of success: dedication, hard work and an unremitting devotion to the things you want to see happen.

~ Frank Lloyd Wright

Oct 9, 2022

B.C. Forbes on the entrepreneur

You will find that at the base and birth of every great business organization was an enthusiast, a man consumed with earnestness of purpose, with confidence in his powers, with faith in the worthiness of his endeavors.

~ B.C. Forbes, publisher

Labels:

enthusiasm,

entrepreneurs,

people - Forbes; B.C.

Samuel Johnson on courage

Courage is the greatest of all the virtues, because if you haven't courage, you may not have an opportunity to use any of the others.

~ Samuel Johnson, essayist, critic, lexicographer

Corrie Ten Boom on faith

Faith is like radar that sees through the fog - the reality of things at a distance that the human eye cannot see.

~ Corrie Ten Boom, Holocaust survivor, Dutch author

Chris Conkey: "The central bank's credibility is very high right now" (2000)

The central bank's credibility is very high right now. There's a strong sense the Fed is on top of things.

~ Chris Conkey, Evergreen Investment Management, "Greenspan's Dilemma: The more confident investors are in him, the harder his job becomes," Business Week, April 3, 2000

Oct 8, 2022

Alvin Toffler on literacy

The illiterate of the 21st century will not be those who cannot read and write, but those who cannot learn, unlearn and relearn.

~ Alvin Toffler, Future Shock

Labels:

learning,

lifelong learning,

literacy,

people - Toffler; Alvin

Oct 7, 2022

Frederic Bastiat on the difference between a good and bad economist

The bad economist pursues a small present good, which will be followed by a great evil to come, while the true economist pursues a great good to come, at the risk of a small present evil.

~ Frédéric Bastiat

Lee Kuan Yew on history and long-term thinking

If you do not know history, you think short term. If you do know history, you think medium and long term.

~ Lee Kuan Yew, first Prime Minister of Singapore from 1959 to 1990

Labels:

history,

long-term thinking,

people - Yew; Lee Kuan

Oct 6, 2022

WSJ: "U.S. has long sought to limit the development of China’s semiconductor industry"

The U.S. has long sought to limit the development of China’s semiconductor industry by placing companies on the Commerce Department’s export blacklist, including telecom giant Huawei Technologies Co. and its largest chip maker, Semiconductor Manufacturing International Corp. The clampdown intensified amid the trade wars of the Trump administration, and the Biden administration has largely picked up where its predecessor left off.

The semiconductor industry was born in the U.S. but has shifted outside of the country in recent decades, mostly to Taiwan, South Korea and China, a state of affairs U.S. officials and legislators see as a worrying national-security vulnerability. Advanced chips are increasingly a pillar of geopolitical power, underpinning both military systems and data-processing capabilities that drive modern economies.

As it places more restrictions on China, the Commerce Department is preparing to roll out tax breaks, factory-building grants and research funding to try to bring more of the semiconductor industry back to the U.S. The funding, worth nearly $77 billion in total, was passed by Congress in July and signed by President Biden in August.

~ Asa Fitch and John D. McKinnon, "U.S. Seeks to Further Restrict Cutting-Edge Chip Exports to China," The Wall Street Journal, October 3, 2022

Oct 5, 2022

Sean Corrigan on what ails employers

After 25 years of green ideology, 10 years of ESG indulgence peddling, 3 years of biohazard totalitarianism, 8 months of totally avoidable warfare and increasingly self-destructive sanctions, who thinks the Fed’s rate rises are the main cause of the travails of employers?

~ Sean Corrigan, tweet, October 5, 2022

Labels:

ESG,

green energy,

people - Corrigan; Sean,

tweets

Henry Kissinger on food, energy and money

Who controls the food supply controls the people; who controls the energy can control whole continents; who controls money can control the world.

~ Henry Kissinger

Anonymous meme on investing vs. trading

In INVESTING, always remember that Rome was not built in a DAY...

Oct 4, 2022

Dylan Grice on good investment returns

To make good returns in the long run, you need to get to the long run as the law of the jungle dictates that survival takes priority over reproduction.

~ Dylan Grice

Dylan Grice on the end of the duration bull market

It's been a golden age for duration. In the bond market, interest rates have gone from 20% to zero in effect over a 40 year period. So the total return from government bonds over the last 40 years has been higher than the total return to equities in the previous 100 years on an annualized basis... The most interesting, maybe the most practical dimension to this is that this has happened over four decades. In other words, that's a full career in finance. And so you have had, I think, this phenomenal tailwind and to multiple asset classes. Obviously corporate bonds and credit markets have had a huge tailwind from the bull market in government bonds, but so have other duration assets. So real duration assets like equities, private equity or venture equity, arguably real estate. All of these things have had this enormous tailwind... So this end of a duration bull market, if that bull market turned into a bear market than pretty much all conventional mainstream portfolios are going to be tossed.

~ Dylan Grice, interview, The Meb Faber Show, 7:35 mark, April 11, 2022

Barry Sternlicht on Jay Powell: "I feel like he's the captain driving the Titanic into the ocean"

We're not arguing that the Fed has to act to bring down inflation, but we need to understand where the inflation came from. It came from all those global stimulus packages on the back of the reopening global economy. It was to the moon and beyond. They missed the meme stocks, they missed the casino and now that we're building momentum and people are getting employed, and wages are rising, now they want to stomp on the whole thing and end the party. I feel like he's the captain driving the Titanic into the ocean. Consumers in the U.S. are still spending, but it's inevitable that they can't keep this up. So the Fed has to stop... They're going to cause unbelievable calamities if they keep up their actions, not just here, but all over the whole globe.

~ Barry Sternlicht, CNBC interview, 2:20 mark, October 4, 2022

Oct 3, 2022

Dan Ferris on misplaced faith in central bankers

It's not that central bankers aren't doing their job right. It's that the job shouldn't exist and can't be done any way but wrong.

~ Dan Ferris, tweet, September 30, 2022

Alex Epstein: "by our standards, the world is extremely energy poor"

By our standards, the world is extremely poor, including energy poor, and one point I make in the book is that there are six billion people in the world who by our standards use a totally inadequate amount of energy, less electricity than one of our refrigerators uses. We live in a world that is energy deprived, and then you learn that fossil fuels provide 80 percent of that energy and their use is still growing, particularly in the parts of the world that care most about low-cost reliable energy. It is insane to talk about phasing them out rapidly. The other side has an enormous burden of proof when claiming that we should be phasing out fossil fuels when the value they provide is so needed and they’re clearly uniquely good at providing it.

~ Alex Epstein, "Debunking Fossil Fuel Hysteria: An Interview with Alex Epstein," The Austrian, September-October 2022

Labels:

energy,

green energy,

people - Epstein; Alex,

poverty,

wealth

Wendy McElroy on the Enclosure Acts, exploitation and the Industrial Revolution

It would be deceptively simplistic to blame the Enclosure Acts alone for the impoverishment usually ascribed to the Industrial Revolution. Many factors were in play. For example, the majority of people in pre-Industrial England dwelt in the countryside, where they often supplemented their income through cottage industries, especially the weaving of wool. This income evaporated with the advent of cheap cotton and industrialized methods of weaving it. Many influences contributed to the desperation of an unemployed army of workers.

What enclosure does illustrate without question, however, is that the abuses ascribed to the Industrial Revolution are far from straightforward. Blaming industrialization for workers’ misery is not merely simplistic, it is also often incorrect. Whether or not some exploitation would have existed within free-market industrialization, the abuses of the Industrial Revolution were standardized, institutionalized, and carried to excess by government and the use of the political means.

~ Wendy McElroy, "The Enclosure Acts and the Industrial Revolution," Future of Freedom Foundation, March 8, 2012

Oct 1, 2022

Kevin Duffy on investing in energy stocks

You have to be willing to be politically incorrect. It takes a certain amount of courage to do that, and most people aren’t wired that way. The green energy lobby has basically been trying to put fossil fuels out of business, but that’s the type of industry that interests me. Oil and gas companies provide a vital commodity in which supply is severely constrained by ideology and politics. Reality is starting to sink in that we can’t just cancel fossil fuels and that this was always a delusion. So even though many commodity prices will go down, energy prices should be a lot stickier.

~ Kevin Duffy, "We're Dealing With a Very Different Animal," The Market, July 18, 2022

Labels:

energy,

energy stocks,

green energy,

people - Duffy; Kevin

Subscribe to:

Posts (Atom)