Despite their claims to the contrary, Fisher Investments appears to be too large of an organization to give each client the personalized account servicing they deserve. Apparently, instead of concentrating their efforts on first rate stock research and implementing stock trading strategies to benefit their individual client needs, Fisher Research uses their massive resources to build and maintain a well oiled, flashy and bureaucratic marketing machine that functions similar to a worldwide mutual fund, but with less regulation, higher expenses and less predictable results than low cost mutual funds. Fisher Investments has delivered mediocre results for their clients throughout the 13 year history of their Private Client Group. A big exception to this was their amazing call to stay out of the market and/or hedge in 2001. As a result of that call they also missed the steep market decline immediately following the tragedy of 9/11. Those who believe in miracles and truly think that Fisher Investments will be able to time the market around the next disaster, I recommend sticking with Fisher Investments. The rest of us will likely be better of going with a more consistent money manager.

~ Jake Berzon, "Fisher Investments - Fishing For Business," Odesskiy Listok, January 28, 2008

Aug 29, 2008

Ken Fisher on his critics

Q: We know you have some critics out there who object to the direct marketing. What’s your response to that?

Fisher: Eat my dust. There are two types of critics. First are the people who don’t like receiving direct mail or don’t like advertisers clogging up what they’d otherwise prefer to get for free. They need to remember that if somebody isn’t advertising, they’re not going to get that content. The other people that are critical are idiots. These are people in the industry who come to a conclusion that says if you do all that marketing you can’t be very good at asset management. One of my criticisms of the industry is that most of the industry isn’t good across the broad spectrum of business disciplines.

~ Ken Fisher, "Never Enough Fisher," EQUITIES, September, 2007

Fisher: Eat my dust. There are two types of critics. First are the people who don’t like receiving direct mail or don’t like advertisers clogging up what they’d otherwise prefer to get for free. They need to remember that if somebody isn’t advertising, they’re not going to get that content. The other people that are critical are idiots. These are people in the industry who come to a conclusion that says if you do all that marketing you can’t be very good at asset management. One of my criticisms of the industry is that most of the industry isn’t good across the broad spectrum of business disciplines.

~ Ken Fisher, "Never Enough Fisher," EQUITIES, September, 2007

John Templeton on the housing bubble (2004)

When I was young, in the three years after 1929, a high proportion of people lost their homes in foreclosure. It's likely to happen again. It's not abnormal. It's cyclical, and it will put pressure on all prices.

~ John Templeton, "An Investment Legend's Advice," Forbes, February 4, 2004

~ John Templeton, "An Investment Legend's Advice," Forbes, February 4, 2004

John Templeton on contrarian thinking

People are always asking me where is the outlook good, but that's the wrong question.... The right question is: Where is the outlook the most miserable?

~ John Templeton, investor, mutual fund pioneer, and philanthropist

~ John Templeton, investor, mutual fund pioneer, and philanthropist

John Templeton: A few of his least favorite things

- Being too optimistic about business ventures

- Relying on any one idea or concept in your investments

- Relying on borrowed money you use for your ventures and assuming that you won’t have to pay it back

~ John Templeton, investor, mutual fund pioneer, and philanthropist, "John Templeton: A Few of His Least Favorite Things," LilaRajiva.com, July 8, 2008, by Lila Rajiva

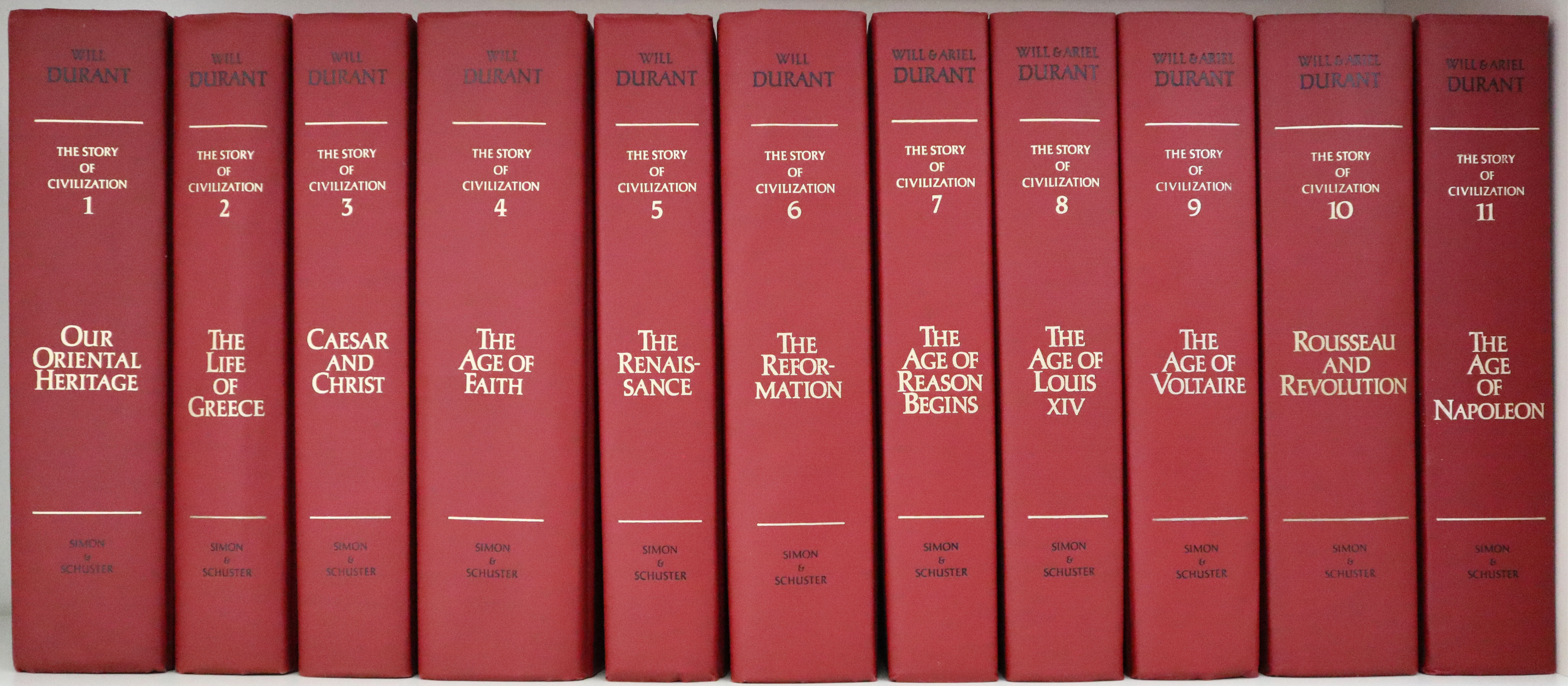

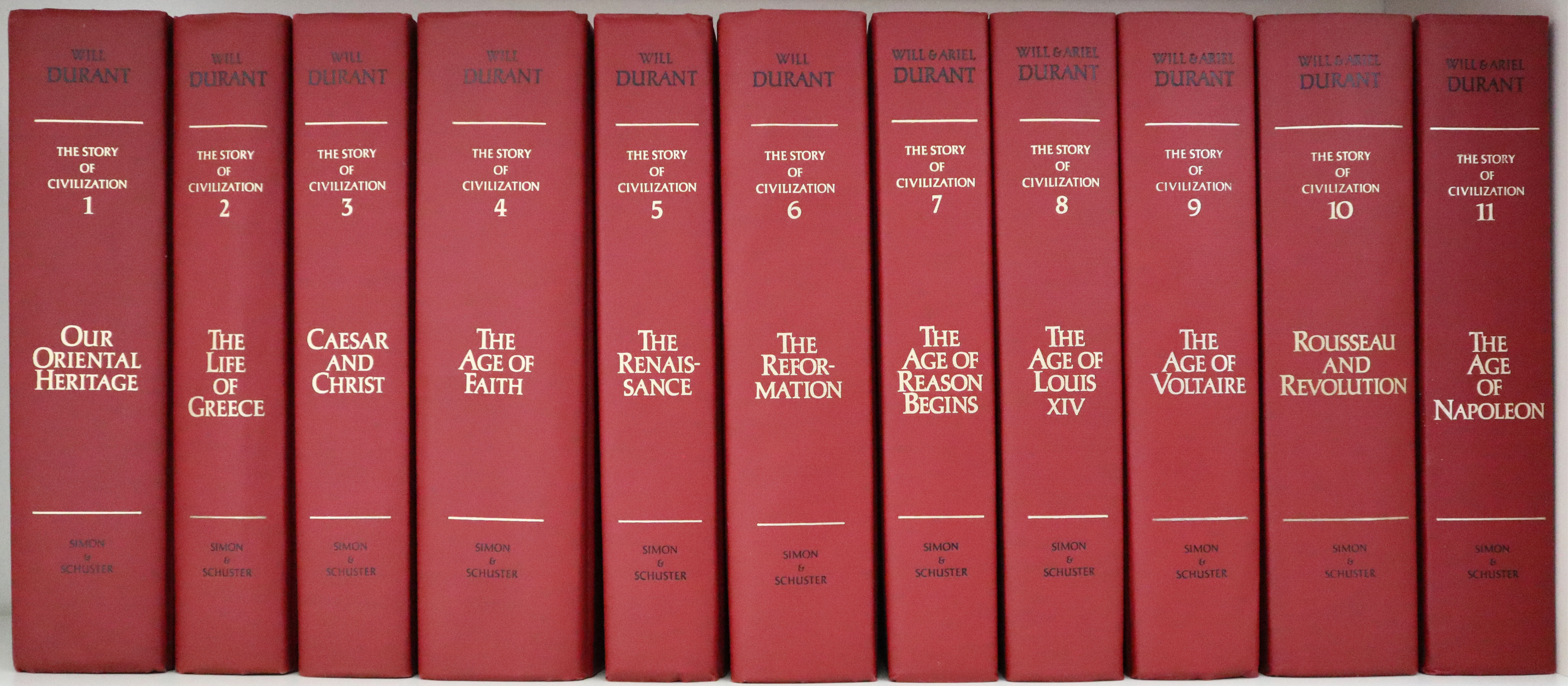

Will Durant on civilization

Civilization is a stream with banks. The stream is sometimes filled with blood from people killing, stealing, shouting and doing the things historians usually record, while on the banks, unnoticed, people build homes, make love, raise children, sing songs, write poetry and even whittle statues. The story of civilization is the story of what happened on the banks. Historians are pessimists because they ignore the banks for the river.

~ Will Durant, The Story of Civilization (1935)

~ Will Durant, The Story of Civilization (1935)

Thomas DiLorenzo on slavery in New York

Last Friday I toured the New York Historical Society's exhibit on "Slavery in New York," accompanied by Butler Shaffer and his daughter Bretigne. We were quite surprised at the high ratio of historical truth to political correctness. I purchased the book on the subject published by the Society, which says this in the introductory chapter:

Bet you didn't learn that in school.

~ Thomas DiLorenzo, "The Myth of the Morally Superior Yankee," LewRockwell.com Blog, January 8, 2006

"For nearly three hundred years, slavery was an intimate part of the lives of all New Yorkers, black and white, insinuating itself into every nook and cranny of New York history. For portions of the seventeenth and eighteenth centuries, New York City housed the largest urban slave population in mainland North America, with more slaves than any other city on the continent. During those years, slaves composed more than one quarter of the labor force in the city and perhaps as much as one half of the workers in many of its outlying districts. Slavery died with glacial slowness; slaves could be found in New York into the fifth decade of the nineteenth century."There were still slaves in New York in the 1850s and, according to the Society's publication, New Jersey did not end slavery until 1865.

Bet you didn't learn that in school.

~ Thomas DiLorenzo, "The Myth of the Morally Superior Yankee," LewRockwell.com Blog, January 8, 2006

|

| 13th Amendment - 75th Anniversary 1865-1940 |

H. L. Mencken on politicians

A good politician is quite as unthinkable as an honest burglar.

~ H. L. Mencken

~ H. L. Mencken

Lew Rockwell on politics

Politics brings out the worst in everyone, which is one good reason to completely depoliticize society. This way we can all busy ourselves in productive work or leisure, instead of wasting vast time watching these clowns on television promise the impossible to us.

~ Lew Rockwell, "Longing For Dictatorship," LewRockwell.com, August 29, 2008

~ Lew Rockwell, "Longing For Dictatorship," LewRockwell.com, August 29, 2008

Aug 28, 2008

Ludwig von Mises on secession

Liberalism forces no one against his will into the structure of the state. Whoever wants to emigrate is not held back. When a part of the people of a state wants to drop out of the union, liberalism does not hinder it from doing so.

~ Ludwig von Mises, Liberalism (1927), pp. 109-110

~ Ludwig von Mises, Liberalism (1927), pp. 109-110

Aug 27, 2008

Bill Miller plugs Citigroup stock (2005)

Citigroup chief financial officer Sallie Krawchek said recently on CNBC that it was "credit nirvana," the best environment they had seen in almost 15 years, and Citigroup raised its dividend another 10%.

Who would park their money in cash at 2% and pay taxes when they could get 3.7% in tax-advantaged dividends in Citigroup stock and own a piece of the world's largest financial-services firm, one that is perfectly well-positioned to be the banker to the developing world's burgeoning consumers?

~ Bill Miller, portfolio manager, Legg Mason Value Trust, "Good Times Are Coming!," Time, March 8, 2005

Who would park their money in cash at 2% and pay taxes when they could get 3.7% in tax-advantaged dividends in Citigroup stock and own a piece of the world's largest financial-services firm, one that is perfectly well-positioned to be the banker to the developing world's burgeoning consumers?

~ Bill Miller, portfolio manager, Legg Mason Value Trust, "Good Times Are Coming!," Time, March 8, 2005

Money magazine on housing speculators (2005)

In the 1990s, Flippers were stock jockeys who finagled their way into initial public offerings, only to flip them days or hours later for big profits.

These days the go-go market is homes, not stocks. In hot spots like Las Vegas and Florida, real estate flippers have discovered that a modest down payment and a little patience can net them tens (even hundreds) of thousands of dollars in profits, sometimes tax-free.

The most aggressive of them figure that some combo of paint, new flooring and kitchen upgrades can turn the dumpy house they bought for $300,000 in February into a $400,000 property they can unload in July. And in the most sizzling markets, they're absolutely right.

~ Money, "They call them flippers," March 14, 2005, by Jon Birger

These days the go-go market is homes, not stocks. In hot spots like Las Vegas and Florida, real estate flippers have discovered that a modest down payment and a little patience can net them tens (even hundreds) of thousands of dollars in profits, sometimes tax-free.

The most aggressive of them figure that some combo of paint, new flooring and kitchen upgrades can turn the dumpy house they bought for $300,000 in February into a $400,000 property they can unload in July. And in the most sizzling markets, they're absolutely right.

~ Money, "They call them flippers," March 14, 2005, by Jon Birger

Henry Paulson on the congressional package to rescue Fannie Mae and Freddie Mac

We recognized quite early on that if there was some concern or lack of confidence in their access to capital, this could create a serious problem. But we certainly couldn't go to Congress and ask for these powers that would make it a self-fulfilling prophecy - - or we wouldn't have gotten the powers.

~ Henry Paulson, Treasury Secretary, "Paulson Risks Goldman Standard as Fannie, Freddie Shares Erode," Bloomberg, August 21, 2008, by Rebecca Christie and Matthew Benjamin

~ Henry Paulson, Treasury Secretary, "Paulson Risks Goldman Standard as Fannie, Freddie Shares Erode," Bloomberg, August 21, 2008, by Rebecca Christie and Matthew Benjamin

Aug 26, 2008

Ben Bernanke on moral hazard

An expectation by financial market participants that financial crises will never occur would create its own form of moral hazard and encourage behavior that would make financial crises more, rather than less, likely.

~ Ben Bernanke, Federal Reserve chairman, “Bernanke Defends Policy of Low Rates," The Wall Street Journal, A3, August 23, 2008

Albert Einstein on ideas

If at first an idea does not sound absurd, then there is no hope for it.

~ Albert Einstein

~ Albert Einstein

Labels:

creativity,

ideas,

innovation,

people - Einstein; Albert

Aug 25, 2008

Bloomberg: Robert Rubin paid over $150 million working for Citigroup

[Robert] Rubin has been criticized by investors including Smith Asset Management's William Smith for collecting more than $150 million in pay in a decade while failing to steer [Citigroup's former CEO Chuck] Prince away from subprime mortgage securities that led to $17.4 billion of net losses in the past three quarters.

~ Bloomberg, "Citigroup Says Robert Rubin to Give Up Committee Role," August 25, 2008, by Bradley Keoun

~ Bloomberg, "Citigroup Says Robert Rubin to Give Up Committee Role," August 25, 2008, by Bradley Keoun

Aug 22, 2008

Barney Frank on the package to rescue Fannie Mae and Freddie Mac

Of the problems that were created by the reckless deregulation that led to the subprime crisis and the neglect of affordable housing that has marked Republican rule in Congress, this package of measures is the best response we could make. It cannot solve all of these deep rooted problems immediately but the bill does represent a mutually reinforcing set of approaches that will begin to diminish the problem. This will begin to lay the groundwork for a turnaround in the housing market and hopefully in the broader economy as well.

~ Barney Frank (D-MA), House Financial Services Committee Chairman, House Committee on Ways and Means press release, July 30, 2008

~ Barney Frank (D-MA), House Financial Services Committee Chairman, House Committee on Ways and Means press release, July 30, 2008

Aug 20, 2008

Mark Twain on American imperialism in the Pacific

I left these shores, at Vancouver, a red-hot imperialist. I wanted the American eagle to go screaming into the Pacific ...Why not spread its wings over the Philippines, I asked myself? ... I said to myself, Here are a people who have suffered for three centuries. We can make them as free as ourselves, give them a government and country of their own, put a miniature of the American Constitution afloat in the Pacific, start a brand new republic to take its place among the free nations of the world. It seemed to me a great task to which we had addressed ourselves. But I have thought some more, since then, and I have read carefully the treaty of Paris, and I have seen that we do not intend to free, but to subjugate the people of the Philippines. We have gone there to conquer, not to redeem. It should, it seems to me, be our pleasure and duty to make those people free, and let them deal with their own domestic questions in their own way. And so I am an anti-imperialist. I am opposed to having the eagle put its talons on any other land.

~ Mark Twain, New York Herald (1900)

~ Mark Twain, New York Herald (1900)

Aug 19, 2008

Citigroup CAO: "Citi is among the best capitalized banks in the world"

Today Citi is among the best capitalized banks in the world with a Tier 1 Capital Ratio at the end of the second quarter of 8.7%.

~ Don Callahan, Citigroup Chief Administrative Officer, New York, "Citi Has Solved Its Capital Issue," letter-to-the-editor, The Wall Street Journal, August 19, 2008

~ Don Callahan, Citigroup Chief Administrative Officer, New York, "Citi Has Solved Its Capital Issue," letter-to-the-editor, The Wall Street Journal, August 19, 2008

Aug 18, 2008

Albert Einstein on common sense

Common sense is the collection of prejudices acquired by age eighteen.

~ Albert Einstein, U.S. (German-born) physicist (1879 - 1955)

~ Albert Einstein, U.S. (German-born) physicist (1879 - 1955)

Aug 15, 2008

Nassim Taleb on history

Learning from history does not come naturally for us humans, a fact that is so visible in the endless repetitions of identically configured booms and busts in modern markets.

~ Nassim Taleb, Fooled By Randomness, 2nd Edition, pp. 53-54

~ Nassim Taleb, Fooled By Randomness, 2nd Edition, pp. 53-54

Aug 13, 2008

Tony Deden on the credit crunch

Despite the indifference and bullishness that permeates the stock markets, we continue to have considerable concerns about the impact that the real economy is likely to suffer as a result of the untangling of such momentous financial mess. In fact, we view these shocks not as a result of some specific malaise, such as the subprime fiasco, as much as tremors that precede the collapse of a phoney monetary order.

~ Anthony Deden, The Edelweiss Fund Monthly Review, October 3, 2007

~ Anthony Deden, The Edelweiss Fund Monthly Review, October 3, 2007

Aug 11, 2008

George Washington on foreign policy

Why quit our own to stand upon foreign ground? Why, by interweaving our destiny with that of any part of Europe, entangle our peace and prosperity in the toils of European ambition, rivalship, interest, humor, or caprice?

~ George Washington, Farewell Address, September 17, 1796

~ George Washington, Farewell Address, September 17, 1796

Aug 10, 2008

Lew Rockwell on credit expansion and personal debt

The entire welfare-warfare empire is based on expanding credit, so it is threatened by the return to economic reality. One role for us as individuals, in addition to learning and speaking the truth about the regime and all its crimes, is to get out of debt, and certainly to avoid all new debt: mortgages, home equity loans, student loans, credit card, and even corporate. Credit is an important market institution distorted beyond all recognition by the Fed. Everyone's circumstances are different, but in general you bug the regime, and help yourself, by not borrowing in a central-banking crisis.

~ Lew Rockwell, "A Loan? No Thanks," LewRockwell.com Blog, August 9, 2008

~ Lew Rockwell, "A Loan? No Thanks," LewRockwell.com Blog, August 9, 2008

Labels:

consumer debt,

credit expansion,

debt,

people - Rockwell; Lew

Aug 6, 2008

Bill Miller: Countrywide Financial is worth $40 per share (2007)

After falling 20% in a only a few days on no news, and this after being down 50% for the year, CFC rallied over 30% in one day once they reported their results and indicated they would be profitable for the 4th quarter and expect to earn a reasonable return on equity of 10-15% for all of 2008. The price action on both sides was driven by emotion -- first fear, then relief -- and was hardly the result of a careful analysis of Countrywide's long term business value. That, by the way, we think is in the $40's compared to its current price of about $14-15.

~ Bill Miller, Legg Mason Value Trust 3rd Quarter 2007 letter, "Bill Miller: Countrywide Financial Is Worth $40/Share," Seeking Alpha, November 4, 2008

(Countrywide was acquired by Bank of America for less than $5/share in stock in July, 2008.)

~ Bill Miller, Legg Mason Value Trust 3rd Quarter 2007 letter, "Bill Miller: Countrywide Financial Is Worth $40/Share," Seeking Alpha, November 4, 2008

(Countrywide was acquired by Bank of America for less than $5/share in stock in July, 2008.)

Ronald Reagan on the Continental Illinois bailout (1984)

It was a thing that we should do and we did it. It was in the best interest of all concerned.

~ Ronald Reagan, on the bailout of Continental Illinois, at the time the 7th largest U.S. bank

(Quoted from The Creature From Jekyll Island, p. 62, source: New York Times, "Reagan Calls Rescue of Bank No Bailout," July 29, 1984.)

~ Ronald Reagan, on the bailout of Continental Illinois, at the time the 7th largest U.S. bank

(Quoted from The Creature From Jekyll Island, p. 62, source: New York Times, "Reagan Calls Rescue of Bank No Bailout," July 29, 1984.)

Aug 5, 2008

Will Rogers on civilization and war

You can't say civilization don't advance, however, for in every war they kill you in a new way.

~ Will Rogers, New York Times, December 23, 1929

~ Will Rogers, New York Times, December 23, 1929

Aug 3, 2008

Robert Higgs on the American empire

How can a government that maintains more than 800 military facilities in more than 140 different foreign countries be anything other than an imperial power?

~ Robert Higgs, “CENTCOM’s Master Plan and U.S. Global Hegemony,” July 22, 2008

~ Robert Higgs, “CENTCOM’s Master Plan and U.S. Global Hegemony,” July 22, 2008

|

| American Empire 1942 |

Labels:

foreign policy,

imperialism,

people - Higgs; Robert

Aug 2, 2008

Pope John XXX III on unity, liberty and charity

In necessariis unitas, in dubiis libertas, in omnibus caritas. (Translated from the Latin as "unity in necessary things; liberty in doubtful things; charity in all things")

~ Pope John Paul XXIII in his encyclical Ad Petri Cathedram. The thought has been communicated by earlier theologians back to the 17th century and is is widely quoted in defence of theological and religious freedom.

~ Pope John Paul XXIII in his encyclical Ad Petri Cathedram. The thought has been communicated by earlier theologians back to the 17th century and is is widely quoted in defence of theological and religious freedom.

Lew Rockwell on statism

The truth is that the state must hide not only its wars but all of its activities. It hides its inflation. It hides the effects of its taxation and its protectionism. It fears anyone who draws the cause-and-effect connection between its activities and their deleterious consequences for the rest of us. It is the most destructive force in our world. Because that truth is so momentous, the state does everything possible to hide the smallest drop of blood.

~ Llewellyn H. Rockwell Jr., “The Seen, the Unseen, and the HiddenCosts of Statism,” July 28, 2008

~ Llewellyn H. Rockwell Jr., “The Seen, the Unseen, and the HiddenCosts of Statism,” July 28, 2008

Aug 1, 2008

Ted Rall: Is John McCain a war hero?

Why is the McCain-as-war-hero myth so hard to unravel? By most accounts, John McCain demonstrated courage as a P.O.W., most notably by refusing his captors' offer of early release. But that doesn't make him a hero.

Hell, McCain isn't even a victim.

At a time when more than a fourth of all combat troops in Vietnam were forcibly drafted (the actual victims), McCain volunteered to drop napalm on "gooks" (his term, not mine). He could have waited to see if his number came up in the draft lottery. Like Bush, he could have used family connections to weasel out of it. Finally, he could have joined the 100,000 draft-eligible males--true heroes, to a man--who went to Canada rather than kill people in a war that was plainly wrong.

When McCain was shot down during his 23rd bombing sortie, he was happily shooting up a civilian neighborhood in the middle of a major city. Vietnamese locals beat him when they pulled him out of a local lake; yeah, that must have sucked. But I can't help think of what would have happened to Mohammed Atta had he somehow wound up alive on a lower Manhattan street on 9/11. How long would he have lasted?

Maybe he would have made it. I don't know. But I do know this: no one would ever have considered him a war hero.

~ Ted Rall, "War Zero," July 17, 2008

Hell, McCain isn't even a victim.

At a time when more than a fourth of all combat troops in Vietnam were forcibly drafted (the actual victims), McCain volunteered to drop napalm on "gooks" (his term, not mine). He could have waited to see if his number came up in the draft lottery. Like Bush, he could have used family connections to weasel out of it. Finally, he could have joined the 100,000 draft-eligible males--true heroes, to a man--who went to Canada rather than kill people in a war that was plainly wrong.

When McCain was shot down during his 23rd bombing sortie, he was happily shooting up a civilian neighborhood in the middle of a major city. Vietnamese locals beat him when they pulled him out of a local lake; yeah, that must have sucked. But I can't help think of what would have happened to Mohammed Atta had he somehow wound up alive on a lower Manhattan street on 9/11. How long would he have lasted?

Maybe he would have made it. I don't know. But I do know this: no one would ever have considered him a war hero.

~ Ted Rall, "War Zero," July 17, 2008

Thomas Donlan on the mortgage mess and political capitalism

Fannie and Freddie and the whole mortgage mess represent capitalism at its worst - the Invisible Hand in the taxpayer's pocket. First, it pays out bonuses and benefits to politically connected big shots. Then, it takes money from some citizens to redress the bad investments of others. It's the classic ‘mixed economy,’ in which rewards are private and risks are socialized.

~ Thomas Donlan, Barron's

~ Thomas Donlan, Barron's

Nouriel Roubini on the Treasury plan to bail out Fannie Mae and Freddie Mac

The treasury bail-out plan (the mother of all moral hazard social bail-outs) is socialism for the rich, well-connected, and Wall Street. It is the continuation of a corrupt system where profits are privatized and losses are socialized.

~ Nouriel Roubini, RGE Moniter, July 2008

~ Nouriel Roubini, RGE Moniter, July 2008

Subscribe to:

Posts (Atom)