Were it not for government bailouts, for which Buffett lobbied hard, many of his company's stock holdings would have been wiped out. Berkshire Hathaway, in which Buffett owns 27%... has more than $26 billion invested in eight financial companies that have received bailout money. [...] The federal deposit insurance corporation (FDIC) backs more than $130 billion of their debt.

Nov 1, 2020

Ronald Stöferle et al. on speculators, political connections and Warren Buffett

Oct 6, 2020

Kevin Duffy clears up confusion about capitalism

Mar 18, 2020

Jim Quinn on the coming bailouts

Trump and his minions are following the exact playbook used in 2008/2009. Socialism for the corporate titans when they blow up the financial system, while average Americans lose their jobs and have their 401ks wiped out for the 3rd time in the last two decades. Every action being taken by politicians today is to save Wall Street and the mega-corporations who buy and sell them.

~ Jim Quinn, "Nothing to Fear But Fear Itself," LewRockwell.com, March 17, 2020

Jan 5, 2020

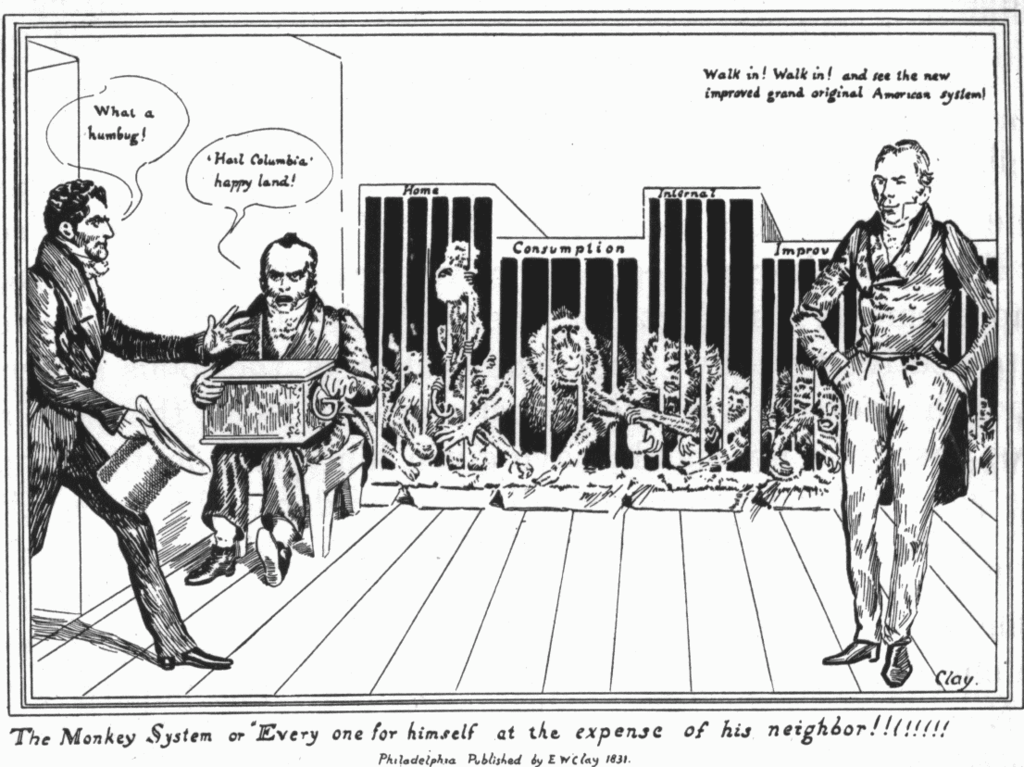

Tom DiLorenzo on how the American System differed from true capitalism

~ Tom DiLorenzo, The Real Lincoln, pp. 59-60

Jan 3, 2020

Edgar Lee Masters on the crony capitalism of Henry Clay

~ Edgar Lee Masters, Lincoln the Man (1997), p. 27

(as quoted by Tom DiLorenzo in Hamilton's Curse, pp. 120-121 and The Real Lincoln, pp. 58-59)

|

| Henry Clay 1873 |

Feb 28, 2012

Napolean Bonaparte on bankers

~ Napolean Bonaparte

Nov 19, 2011

Vice President Joe Biden on Jon Corzine

~ Vice-President Joe Biden on Jon Corzine

Oct 17, 2010

Sheldon Richman on the charade of left-right politics

The political establishment, helped by the mass media and intelligentsia, has long played a game in this country. It consists in depicting the competition for power as between two blocs: one hostile to business in the name of social justice, the other friendly to business in the name of “the free market.” Each bloc’s talking points and pet projects are calculated in superficial ways to reinforce its signature theme. Whenever the blocs need to rally their respective bases, they accentuate their surface differences. The “anti-business” bloc accuses its opponents of being, say, Wall Street lackeys, while the “pro-free-enterprise” bloc accuses its opponents of being, say, socialists.

It’s all a sham that serves both side’s interests. The rivals actually want two variations of the same thing: the corporate state, a system of economic privilege that transfers wealth via government from market entrepreneurs, workers, and consumers to well-connected business interests.

~ Sheldon Richman, "The Charade," The Freeman, October 15, 2010

Janet Tavakoli on how Bill Gross's Pimco Total Return Fund benefitted from Fed intervention in 2008

[...]

Bill Gross’s Pimco Total Return Fund had sold $760 million of default guarantees (as credit default swaps) on AIG, and it would have cost him if AIG went under. 22 Mr. Gross might have thought he had a good idea of how the Fed would behave. Pimco had hired Alan Greenspan as a consultant. I was not surprised when Bill Gross said the Fed intervention was a “ necessary step. ”

[...]

Pimco ’ s Bill Gross found there is a limit to the Fed’s largesse, and his Lehman investment lost money. In March, Bear Stearns, the fifth largest investment bank, was deemed too big to fail, but the Fed refused to help Lehman, the fourth largest investment bank. As Jim Rogers predicted, larger investment banks than Bear Stearns had problems, and the Fed had other problems besides investment banks — Fannie, Freddie, and AIG. Pimco’s investments were only partially protected by the Fed. The Total Return Fund’s return slumped, and it will be interesting to see if Gross ends up a net winner or a net loser as the market struggles for balance.

~ Janet M. Tavakoli, Dear Mr. Buffett: What An Investor Learns 1,269 Miles From Wall Street, Chapter 10

Aug 27, 2010

David Stockman on Bill Gross, Pimco, crony capitalism, and gaming the drive to homeownership

Some raids on the US Treasury by America's crony capitalists are so egregious as to provoke a rant -- even if you aren't Rick Santelli. One such rant-worthy provocation is Pimco latest scheme to loot Uncle Sam's depleted exchequer.

According to Bill Gross, who heads what appears to be the firm's squad of public policy front runners, the American economy can be saved only through "full nationalization" of the mortgage finance system and a massive "jubilee" of debt forgiveness for millions of underwater homeowners. If nothing else, these blatantly self-serving recommendations demonstrate that Matt Taibbi was slightly off the mark in his famed Rolling Stone diatribe. It turns out that the real vampire squid wrapped around the face of the American taxpayer isn't Goldman Sachs (GS) after all. Instead, it's surely the Pacific Investment Management Co.

As overlord of the fixed-income finance market, the latter generates billions annually in effort-free profits from its trove of essentially riskless US Treasury securities and federally guaranteed housing paper. Now Pimco wants to swell Uncle Sam's supply of this no-brainer paper even further -- adding upward of $2 trillion per year of what would be "government-issue" mortgages on top of the existing $1.5 trillion in general fund deficits.

This final transformation of American taxpayers into indentured servants of HIDC (the Housing Investment & Debt Complex) has been underway for a long time, and is now unstoppable because all principled political opposition to Pimco-style crony capitalism has been extinguished. Indeed, the magnitude of the burden already created is staggering. Before Richard Nixon initiated the era of Republican "me-too" Big Government in the early 1970s -- including his massive expansion of subsidized housing programs -- there was about $475 billion of real estate mortgage debt outstanding, representing a little more than 47% of GDP.

Had sound risk management and financial rectitude, as it had come to be defined under the relatively relaxed standards of post-war America, remained in tact, mortgage debt today would be about $7 trillion at the pre-Nixon GDP ratio. In fact, at $14 trillion or 100% of GDP the current figure is double that, implying that American real estate owners have been induced to shoulder an incremental mortgage burden that amounts to nearly half the nation's current economic output.

There's no mystery as to how America got hooked on this 40-year mortgage debt binge. At the heart of the matter is the statist Big Lie trumpeting the alleged public welfare benefits of the home-ownership society and subsidized real estate finance. Once the conservative party embraced this alluring but dangerously destructive idea, the cronies of capitalism have had a field day conducting a Washington bidding war between the two parties which is now in its fifth decade

During this time span all of the congregates of the HIDC lobby -- homebuilders, mortgage bankers, real estate brokers, Wall Street securitizers, property appraisers and lawyers, landscapers and land speculators, home improvement retailers and the rest -- have gotten their fill at the Federal trough. But the most senseless gift -- the extra-fat risk-free spread on Freddie and Fannie paper -- went to the great enablers of the mortgage debt boom, that is, the mega-funds like Pimco, which did little more than hang out an "open to buy" shingle as billions poured in year after year. Sadly, there isn't a shred of evidence that all of this largese serves any legitimate public purpose whatsoever, and plenty of evidence that the HIDC boom has been deeply destructive. But the intellectual cobwebs spun by the housing cronies so obfuscate these truths that the only way to grasp them is through an examination of the contra-factual -- a postulated world without Freddie/Fannie/FHA and the $100 billion annual tax subsidy on mortgage interest.

In that world, households would be tax-indifferent as to whether they acquired shelter services through renting or owning, and appropriately so. There's simply no evidence that home ownership produces any externality or "public good," such as making people better citizens, causing them to work harder or aspire higher, turning them into better neighbors, or even growing hair on their chests. Housing is a commodity like furniture and automobiles, and inducing citizens to buy more of it is no business of the state.

~ David Stockman, "How Pimco Is Holding American Homeowners Hostage," Minyanville.com, August 27, 2010

Jul 6, 2010

Robert David Steele on the political entrepreneur class

These people think they're the movers and the shakers; they're only the movers and the shakers so long as you let them be the movers and the shakers.

~Robert David Steele, former CIA officer, open-source intelligence advocate, YouTube presentation video, April 1st, 2010

Mar 21, 2010

Dylan Ratigan on US financial system

~ Dylan Ratigan, discussing Lehman, US financial system, MSNBC, March 12, 2010

Jan 19, 2010

FDR on banking influence on government

~ President Franklin Roosevelt, November 21, 1933

Nov 18, 2009

Charles Goyette on American cronyism

~ Charles Goyette, The Dollar Meltdown

Sep 19, 2008

Jim Chanos on Wall Street's twisted version of capitalism

~ Jim Chanos, "Short Sellers Under Fire in U.S., U.K. After Lehman, AIG Fall," Bloomberg, September 19, 2008, by Michael Tsang

Sep 10, 2008

Bill Gross: Pimco profits to the takeover of Fannie/Freddie to the tune of $8 billion

Gross: Well, the Total Return Fund, as you mentioned, by a billion and a half plus, the company itself by probably about 8 billion. It was a big day for us. But I wouldn't suggest... that's coming from the taxpayers or the Treasury.

Joe Kernen: That was simplistic. But, um, it's just anyone basically could've done it if they were watching you on CNBC. It wasn't that hard to figure out.

Gross: Well, I think that's true. And I think that everyone should come back like Bill Clinton in their next life. They should come back as a bond manager. Right, Joe?

Nouriel Roubini: We bailed out the credit of Bear Stearns, Fannie and Freddie, now GM and Ford want to get bailed out and so on. At which point is the end of this thing, and aren't we in a situation in which there is a systemic banking and financial crisis? And at this point we can't just bail out everybody. What's going to be the end of this game?

Gross: Well, there is an end game. But I likened it to a situation where we've had a drunk driver - and face it, we're all in there in terms of driving drunk and using lots of debt, and poor regulation and all of that. We're all responsible. But a drunk driver that's now lying on the road bleeding - you don't just leave him there. You take him to the hospital and then you throw him in jail. Then, you throw him in the clinker, but not now.

Carl Quintanilla: Bill, Joe started out with that joke about the taxpayers and your good day at Total Return on Monday. Are you prepared, though, for some political pushback or to become some kind of flash point? You lobby the government to save Main Street and the biggest bond company in the world profits?

Gross: Well, we were lobbying, but only from the standpoint of a suggested solution... You know the lobbying has really taken place over the last 6 to 12 to 18 months. It's what we expected to happen, and so um, lobbying, yes. But you asked me on TV over the past several months exactly what I thought should happen and it did.

~ Bill Gross, Pimco founder, interview on CNBC, September 10, 2008

Aug 1, 2008

Thomas Donlan on the mortgage mess and political capitalism

~ Thomas Donlan, Barron's

Nouriel Roubini on the Treasury plan to bail out Fannie Mae and Freddie Mac

~ Nouriel Roubini, RGE Moniter, July 2008

Jul 29, 2008

Paul Gigot on the lesson of Fannie Mae and Freddie Mac

~ Paul A. Gigot, editorial page editor, The Wall Street Journal, "The Fannie Mae Gang," July 23, 2008

Jul 8, 2008

Ambrose Bierce on politics

~ Ambrose Bierce, The Devil's Dictionary (1906)