~ Ludwig von Mises, Liberalism (1927)

Feb 29, 2008

Ludwig von Mises on alcohol and drug prohibition

It is an established fact that alcoholism, cocainism, and morphinism are deadly enemies of life, of health, and of the capacity for work and enjoyment; and a utilitarian must therefore consider them as vices. But this is far from demonstrating that the authorities must interpose to suppress these vices by commercial prohibitions, nor is it by any means evident that such intervention on the part of the government is really capable of suppressing them or that, even if this end could be attained, it might not therewith open up a Pandora's box of other dangers, no less mischievous than alcoholism and morphinism.

~ Ludwig von Mises, Liberalism (1927)

~ Ludwig von Mises, Liberalism (1927)

Bill Laggner on subprime securities

Without the accounting it becomes a confidence game.

~ "Navigating Subprime Securities," Fortune, August 23, 2007

~ "Navigating Subprime Securities," Fortune, August 23, 2007

Feb 28, 2008

Thomas Jefferson on banking

I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of currency, first by inflation, then by deflation, the banks and the corporations that will grow up around (the banks) will deprive the people of all property until their children wake-up homeless on the continent their fathers had conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.

~ Thomas Jefferson

~ Thomas Jefferson

Labels:

banking,

fiat money,

inflation,

people - Jefferson; Thomas

Henry Paulson on bailouts

"I'm seeing a series of ideas suggested involving major government intervention in the housing market, and these things are usually presented or sold as a way of helping homeowners stay in their homes. Then when you look at them more carefully what they really amount to is a bailout for financial institutions or Wall Street." The secretary added one caveat: "It would be imprudent not to have contingency plans, but we are so far away from seeing something that would have me calling for a bailout that I don't see it."

~ Henry Paulson, Treasury Secretary, "Paulson Dismisses Mortgage Rescue Plan," The Wall Street Journal, February 28, 2008

~ Henry Paulson, Treasury Secretary, "Paulson Dismisses Mortgage Rescue Plan," The Wall Street Journal, February 28, 2008

Doug Wakefield on the fate of current financial bubbles (2007)

Our parabolic spikes, of late, are nothing more than the effect of the unsustainable inflationary policies of central banks coupled with man's innate inclination to go with the crowd in hopes that he will win. What matters, then, is this: If history proves that all bubbles eventually implode, this should properly motivate us to search for the end of our current trend.

Doug Wakefield, Best Minds Inc., October 17, 2007

Doug Wakefield, Best Minds Inc., October 17, 2007

Feb 27, 2008

Gandhi on gun control

Among the many misdeeds of the British rule in India, history will look upon the act of depriving a whole nation of arms, as the blackest.

~ Mahatma Gandhi, My Experiments with Truth (1927)

~ Mahatma Gandhi, My Experiments with Truth (1927)

Investor's Business Daily on John T. Flynn's book, "The Roosevelt Myth"

Flynn's book is a careful account of Roosevelt's presidency. Flynn was no businessman, no Republican shill. He was a respected, old-line liberal journalist who made his name with a series of books attacking big business. That's what makes his indictment of Roosevelt all the more notable.

~ Investor's Business Daily

~ Investor's Business Daily

New York Times on the income tax amendment

In substance, the court holds that the Sixteenth Amendment did not empower the Federal Government to levy a new tax.

~ The New York Times, January 25, 1916

~ The New York Times, January 25, 1916

Goethe on freedom and slavery

None are more hopelessly enslaved than those who falsely believe they are free.

~ Johann Wolfgang von Goethe

~ Johann Wolfgang von Goethe

Supreme Court Chief Justice on taxation

The power to tax is the power to destroy.

~ John Marshall, Supreme Court Chief Justice

~ John Marshall, Supreme Court Chief Justice

Songs

Egalitarianism:

- The Trees - Rush

Government:

- Sunshine - Jonathan Edwards

Taxation:

- Taxman - The Beatles

- Get Over It - Eagles

- It's a Mistake - Men At Work

- Walking on a Thin Line - Huey Lewis & The News

- Not Ready to Make Nice - Dixie Chicks

Mark Twain on taxation

The only difference between a tax man and a taxidermist is that the taxidermist leaves the skin.

~ Mark Twain

~ Mark Twain

Woodrow Wilson on the creation of the Federal Reserve on his watch

I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is now controlled by its system of credit.

We are no longer a government by free opinion, no longer a government by conviction and the voice of the majority, but a government by the opinion and duress of a small group of dominant men.

~ Woodrow Wilson

We are no longer a government by free opinion, no longer a government by conviction and the voice of the majority, but a government by the opinion and duress of a small group of dominant men.

~ Woodrow Wilson

|

| Woodrow Wilson 1954-1968 |

Mayer Rothschild on the power of central banking

Give me control of a nation's money supply, and I care not who makes its laws.

~ Mayer Rothschild, private banker

~ Mayer Rothschild, private banker

Mish on the ratings agencies reaffirming AAA ratings for Ambac and MBIA

In a widely expected move, the S&P proved they have an iron stomach for gall and/or a nose that cannot distinguish horse hockey from a rose. Today the S&P Affirmed The AAA Rating Of Insurers MBIA, Ambac Ratings.

~ Mike "Mish" Shedlock, "S&P Sniffs Horse Hockey, Calls It a Rose," Mish's Global Economic Trend Analysis, February 25, 2008

Standard & Poor's reaffirmed the Triple A rating on the two biggest bond insurers, MBIA and Ambac Financial Group, sparking a rally by both stocks and the market in general. S&P ended its downgrade review for MBIA's (MBI) Triple A rating, citing success by the largest U.S. bond insurer in raising new capital.Citing ability to raise $3 billion in capital (a deal that is not even finalized), and in the face of monolines holding $70-$150 billion of worthless CDOs, the S&P held its nose and confirmed horse hockey smells like a rose.

The action reflects the company's ability to successfully access $2.6 billion in extra capital that can be used to pay claims, S&P said in a statement. The outlook is negative, indicating a rating cut may still be likely over the next two years.

The "AAA" ratings of Ambac (ABK) were affirmed but remain on review for downgrade. A group of banks has largely finalized a deal to recapitalize Ambac and is now trying to sell the plan to the rating agencies to save Ambac's triple-A rating, CNBC has learned.

S&P's affirming of Ambac doesn't take into account the recapitalization plan, but the review will continue until details of the plan are clearer.

A tentative structure for up to $3 billion in capital for Ambac has been agreed to by the consortium, which includes Citigroup (C)and Wachovia (WB). The banks are trying to save Ambac, as well as other bond insurers, because a ratings downgrade could force the banks to write down billions more of their own debt.

~ Mike "Mish" Shedlock, "S&P Sniffs Horse Hockey, Calls It a Rose," Mish's Global Economic Trend Analysis, February 25, 2008

Minyanville on what happens when the monoline insurers can't pay claims

A hurricane comes through your town and levels your house. A few weeks later, you receive a letter from your insurance company telling you that unless you buy some of its stock, it won’t be able to pay your insurance claim. What do you do?

As far fetched as this question may feel, this is, in principle, what’s behind the bailout of the monoline insurance companies. Unless their biggest CDS counterparties step up with more capital, the insurance companies won’t be able to make good on their CDS and the banks will be forced to take write-downs.

~ Minyanville.com, "Insurers' Day of Reckoning," February 25, 2008

As far fetched as this question may feel, this is, in principle, what’s behind the bailout of the monoline insurance companies. Unless their biggest CDS counterparties step up with more capital, the insurance companies won’t be able to make good on their CDS and the banks will be forced to take write-downs.

~ Minyanville.com, "Insurers' Day of Reckoning," February 25, 2008

Videos/Documentaries

Credit bubble:

- Subprime Mortgage Loans - comedy (John Fortune & John Bird)

- The Call of the Entrepreneur (Acton Institute)

- Environmentalism, Global Warming, Endangered Species, etc. - comedy (George Carlin)

- Fiat Empire (Cornerstone/Matrixx Entertainment)

- Freedom to Fascism (Aaron Russo)

- Money, Banking and the Federal Reserve (Ludwig von Mises Institute)

- We Like War - comedy (George Carlin)

- Dr. Turlington's Lower Back Tattoo Remover (Saturday Night Live)

- The Philosophy of Liberty (Creative Commons)

- Indoctrinate U (Moving Picture Institute)

- Do As I Say (Moving Picture Institute)

- Ron Paul Schools Ben Bernanke Yet Again - February 27, 2008 (YouTube)

Feb 26, 2008

Gazprom planning to build 1,300-foot tower in St. Petersberg

Built by Peter the Great as Russia's gateway to the West, St. Petersburg is known for its baroque and neoclassical architecture. So a 1,300-foot tower planned by Russia's energy giant Gazprom that exceeds zoning laws has critics aghast - and Unesco threatening to yank the city's World Heritage designation. But Gazprom is St. Pete's largest taxpayer, and the city is helping finance the project, which a Gazprom spokesperson says represents the "ambition of new Russia." The smart rubles are on the tower's getting built.

~ "Nyet in My Backyard," Fortune, March 3, 2008, by Eugenia Levenson

(Tapei 101 has held the title as "World's Tallest Building" since 2004 with a roof height of 1,474 feet.)

~ "Nyet in My Backyard," Fortune, March 3, 2008, by Eugenia Levenson

(Tapei 101 has held the title as "World's Tallest Building" since 2004 with a roof height of 1,474 feet.)

David Gelertner on feminism neutering the English language

How can I teach my students to write decently when the English language has become a wholly-owned subsidiary of the Academic-Industrial Complex? Our language used to belong to all its speakers and readers and writers. But in the 1970s and '80s, arrogant ideologues began recasting English into heavy artillery to defend the borders of the New Feminist state. In consequence we have all got used to sentences where puffed-up words like "chairperson" and "humankind" strut and preen, where he-or-she's keep bashing into surrounding phrases like bumper cars and related deformities blossom like blisters; they are all markers of an epoch-making victory of propaganda over common sense.

We have allowed ideologues to pocket a priceless property and walk away with it. Today, as college students and full-fledged young English teachers emerge from the feminist incubator in which they have spent their whole lives, this victory of brainless ideology is on the brink of becoming institutionalized. If we mean to put things right, we can't wait much longer.

Our ability to write and read good, clear English connects us to one another and to our common past. The prime rule of writing is to keep it simple, concrete, concise. Shakespeare's most perfect phrases are miraculously simple and terse. ("Thou art the thing itself." "A plague o' both your houses." "Can one desire too much of a good thing?") The young Jane Austen is praised by her descendants for having written "pure simple English." Meanwhile, in everyday prose, a word with useless syllables or a sentence with useless words is a house fancied-up with fake dormers and chimneys. It is ugly and boring and cheap, and impossible to take seriously.

But our problem goes deeper than a few silly words and many tedious sentences. How can I (how can any teacher) get students to take the prime rule seriously when virtually the whole educational establishment teaches the opposite? When students have been ordered since first grade to put "he or she" in spots where "he" would mean exactly the same thing, and "firefighter" where "fireman" would mean exactly the same thing? How can we then tell them, "Make every word, every syllable count!" They may be ignorant but they're not stupid. The well-aimed torpedo of Feminist English has sunk the whole process of teaching students to write. The small minority of born writers will always get by, inventing their own rules as they go. But we used to expect every educated citizen to write decently--and that goal is out the window.

~ David Gelertner, "Feminism and the English Language," The Weekly Standard, February 25, 2008

We have allowed ideologues to pocket a priceless property and walk away with it. Today, as college students and full-fledged young English teachers emerge from the feminist incubator in which they have spent their whole lives, this victory of brainless ideology is on the brink of becoming institutionalized. If we mean to put things right, we can't wait much longer.

Our ability to write and read good, clear English connects us to one another and to our common past. The prime rule of writing is to keep it simple, concrete, concise. Shakespeare's most perfect phrases are miraculously simple and terse. ("Thou art the thing itself." "A plague o' both your houses." "Can one desire too much of a good thing?") The young Jane Austen is praised by her descendants for having written "pure simple English." Meanwhile, in everyday prose, a word with useless syllables or a sentence with useless words is a house fancied-up with fake dormers and chimneys. It is ugly and boring and cheap, and impossible to take seriously.

But our problem goes deeper than a few silly words and many tedious sentences. How can I (how can any teacher) get students to take the prime rule seriously when virtually the whole educational establishment teaches the opposite? When students have been ordered since first grade to put "he or she" in spots where "he" would mean exactly the same thing, and "firefighter" where "fireman" would mean exactly the same thing? How can we then tell them, "Make every word, every syllable count!" They may be ignorant but they're not stupid. The well-aimed torpedo of Feminist English has sunk the whole process of teaching students to write. The small minority of born writers will always get by, inventing their own rules as they go. But we used to expect every educated citizen to write decently--and that goal is out the window.

~ David Gelertner, "Feminism and the English Language," The Weekly Standard, February 25, 2008

Labels:

English language,

feminism,

political correctness,

writing

Ludwig von Mises on capitalism

The capitalist system of production is an economic democracy in which every penny gives a right to vote. The consumers are the sovereign people. The capitalists, the entrepreneurs, and the farmers are the peoples mandatories.

~ Ludwig von Mises, Bureaucracy

~ Ludwig von Mises, Bureaucracy

Lew Rockwell on how the anti-communist movement undermined the limited government plank of the Republican Party

Murray Rothbard used to tell the story of speaking to conservative and Republican audiences in the late 1950s and early 1960s. There would be large groups gathered for various talks on economics and politics. He would give a lecture on the problem of price controls, or protectionism, or high taxes. People really liked what he had to say. They would clap, and learn from his lecture.

Then he would sit down. At some point in the course of the conference, the appointed anti-communist speaker would rise to the podium. He would decry the evil of Russia and its atheistic system of government. He would call for beefing up nuclear weapons and hint darkly of the necessity of war. He would end with an apocalyptic statement about the need for everyone to completely dedicate themselves to eradicating the communists by any means necessary. No talk of limiting or cutting government; quite the opposite.

So how would these people, who clapped for Murray, respond to the warmonger? Insanely, wildly, uncontrollably. They would stand and scream and yell and cheer, getting up on their chairs and putting their hands together high in the air. The applause would go on for five minutes and more, and the speaker would be later mauled for autographs. His books would sell wildly.

Meanwhile, poor Murray would stand there in alarm. How could these same people cheer both a call for liberty and a call for empire, and, most notably, give their hearts over to the maniacal nationalist while being merely polite to a call for the same liberty that had led this party to oppose FDR's domestic and foreign-policy? It was experiences like these that led him to write the most important dissection of the Republican party ever to appear: The Betrayal of the American Right. It is here that Murray engages in a deep, soul-searching look at his own role in red-baiting in the 1950s. He had hoped to use the anti-communist movement to educate people about the need for freedom.

"It is clear that libertarians and Old Rightists, including myself, had made a great mistake in endorsing domestic red-baiting, a red-baiting that proved to be the major entering wedge for the complete transformation of the original right wing," writes Murray. Instead of supporting freedom, the anti-communist movement ended up acculturating Republicans to the imperial mindset. The moral priority of crushing a foreign government trumped every other issue.

At the same time, the libertarianism of the GOP's domestic agenda was supplanted by a belief that "big government and domestic statism were perfectly acceptable, provided that they were steeped in some sort of Burkean tradition and enjoyed a Christian framework." Fiery individualism and radicalism were replaced by a longing for a static, controlling elite of the European sort. Liberty was washed away.

~ Lew Rockwell, "Triumph of the Red-State Fascists," LewRockwell.com, February 26, 2008

Then he would sit down. At some point in the course of the conference, the appointed anti-communist speaker would rise to the podium. He would decry the evil of Russia and its atheistic system of government. He would call for beefing up nuclear weapons and hint darkly of the necessity of war. He would end with an apocalyptic statement about the need for everyone to completely dedicate themselves to eradicating the communists by any means necessary. No talk of limiting or cutting government; quite the opposite.

So how would these people, who clapped for Murray, respond to the warmonger? Insanely, wildly, uncontrollably. They would stand and scream and yell and cheer, getting up on their chairs and putting their hands together high in the air. The applause would go on for five minutes and more, and the speaker would be later mauled for autographs. His books would sell wildly.

Meanwhile, poor Murray would stand there in alarm. How could these same people cheer both a call for liberty and a call for empire, and, most notably, give their hearts over to the maniacal nationalist while being merely polite to a call for the same liberty that had led this party to oppose FDR's domestic and foreign-policy? It was experiences like these that led him to write the most important dissection of the Republican party ever to appear: The Betrayal of the American Right. It is here that Murray engages in a deep, soul-searching look at his own role in red-baiting in the 1950s. He had hoped to use the anti-communist movement to educate people about the need for freedom.

"It is clear that libertarians and Old Rightists, including myself, had made a great mistake in endorsing domestic red-baiting, a red-baiting that proved to be the major entering wedge for the complete transformation of the original right wing," writes Murray. Instead of supporting freedom, the anti-communist movement ended up acculturating Republicans to the imperial mindset. The moral priority of crushing a foreign government trumped every other issue.

At the same time, the libertarianism of the GOP's domestic agenda was supplanted by a belief that "big government and domestic statism were perfectly acceptable, provided that they were steeped in some sort of Burkean tradition and enjoyed a Christian framework." Fiery individualism and radicalism were replaced by a longing for a static, controlling elite of the European sort. Liberty was washed away.

~ Lew Rockwell, "Triumph of the Red-State Fascists," LewRockwell.com, February 26, 2008

Mark Twain on elitists who run the world

Sometimes I wonder whether the world is being run by smart people who are putting us on... or by imbeciles who really mean it.

~ Mark Twain

~ Mark Twain

Labels:

elitism,

people - Twain; Mark,

world improvers

Feb 25, 2008

Mark Twain on breeding

Good breeding consists in concealing how much we think of ourselves and how little we think of the other person.

~Mark Twain, Mark Twain's Notebook (1898)

~Mark Twain, Mark Twain's Notebook (1898)

Feb 23, 2008

Justin Raimondo on Murray Rothbard's concerns about "conservative" foreign policy

Rothbard realized that, irrespective of the rhetoric about the "free market" and "individual liberty" that came out of the mouths of conservatives, objectively the result of their policies – specifically, their foreign policy of relentless aggression and confrontation with the Soviet Union – would lead to the exact opposite of their stated intentions. He saw that, as long as we were leading a global crusade, and pouring billions down the "anti-Communist" rat-hole, building up a huge military apparatus and national security bureaucracy – complete with an arsenal of nuclear weapons that could destroy the world several times over – our liberties, indeed our very lives, would be threatened with extinction.

~ Justin Raimondo, "The Year of the Insurgents," Anti-war.com, February 22, 2008

~ Justin Raimondo, "The Year of the Insurgents," Anti-war.com, February 22, 2008

Feb 22, 2008

Motley Fool on the futility of market timing

An aside to all of this optimism

It should be noted that stocks dropped substantially in 2000 leading up to the recession -- just as they've dropped of late. Those examples, however, just go to show how the stock market does not move in lockstep with economic realties. Instead, it's an imperfect prediction machine with millions of analysts, institutions, and individuals trying to incorporate the information they know into daily trading decisions.

All that dynamism makes the market impossible to time, and if you're only starting to worry about recession as we may or may not be entering one, you are way late to the game. To get ahead of the curve, you should start thinking about buying and holding for the long term.

Don't just take our word for it, though. There's also brand-new research from IESE Business School professor Javier Estrada.

Javier who?

Mr. Estrada's recent paper "Black Swans and Market Timing: How Not to Generate Alpha" is one of the most persuasive cases I've read for a disciplined buy-to-hold investment philosophy.

Estrada studied 15 major global stock markets for periods ranging from 31 to 79 years, with the full data encompassing more than 160,000 trading days. What he found is "less than 0.1% of the days considered" actually matter to long-term returns, which means that "the odds against successful market timing are staggering."

So ... don't try to time the bottom

Now, this is a dangerous article to go on record with. If the market does tank this year, I'm going to get plenty of profanity-laced emails telling me that I'm "the real fool now" (seriously, you'd think people would be over that joke by now).

But even if we lose money this year (yes, I'm staying invested myself), we're all going to make a lot more money down the line not by trying in vain to time the market but by adding new money to great companies on a regular basis.

That way, rather than run from the lows, we'll double-down on them ... and supercharge our returns in the process.

~ Tim Hanson, "Will You Cash Out Before the Market Crashes?," The Motley Fool, February 15, 2008

It should be noted that stocks dropped substantially in 2000 leading up to the recession -- just as they've dropped of late. Those examples, however, just go to show how the stock market does not move in lockstep with economic realties. Instead, it's an imperfect prediction machine with millions of analysts, institutions, and individuals trying to incorporate the information they know into daily trading decisions.

All that dynamism makes the market impossible to time, and if you're only starting to worry about recession as we may or may not be entering one, you are way late to the game. To get ahead of the curve, you should start thinking about buying and holding for the long term.

Don't just take our word for it, though. There's also brand-new research from IESE Business School professor Javier Estrada.

Javier who?

Mr. Estrada's recent paper "Black Swans and Market Timing: How Not to Generate Alpha" is one of the most persuasive cases I've read for a disciplined buy-to-hold investment philosophy.

Estrada studied 15 major global stock markets for periods ranging from 31 to 79 years, with the full data encompassing more than 160,000 trading days. What he found is "less than 0.1% of the days considered" actually matter to long-term returns, which means that "the odds against successful market timing are staggering."

So ... don't try to time the bottom

Now, this is a dangerous article to go on record with. If the market does tank this year, I'm going to get plenty of profanity-laced emails telling me that I'm "the real fool now" (seriously, you'd think people would be over that joke by now).

But even if we lose money this year (yes, I'm staying invested myself), we're all going to make a lot more money down the line not by trying in vain to time the market but by adding new money to great companies on a regular basis.

That way, rather than run from the lows, we'll double-down on them ... and supercharge our returns in the process.

~ Tim Hanson, "Will You Cash Out Before the Market Crashes?," The Motley Fool, February 15, 2008

H.L. Mencken on liberty, security, and the police state

What the common man longs for in this world, before and above all his other longings, is the simplest and most ignominious sort of peace: the peace of a trusty in a well-managed penitentiary. He is willing to sacrifice everything else to it. He puts it above his dignity and he puts it above his pride. Above all, he puts it above his liberty. The fact, perhaps, explains his veneration for policemen, in all the forms they take--his belief that there is a mysterious sanctity in law, however absurd it may be in fact.

A policeman is a charlatan who offers, in return for obedience, to protect him (a) from his superiors, (b) from his equals, and (c) from himself. This last service, under democracy, is commonly the most esteemed of them all. In the United States, at least theoretically, it is the only thing that keeps ice-wagon drivers, Y.M.C.A. secretaries, insurance collectors and other such human camels from smoking opium, ruining themselves in the night clubs, and going to Palm Beach with Follies girls...Here, though the common man is deceived, he starts from a sound premise: to wit, that liberty is something too hot for his hands---or, as Nietzsche put it, too cold for his spine.

~ H.L. Mencken, Notes on Democracy (1920)

A policeman is a charlatan who offers, in return for obedience, to protect him (a) from his superiors, (b) from his equals, and (c) from himself. This last service, under democracy, is commonly the most esteemed of them all. In the United States, at least theoretically, it is the only thing that keeps ice-wagon drivers, Y.M.C.A. secretaries, insurance collectors and other such human camels from smoking opium, ruining themselves in the night clubs, and going to Palm Beach with Follies girls...Here, though the common man is deceived, he starts from a sound premise: to wit, that liberty is something too hot for his hands---or, as Nietzsche put it, too cold for his spine.

~ H.L. Mencken, Notes on Democracy (1920)

Feb 21, 2008

H.L. Mencken on the crowd and free speech

All appeals to any intrinsic love of free speech are futile. There is no such passion in the people. It is only an aristocracy that is ever tolerant. The masses are invariably cocksure, suspicious, furious, and tyrannical. This, in fact, is the central objection to democracy: that it hinders progress by penalizing innovation and non-conformity.

~ H.L. Mencken, Letters of H.L. Mencken (1961), p. 109

~ H.L. Mencken, Letters of H.L. Mencken (1961), p. 109

Labels:

crowd behavior,

free speech,

people - Mencken; H.L.

Feb 20, 2008

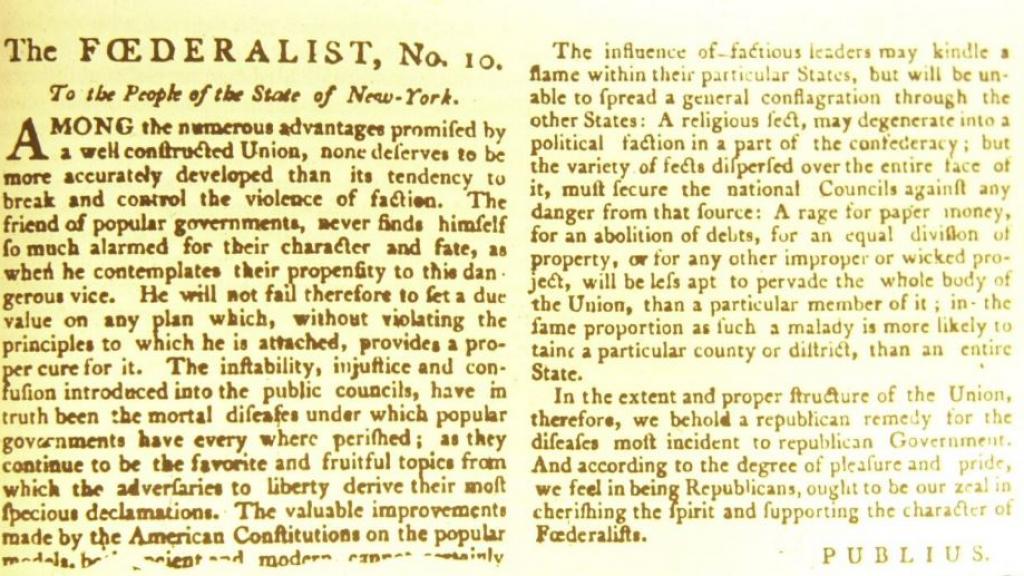

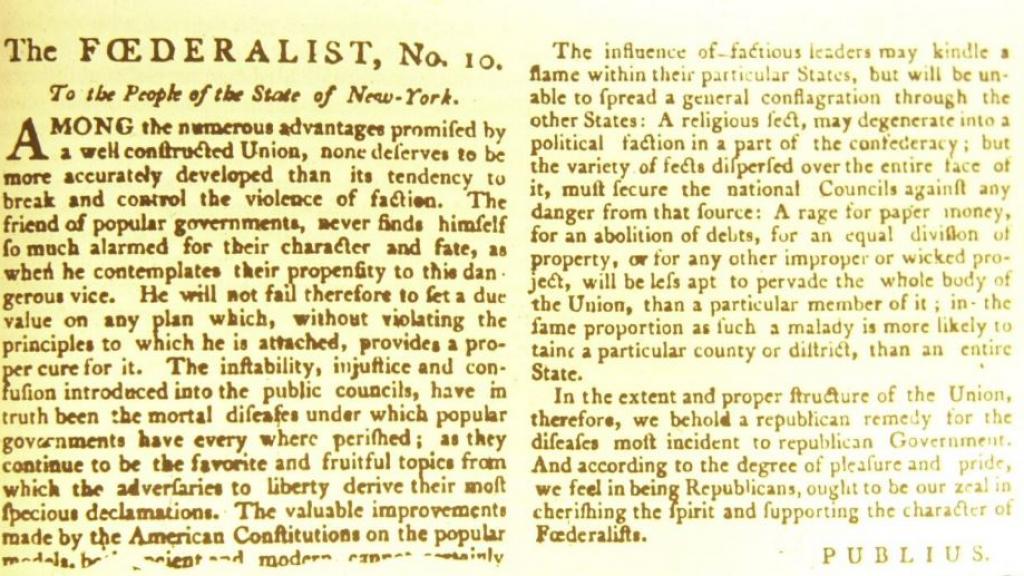

James Madison on democracy

A common passion or interest will, in almost every case, be felt by a majority of the whole; a communication and concert result from the form of government itself; and there is nothing to check the inducements to sacrifice the weaker party or an obnoxious individual. Hence it is that such democracies have ever been spectacles of turbulence and contention; have ever been found incompatible with personal security or the rights of property; and have in general been as short in their lives as they have been violent in their deaths.

~ James Madison, Federalist No. 10, November 22, 1787

~ James Madison, Federalist No. 10, November 22, 1787

Alan Greenspan on the housing bubble

I would tell audiences that we were facing not a bubble but a froth - lots of small, local bubbles that never grew to a scale that could threaten the health of the overall economy.

~ Alan Greenspan, The Age of Turbulence (2007)

~ Alan Greenspan, The Age of Turbulence (2007)

Feb 19, 2008

Joan McCullough on the credit bubble

If it were not for an unrealistically stretched-out car payment schedule (unrealistic in terms of balance outstanding vs. depreciation of the underlying asset) would a $50k per annum couple even be thinking about a $16k car? Not on your life. Come to think of it, if enough $50k per annum families said "no way, Jose" to a $16k used car, what do you think would happen to the price, eh? Right. If that zero-down, option payment, 80/20 mortgage were not available, do you think Joe Schmo would have signed on the dotted line for 6x his gross income for 4 walls and a roof? Right. But given the terms, Joe was a glorified renter and had nothin' to lose. So he took a shot. Unfortunately, Joe crapped out early in the game. Sayonara, Joe.

The point here is that the credit gimmicks that entrapped so many Americans simultaneously supported prices bubbles. And the insidiousness of this credit-gimmick tack is underscored by the fact that nobody complained about the price of a new car being equal to or a multiple of one's yearly income. Or that home, even a starter home, had run up to a frightening multiple of same. As long as the monthly nut was kept palatable and the credit spigot in the permanent "on" position, all was well on Main St., USA.

How do we stop the madness then? The answer is to break the back of the bubble once and for all by taking away the props and letting the market price the assets accordingly. Given the tightening of loan standards and the actions being taken by the credit card issuers, the process has already begun. What's troublesome, though, is that the government is interfering. Why are they hell-bent on throwing good money (ours) after bad?

Because they are serial MANIPULATORS. While the price of homes, for example, has been escalating out of control, they turned a blind eye to the credit abuses that were rampant on their watch with a view towards allowing the game to continue.

~ Joan McCullough, East Shore Partners, Morning Comment, February 19, 2008

The point here is that the credit gimmicks that entrapped so many Americans simultaneously supported prices bubbles. And the insidiousness of this credit-gimmick tack is underscored by the fact that nobody complained about the price of a new car being equal to or a multiple of one's yearly income. Or that home, even a starter home, had run up to a frightening multiple of same. As long as the monthly nut was kept palatable and the credit spigot in the permanent "on" position, all was well on Main St., USA.

How do we stop the madness then? The answer is to break the back of the bubble once and for all by taking away the props and letting the market price the assets accordingly. Given the tightening of loan standards and the actions being taken by the credit card issuers, the process has already begun. What's troublesome, though, is that the government is interfering. Why are they hell-bent on throwing good money (ours) after bad?

Because they are serial MANIPULATORS. While the price of homes, for example, has been escalating out of control, they turned a blind eye to the credit abuses that were rampant on their watch with a view towards allowing the game to continue.

~ Joan McCullough, East Shore Partners, Morning Comment, February 19, 2008

Goethe on acting as one thinks

To think is easy. To act is difficult. To act as one thinks is the most difficult of all.

~ Johann Wolfgang von Goethe

~ Johann Wolfgang von Goethe

Mike Whitney on laying blame for the credit crunch

We don't blame Bernanke. He's been remarkably straightforward from the very beginning and deserves credit. He's simply left with the thankless task of mopping up the ocean of red ink left behind by Greenspan. It's not his fault. He should be applauded for dispelling the decades-long illusion that a nation can borrow its way to prosperity or that chronic indebtedness is the same as real wealth. It's not; and the bill has finally come due.

Of course, now that the low-interest speculative orgy is over; there's bound to be a painful unwind of hyper-inflated assets, falling home prices, tumbling stock markets, increased unemployment, and a generalized credit-contraction throughout the real economy. Ouch. Who said it was going to be easy?

~ Mike Whitney, "Bernanke's State of the Economy Speech: ‘You Are All Dead Ducks’," LewRockwell.com, February 19, 2008

Of course, now that the low-interest speculative orgy is over; there's bound to be a painful unwind of hyper-inflated assets, falling home prices, tumbling stock markets, increased unemployment, and a generalized credit-contraction throughout the real economy. Ouch. Who said it was going to be easy?

~ Mike Whitney, "Bernanke's State of the Economy Speech: ‘You Are All Dead Ducks’," LewRockwell.com, February 19, 2008

Kevin Duffy on reforming the voting process

We should divide the country into those who support the state (net tax payers) and those who live off of the state (net tax eaters). The latter group would automatically include politicians, bureaucrats, lobbyists, lawyers, public school teachers, etc. and should be denied the vote. Somehow, I would imagine the presidential debates would be quite different.

~ Kevin Duffy, Bearing Asset Management, February 18, 2008

~ Kevin Duffy, Bearing Asset Management, February 18, 2008

|

| Register and Vote 1964 |

Labels:

elections,

people - Duffy; Kevin,

stamps,

voting

Feb 18, 2008

The Federal Reserve on its role as inflation fighter

One of the most important jobs of the Federal Reserve is to keep our economy healthy. It does this by managing the nation’s system of money and credit—in other words, conducting monetary policy.

Experience has shown us that the economy performs well when inflation is low. When inflation is low—and is expected to remain low—interest rates are usually low as well. Such an environment fosters low unemployment and allows the economy to achieve its growth potential. Free from the disruptive effects of high and variable inflation, consumers and producers make economic decisions with confidence and wisdom.

The ability to maintain a low inflation rate is a long-term measure of the Fed’s success. To achieve this, the Fed sets a variety of intermediate targets, including monetary aggregates, reserve aggregates and interest rates, to gauge the impact of its policies on the economy.

The actions that the Fed takes today influence the economy and the inflation rate for some time to come. Consequently, policymakers must be forward-looking and must take pre-emptive action to head off inflation before it gathers momentum.

~ Federal Reserve website (frb.org), "In Plain English: Making Sense of the Federal Reserve"

(Graph of Consumer Price Index: 1800-2007)

Experience has shown us that the economy performs well when inflation is low. When inflation is low—and is expected to remain low—interest rates are usually low as well. Such an environment fosters low unemployment and allows the economy to achieve its growth potential. Free from the disruptive effects of high and variable inflation, consumers and producers make economic decisions with confidence and wisdom.

The ability to maintain a low inflation rate is a long-term measure of the Fed’s success. To achieve this, the Fed sets a variety of intermediate targets, including monetary aggregates, reserve aggregates and interest rates, to gauge the impact of its policies on the economy.

The actions that the Fed takes today influence the economy and the inflation rate for some time to come. Consequently, policymakers must be forward-looking and must take pre-emptive action to head off inflation before it gathers momentum.

~ Federal Reserve website (frb.org), "In Plain English: Making Sense of the Federal Reserve"

(Graph of Consumer Price Index: 1800-2007)

Ben Bernanke on the Fed's role in causing the Great Depression

I would like to say to Milton [Friedman] and Anna [J. Schwartz]: Regarding the Great Depression. You're right, we did it. We're very sorry. But thanks to you, we won't do it again.

~ Ben Bernanke, "On Milton Friedman's Ninetieth Birthday," At the Conference to Honor Milton Friedman, University of Chicago, Chicago, Illinois, November 8, 2002

~ Ben Bernanke, "On Milton Friedman's Ninetieth Birthday," At the Conference to Honor Milton Friedman, University of Chicago, Chicago, Illinois, November 8, 2002

Holman W. Jenkins, Jr. on the Carolina Katz Reid study of low-income homeowership from 1977-1993

A home financed by a mortgage is not just an asset. It's also a liability. We owe thanks to Carolina Katz Reid, then a graduate student at University of Washington, for a 2004 study of what she dubbed the "low income homeownership boom." She considered a simple question -- "whether or not low-income households benefit from owning a home." Her discoveries are bracing:

~ Holman W. Jenkins, Jr., "Payback," The Wall Street Journal, August 22, 2007

Of low-income households from a nationally representative sample who became homeowners between 1977 and 1993, fully 36% returned to renting in two years, and 53% in five years. Suggesting their sojourn among the homeowning was not a happy one, few returned to homeownership in later years.Bottom line: Homeownership likely has had an exceedingly poor payoff for millions of low-income purchasers, perhaps even blighting the prospects of what might otherwise be upwardly mobile families.

~ Holman W. Jenkins, Jr., "Payback," The Wall Street Journal, August 22, 2007

Holman W. Jenkins, Jr. on the drive towards homeownership

Everybody talks about moral hazard. A wisp of memory came to mind last week. Then-Fannie Mae chief Franklin Raines visited The Journal years ago and entertained himself by mocking editorial writers who assume that establishing that a policy is economically inefficient is enough to establish that it's unwise.

He yukked it up quite a bit, in fact, noting that voters are perfectly entitled to assert values other than those of the market, namely that homeownership is a social blessing and should be encouraged with subsidies. And so we've done with tax subsidies, lending subsidies and a concerted set of policies by Bill Clinton's HUD to move low-income people out of rental units and into homes they own. His goal, which was achieved, was to lift the homeownership rate from 64.2% to 67.5% of households.

~ Holman W. Jenkins, Jr., "Payback," The Wall Street Journal, August 22, 2007

He yukked it up quite a bit, in fact, noting that voters are perfectly entitled to assert values other than those of the market, namely that homeownership is a social blessing and should be encouraged with subsidies. And so we've done with tax subsidies, lending subsidies and a concerted set of policies by Bill Clinton's HUD to move low-income people out of rental units and into homes they own. His goal, which was achieved, was to lift the homeownership rate from 64.2% to 67.5% of households.

~ Holman W. Jenkins, Jr., "Payback," The Wall Street Journal, August 22, 2007

Ludwig von Mises on fiat money

Government is the only agency which can take a useful commodity like paper, slap some ink on it, and make it totally worthless.

~ Ludwig von Mises

~ Ludwig von Mises

Gandhi on the long battle to bring about change

First they ignore you, then they laugh at you, then they fight you, then you win.

~ Mahatma Gandhi

~ Mahatma Gandhi

Feb 17, 2008

Ken Fisher on the credit crunch: Like 1930 or 1998?

The worrywarts seek a parallel to today's market and think they see it in 1930: credit crunch, rising unemployment, financial institutions in trouble. So we must be in for a ferocious bear market. I seek a parallel and find it only ten years ago. And that makes me bullish.

Early 1998 saw financial crises eerily similar to today's and a lot of hand-wringing about institutions collapsing and setting off a domino chain of other collapses. But guess what? The S&P 500 was up 28% that year.

~ Ken Fisher, "1998 Redux," Forbes, February 25, 2008

Early 1998 saw financial crises eerily similar to today's and a lot of hand-wringing about institutions collapsing and setting off a domino chain of other collapses. But guess what? The S&P 500 was up 28% that year.

~ Ken Fisher, "1998 Redux," Forbes, February 25, 2008

Ken Fisher on the outlook for 2008

Let me make you a solemn promise for 2008. This year, and for the rest of your life, the U.S. market and economy won't head markedly one way while the foreign world collectively goes the other. We're too intertwined globally. Since the foreign economy is twice America's size, and is strong, America should do well in 2008--better, at any rate, than people expect.

~ Ken Fisher, "We're Too Gloomy," Forbes, January 28, 2008

~ Ken Fisher, "We're Too Gloomy," Forbes, January 28, 2008

Ken Fisher: Bullish on AIG

Giant insurer AIG (57, AIG) is lower than it was one, three, five or even eight years ago--back when it sold for 40 times earnings. Now it is just 8 times earnings and 1.2 times annual revenue. But with an exceptionally strong presence in insurance and broader finance and slow but steady growth, it will enjoy a good run in the stock market in 2008.

~ Ken Fisher, "We're Too Gloomy," Forbes, January 28, 2008

~ Ken Fisher, "We're Too Gloomy," Forbes, January 28, 2008

Ken Fisher on a "New Era" of above-average returns for stocks

At first post-2002 bulls were dismissed by academics and Wall Street sourpusses as not with it. Well, those who uttered the bearish New Era babble were the ones who weren't with it and should be relegated to the Siberia of commentators. But note that five years of above-average returns haven't yet generated any groundswell of thinking that we're now in some New Era of above-average returns.

That's bullish! It means sentiment hasn't turned euphoric, as it did in the late 1990s. Thus, there's room for more of a bull market ahead. I want to be the first to say we definitely are in a New Era of above-average returns. I'll keep buying stocks until we hear multiple pundits say we are entering a new period of high returns. That will be a time to sell.

When will this happen, that the consensus will turn almost uniformly bullish? I don't know, but I doubt it will be before 2009 starts. Hence, I'm expecting another above-average year ahead, an easy one.

~ Ken Fisher, "Another New Era," Forbes, December 10, 2007

That's bullish! It means sentiment hasn't turned euphoric, as it did in the late 1990s. Thus, there's room for more of a bull market ahead. I want to be the first to say we definitely are in a New Era of above-average returns. I'll keep buying stocks until we hear multiple pundits say we are entering a new period of high returns. That will be a time to sell.

When will this happen, that the consensus will turn almost uniformly bullish? I don't know, but I doubt it will be before 2009 starts. Hence, I'm expecting another above-average year ahead, an easy one.

~ Ken Fisher, "Another New Era," Forbes, December 10, 2007

Jim Grant on where he invests his own money

How am I investing my own untold wealth? In a confection of long-short equity hedge funds (no bonds), in gold and in Japanese stocks, chronically cheap but cheaper than ever in 2008.

~ Jim Grant, "Valedictory," Forbes, February 25, 2008

~ Jim Grant, "Valedictory," Forbes, February 25, 2008

Warren Buffett on gold

It gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.

~ Warren Buffett, speech given at Harvard, 1998

~ Warren Buffett, speech given at Harvard, 1998

| California Gold Centennial 1848-1948 |

Labels:

gold,

people - Buffett; Warren,

stamps,

stamps - history

Subscribe to:

Posts (Atom)