~ Brian Schartz, Downtown Associates 2020 Year End Letter, January 26, 2021

Showing posts with label people - Schartz; Brian. Show all posts

Showing posts with label people - Schartz; Brian. Show all posts

Mar 24, 2021

Brian Schartz on the retail investor and parallels to 2000

We have also taken note of the significant spike in retail trading activities. In our mid-year letter last summer, we referenced a friend who had gone from asking for help rebalancing his retirement funds to opening a Robinhood account to day trade option contracts in a matter of months. The financial press has been littered with similar anecdotes, and retail trading account openings have been extraordinarily strong over the course of 2020. We are reminded of the E-Trade and Ameritrade account openings of the late 1990’s by scores of unsophisticated traders who thought that they knew how to invest, simply by virtue of making a lot of money trading in the run up to the dot-com bubble. Of course, when that bubble popped, their trading accounts suffered mightily and most found themselves in new careers. These new market participants CANNOT determine valuation simply because they lack the experience and training necessary to make those determinations.

May 18, 2020

Brian Schartz on the rush by investors to buy Covid-19 winners

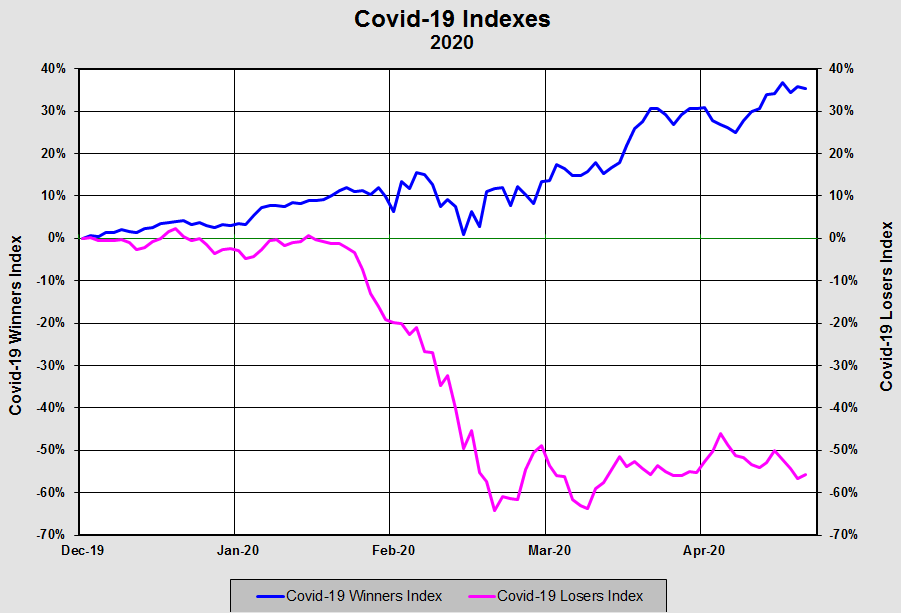

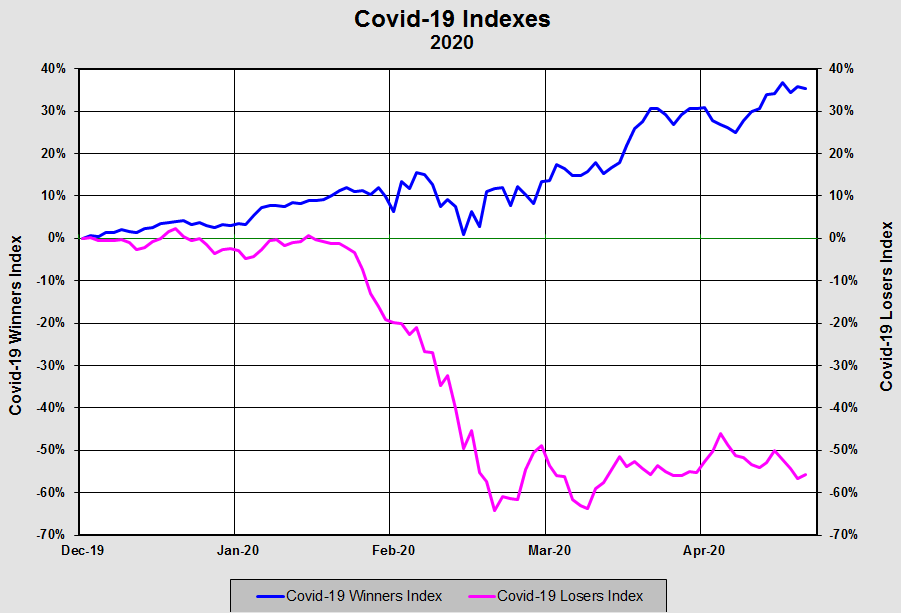

Like Pavlov’s dogs, investors have rushed right back to many of the same incredibly valued equities, despite a clear and convincing outlook that a severe recession is about to play out in the United

States and all around the world. Central bankers have rung the bell, and investors responded as they have been conditioned. In some cases, investors have declared certain equities as “pandemic

winners” and bid the shares to new all-time highs creating valuations that cannot be justified even if their businesses are strong for the duration of this crisis. We simply contemplate the magnitude of

the current situation compared to the housing crisis and the dot-com bust. We are convinced that the magnitude of this recession will prove to be much larger than either of those events. As a result,

we foresee a meaningful “second wave” of selling in the markets in the coming months. Bull markets are born at moments of despair, not days of central bank induced hope.

~ Brian Schartz, Downtown Associates Q1 Investor Letter, April 24, 2020

~ Brian Schartz, Downtown Associates Q1 Investor Letter, April 24, 2020

Subscribe to:

Posts (Atom)