~ Marc Faber, "High Risk of Market Crash as Smart Investors Sell with Marc Faber," WTFinance, 5:45 mark, December 11, 2024

Showing posts with label people - Faber; Marc. Show all posts

Showing posts with label people - Faber; Marc. Show all posts

Dec 14, 2024

Marc Faber on tariffs and onshoring

Now they have this brilliant idea to impose tariffs. It's an absurd idea because the tariffs will increase the prices of just about everything. And the employment gains will be very minimal because companies will pay the tariffs rather than move production into the U.S. where there is not sufficient technological skills, nor are there enough people to do the jobs that the Chinese or the Indians or the Vietnamese do.

Labels:

import tariffs,

onshoring,

people - Faber; Marc

Nov 18, 2024

Marc Faber on China's rise as a manufacturing superpower (2002)

I'll start with emerging markets, where valuations are attractive and expectations are very low. Since 1990 the markets in the developed countries of Western Europe and the U.S. are up, say, five times. In emerging economies most markets are down 80% in dollar terms, and earnings are bottoming out. Money has been flowing out of emerging-market funds for 2-3 years.

One concern is that Chinese competition will continue to erode the market share of other Asian exporters to Western Europe and the U.S. In the long run, very few emerging economies will be able to compete with China. I wouldn't rule out, in 5-10 years' time, the possibility that China becomes the workshop of the world, the way Lancashire [England] did in 1830s. But China will also become the customer of other emerging economies. China has a population of 1.2 billion people. Today less than 1% of the population is outbound, but 5%-10% could be traveling over the next 10-15 years. That would mean a meaningful influx of tourists into the surrounding countries of Asia, and Australia, New Zealand, the United States and Western Europe. Food and plantation companies will benefit from Chinese demand. Companies that cater to domestic consumer demand -- cigarette companies, pharmaceutical companies, software companies -- will also be helped.

~ Marc Faber, "Past and Presents Four pros speak their minds on history, science and compelling stocks," interview by Laura Rublin, Barron's, January 21, 2002

(Emphasis mine.)

Jan 25, 2022

Marc Faber on the Reddit crowd

Concerning the Reddit crowd, which buys meme stocks, unicorns, all sorts of cryptocurrencies, NFTs, etc., I am reminded of the words of Seneca the Younger: “It is the proof of a bad cause when it is applauded by the mob.”

~ Marc Faber, The Gloom, Boom & Doom Report, January 1, 2022

Jan 25, 2021

Marc Faber on governments finding scapegoats for its failures

Every failed state has always accused somebody else for its own shortcomings. The Bolsheviks blamed foreign interference and foreign spies; Stalin blamed Hitler; Hitler blamed the Communists and Jews;

Trump blamed the Chinese; and the Democrats blamed Trump for everything that went wrong, etc.

~ Marc Faber, The Gloom, Boom & Doom Report, February 1, 2021

Dec 29, 2020

Marc Faber: "The Chinese economy will be the size of Europe and America combined"

If I were an American, I would hold some assets outside America and I would not only listen to the "China bashers," but also try to understand that the Chinese economy will be the size of Europe and America combined... And whether you like the Chinese or not, and whether you're racist or not, I think that portfolios will have to own some assets in China, whether it's real estate or stocks or bonds. In all the global indices, China is way underweight. I have many friends - they invest in China - and they find world class companies. Nobody can deny that Netease or Alibaba or Tencent are not world class companies. There are also industrial companies. There are also beverage companies that are world class. When Grant [Williams] asked the question, "How do you protect yourself?", I think you need an international diversification. I think China is an option.

~ Marc Faber, "The End Game Ep. 8 - Dr. Marc Faber," The Grant Williams Podcast, 1:03:50 mark, October 7, 2020

Marc Faber on dishonest central bankers

Everybody applauds the central banks. Because of course the fund managers, they want the central banks to print money because their fees go up. They don't want an honest central bank. They want a dishonest central bank. At the same time they want dishonest politicians because everybody's dishonest so they can also stay dishonest as fund managers.

~ Marc Faber, "The End Game Ep. 8 - Dr. Marc Faber," The Grant Williams Podcast, 22:00 mark, October 7, 2020

Nov 30, 2019

Marc Faber on why younger Americans are poorer than previous generations

There is a reason for younger Americans to be in worse financial straits than the generations that preceded them. Aside from large borrowings (student debts are up from less than $50 billion in 1999 to more than $1.5 trillion in 2019), the millennials are also poor investors. Just like other individual investors they lack the discipline to implement a consistent investment strategy, and most importantly, patience. In addition, they trade far too frequently and chase the most popular stocks.

~ Marc Faber, Market Commentary, December 1, 2019

~ Marc Faber, Market Commentary, December 1, 2019

Oct 18, 2017

Marc Faber on freedom of speech and press

If you have to live in a society where you cannot express your views and your views are immediately condemned without further analysis and analysis of the context in which [they’re written] — if you can’t live with that, then it is a sad state of where freedom of the press and freedom of expression have come.

~ Marc Faber, quoted in "Faber says U.S. wouldn’t have made as much ‘progress’ if colonized by blacks," MarketWatch.com, October 18, 2017

~ Marc Faber, quoted in "Faber says U.S. wouldn’t have made as much ‘progress’ if colonized by blacks," MarketWatch.com, October 18, 2017

Jul 28, 2014

Dennis Gartman: Pay no attention to Faber's crash predictions

Listening to Marc Faber call for a 20 or 30 percent crash makes absolutely no sense, but he's been predicting it for years.

~ Dennis Gartman, as appeared on CNBC's Fast Money, July 28, 2014

~ Dennis Gartman, as appeared on CNBC's Fast Money, July 28, 2014

Jan 18, 2014

Marc Faber on the Fed: "They are going to bankrupt the world"

Nobody could have a more negative view of the Federal Reserve than I. It is run by a disastrous group of academics, who have no clue about what is happening in the real world. They believe money-printing can create jobs. They are going to bankrupt the world.

~ Marc Faber, Barron's Roundtable, January 13, 2014

~ Marc Faber, Barron's Roundtable, January 13, 2014

Labels:

Federal Reserve,

Hedgeye,

people - Faber; Marc

Apr 10, 2011

Marc Faber on gold

At a conference in Singapore yesterday which was sponsored by a large wealth manager I asked the audience of 200 people how many of you own gold and nobody raised their hand.

I think gold is trading below where it was in 1999 based on the worlds expansion of money.

Marc Faber, CNBC.com, April 8, 2011

I think gold is trading below where it was in 1999 based on the worlds expansion of money.

Marc Faber, CNBC.com, April 8, 2011

Mar 27, 2011

Marc Faber on crude oil

I still think in a risk/reward view oil is a very attractive commodity.

If you take a very optimistic view of the world namely a global economic recovery, demand in the Western World will pick up and demand in the Emerging World will continue to rise strongly, so from a very optimistic point of view you should be long oil.

[On the flip side,] if you take the ultra bearish scenario, like I do, where you think everything will collapse, that there will be World War III and collapsing countries in the middle East, then supplies will be curtailed and prices will go up.

~ Marc Faber, "Accumulate gold and Japanese shares, says Marc Faber,"Business Intelligence Middle East, March 25, 2011 (quoting Faber from a recent CNBC interview)

If you take a very optimistic view of the world namely a global economic recovery, demand in the Western World will pick up and demand in the Emerging World will continue to rise strongly, so from a very optimistic point of view you should be long oil.

[On the flip side,] if you take the ultra bearish scenario, like I do, where you think everything will collapse, that there will be World War III and collapsing countries in the middle East, then supplies will be curtailed and prices will go up.

~ Marc Faber, "Accumulate gold and Japanese shares, says Marc Faber,"Business Intelligence Middle East, March 25, 2011 (quoting Faber from a recent CNBC interview)

Jan 17, 2011

Marc Faber says the dollar is no longer a unit of account

If you measure the stock market not in dollars but gold, it is down 80% since 1999. I no longer regard the U.S. dollar as a valid unit of account. People shouldn't value their wealth in dollars because one day, in dollars, everyone will be a billionaire.

~Marc Faber, investor and author, The Gloom Boom Doom Report, Barron's magazine 2011 Barron's Roundtable, January 15, 2011

~Marc Faber, investor and author, The Gloom Boom Doom Report, Barron's magazine 2011 Barron's Roundtable, January 15, 2011

Jan 9, 2011

Marc Faber on the China bubble

naIt may be a painful adjustment, but in the near term there is no danger of an implosion in China. If I was negative about China and the credit implosion in China, I would short the Chinese banks.

~ Marc Faber, Hong Kong-based investment adviser and fund manager who publishes the Gloom, Boom & Doom report, "Eclectica's Hendry Turns Greece Profit Into China Failure Bet," Bloomberg, January 9, 2011

~ Marc Faber, Hong Kong-based investment adviser and fund manager who publishes the Gloom, Boom & Doom report, "Eclectica's Hendry Turns Greece Profit Into China Failure Bet," Bloomberg, January 9, 2011

Jul 22, 2010

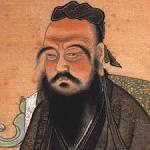

Marc Faber cites the wisdom of Confucius

If a man gives no thought about what is distant, he will find sorrow near at hand.

~ Confucius

(cited by Marc Faber, editor, Gloom Boom & Doom Report, July 22nd, 2010)

~ Confucius

(cited by Marc Faber, editor, Gloom Boom & Doom Report, July 22nd, 2010)

Jun 3, 2010

Marc Faber on a new model for financial analysis

It is no longer sufficient to analyze macroeconomic and microeconomic trends and individual companies and sectors; we now increasingly need the help of a political analyst who can warn us of what governments’ next regulatory ‘Schnapsideen’ (ideas developed while heavily intoxicated) are likely to be.

~ Marc Faber, editor, Gloom, Boom and Doom Report, The Daily Reckoning

~ Marc Faber, editor, Gloom, Boom and Doom Report, The Daily Reckoning

Apr 30, 2010

Marc Faber on the logic of the Greek crisis

In a democracy, no problems are solved, they are just postponed until the ultimate crash destroys everything.

~Marc Faber, editor, Gloom, Boom and Doom Report, Bloomberg TV, April 30th, 2010

~Marc Faber, editor, Gloom, Boom and Doom Report, Bloomberg TV, April 30th, 2010

Labels:

boom and bust cycle,

democracy,

people - Faber; Marc

Apr 23, 2010

Marc Faber on President Obama

Mr. Obama will do everything he can to get re-elected and that may involve some very bad decisions. He is like a roman emperor; he just gives out bread to the mob and produces games and circuses.

~ Marc Faber, "Gold Run not Over," Kitco, April 23, 2010

~ Marc Faber, "Gold Run not Over," Kitco, April 23, 2010

Apr 22, 2010

Marc Faber on the impossibility of driving an economic car

Either you believe that a government can steer the economy like a car, you put the brakes on and then you put your foot on the accelerator, and so forth, and you can perfectly steer it-- that is not my view. I think that governments eventually create a misallocation of capital, and measures they undertake either through monetary policies or fiscal policies or regulations, always lead to some unintended consequences.

~ Marc Faber, editor, Gloom, Boom and Doom Report, Bloomberg TV interview, April 21st, 2010

~ Marc Faber, editor, Gloom, Boom and Doom Report, Bloomberg TV interview, April 21st, 2010

Marc Faber on the risks of the Chinese bubble bursting

First of all, the Chinese stock market is still well below its peak in 2007. Secondly, the stock market in China is lower than in August 2009, and is lower, as is the Hang Seng Index, than in November 2009. In other words, we have essentially a boom in properties not reflected in the stock market. I think maybe the stock market is giving us a signal that not all is right in China. And, all I am maintaining is that if the bubble bursts in China, you don't want to be in say, Australian stocks, in the Australian dollar, in commodities and industrial commodities like copper and nickel and aluminum, because the demand for commodities in a scenario of the Chinese bubble bursting is going to go down very substantially.

There's a risk now, it may not happen right away, it may only happen next year, but an investor should keep this in mind-- that when a bubble bursts in China, and for sure, if it doesn't burst now it will burst in 6 months, and if it doesn't burst in 6 months it will burst in 12 months or in 18 months, but the longer it doesn't happen the worse it will be.

~ Marc Faber, editor, Gloom, Boom and Doom Report, Bloomberg TV interview, April 21, 2010

There's a risk now, it may not happen right away, it may only happen next year, but an investor should keep this in mind-- that when a bubble bursts in China, and for sure, if it doesn't burst now it will burst in 6 months, and if it doesn't burst in 6 months it will burst in 12 months or in 18 months, but the longer it doesn't happen the worse it will be.

~ Marc Faber, editor, Gloom, Boom and Doom Report, Bloomberg TV interview, April 21, 2010

Subscribe to:

Posts (Atom)