Mar 30, 2024

The Economist on Xi Jinping's "grip" on the economy

Saifedean Ammous on the failed forecasts of Paul Samuelson's economics textbook

Mar 29, 2024

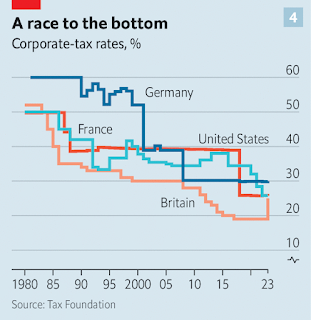

The Economist on the impact of lower interest rates and corporate tax rates on corporate profits (1989-2019)

Thomas Sowell on envy

Mar 28, 2024

Simon Handrahan on two keys to investing

Mar 27, 2024

The Economist: "technological breakthroughs take ages to pay off"

The Economist on bugs in generative AI

Mar 26, 2024

The Economist on the failure of Israel's invasion of Gaza

Mar 25, 2024

Fred Hickey on the lack of demand for generative AI

Derek Au on AI: "training is computation heavy, inferencing is computation light"

Sheldon Richman on the proposed bill to force a sale of TikTok

Tom Woods on his stingray experience

Robert F. Kennedy, Jr. on war China's foreign policy

Stanley Druckenmiller on patience and investing

Mar 24, 2024

Hans-Hermann Hoppe on decentralization

The Economist on how woke images appeared on Google's AI search engine

Jim Chanos on the meme stock mania

There's just a cognitive dissonance in a lot of these situations. And short sellers get the blame for it. Short sellers were seen, politically and (socially), as heroes after Enron and the dot com era. A little less so in '08-'09 … but now, post-meme stock world, short sellers are again the evil conspiracy to derail retail investors from making their profits in stocks like AMC and Bed Bath and Beyond. [The meme stock rally was] probably the best example in modern financial history [of cognitive dissonance in the markets]. Despite evidence staring you in the face about the declining business prospects of AMC or Bed Bath and Beyond, the cult members want to continue to believe in things like naked short selling or phantom shares and what have you. I just keep saying 'Guys, if you do spend all this time on this nonsense, instead, learn how to read a balance sheet – you'd be far better off'.

~ Jim Chanos, "'I'm not dead yet': Jim Chanos isn't done short selling despite hedge fund wind down," Pensions & Investments, December 14, 2023