The shock therapy of decisive war will elevate the stock market by a couple of thousand points.

~ Larry Kudlow, National Review Online, June 26, 2002

Dec 31, 2007

Ken Fisher: "Housing sector is already making a comeback" (2007)

Don't buy it. For months now the debate has been over whether America will have a hard landing of soft landing, the answer hinging on how big 2007's housing disaster turns out to be. Well, there won't be any housing disaster. We won't have a landing at all, soft or hard. Right now the U.S. and global economies are both accelerating.

You can see right through the housing crash story by looking at the prices of housing stocks. The market knows what the economic worrywarts do not, which is that the housing sector is already making a comeback. In the last six months housing stocks are up 24%, well ahead of the overall market. If housing were destined to fall apart in 2007 these stocks wouldn't be so strong now.

~ Ken Fisher, "Housing Boom!," Forbes, February 26, 2007 (He recommend Pulte Homes (34, PHM), Toll Brothers (34, TOL), and Beazer Homes (44, BZH).)

You can see right through the housing crash story by looking at the prices of housing stocks. The market knows what the economic worrywarts do not, which is that the housing sector is already making a comeback. In the last six months housing stocks are up 24%, well ahead of the overall market. If housing were destined to fall apart in 2007 these stocks wouldn't be so strong now.

~ Ken Fisher, "Housing Boom!," Forbes, February 26, 2007 (He recommend Pulte Homes (34, PHM), Toll Brothers (34, TOL), and Beazer Homes (44, BZH).)

Larry Kudlow: "Not even Greenspan can stop the Internet economy" (2000)

This correction will run its course until the middle of the year. Then things will turn up again, because not even Greenspan can stop the Internet economy.

~ Larry Kudlow, The New York Post, February 25, 2000

~ Larry Kudlow, The New York Post, February 25, 2000

Steve Leisman on corporate balance sheets

The corporate balance sheet - as I've been pounding the table - remains healthy.

~ Steve Leisman, CNBC, December 31, 2007

~ Steve Leisman, CNBC, December 31, 2007

Bernie Schaeffer on the VIX as a "smart money" indicator

This year... I personally found new significance for the CBOE Market Volatility Index – as an indicator of the smart money's assessment of the volatility landscape as opposed to the "dumb money fear gauge" it is so widely believed to represent.

~ Bernie Schaeffer, Schaeffer's Monday Morning Outlook, December 31, 2007

~ Bernie Schaeffer, Schaeffer's Monday Morning Outlook, December 31, 2007

Dec 28, 2007

Paul Krugman blaming the credit crunch on lax regulation and adherence to free market ideology

So where were the regulators as one of the greatest financial disasters since the Great Depression unfolded? They were blinded by ideology.

“Fed shrugged as subprime crisis spread,” was the headline on a New York Times report on the failure of regulators to regulate. This may have been a discreet dig at Mr. Greenspan’s history as a disciple of Ayn Rand, the high priestess of unfettered capitalism known for her novel “Atlas Shrugged.”

In a 1963 essay for Ms. Rand’s newsletter, Mr. Greenspan dismissed as a “collectivist” myth the idea that businessmen, left to their own devices, “would attempt to sell unsafe food and drugs, fraudulent securities, and shoddy buildings.” On the contrary, he declared, “it is in the self-interest of every businessman to have a reputation for honest dealings and a quality product.”

It’s no wonder, then, that he brushed off warnings about deceptive lending practices, including those of Edward M. Gramlich, a member of the Federal Reserve board. In Mr. Greenspan’s world, predatory lending — like attempts to sell consumers poison toys and tainted seafood — just doesn’t happen.

~ Paul Krugman, "Blindly Into the Bubble," The New York Times, December 21, 2007

“Fed shrugged as subprime crisis spread,” was the headline on a New York Times report on the failure of regulators to regulate. This may have been a discreet dig at Mr. Greenspan’s history as a disciple of Ayn Rand, the high priestess of unfettered capitalism known for her novel “Atlas Shrugged.”

In a 1963 essay for Ms. Rand’s newsletter, Mr. Greenspan dismissed as a “collectivist” myth the idea that businessmen, left to their own devices, “would attempt to sell unsafe food and drugs, fraudulent securities, and shoddy buildings.” On the contrary, he declared, “it is in the self-interest of every businessman to have a reputation for honest dealings and a quality product.”

It’s no wonder, then, that he brushed off warnings about deceptive lending practices, including those of Edward M. Gramlich, a member of the Federal Reserve board. In Mr. Greenspan’s world, predatory lending — like attempts to sell consumers poison toys and tainted seafood — just doesn’t happen.

~ Paul Krugman, "Blindly Into the Bubble," The New York Times, December 21, 2007

Comptroller of the Currency John C. Dugan on risky non-traditional mortgage products

Today’s non-traditional mortgage products – interest-only, payment option ARMs, no doc and low-doc, and piggyback mortgages, to name the most prominent examples – are a different species of product, with novel and potentially risky features.

...This dominance is increasingly reflected in the numbers. By some estimates, interest-only products constituted approximately 50 percent of all mortgage originations last year. In the first half of 2005, IOs started to decline in favor of payment-option ARMs, which, according to one source, comprised half of new mortgage originations. And roughly every other mortgage these days is also a “piggyback” or reduced documentation mortgage, which points to another development that concerns us: the trend toward "layering" of multiple risks. There is no doubt that when several risky features are combined in a single loan, the total risk is greater than the sum of the parts.

We can readily understand why these new products have become fixtures in the marketplace in such a short time. One reason is that they have helped sustain loan volume that would otherwise almost certainly be falling, because rising interest rates have brought an end to the refinance boom. More important, lenders have scrambled to find ways to make expensive houses more affordable – although there’s now a concern that the very availability of this new type of financing has done its share to help drive up house prices, which in turn stimulates demand for even more non-traditional financing."

~ John C. Dugan, Comptroller of the Currency, "Remarks by John C. Dugan Before an OCC Credit Risk Conference," Atlanta, Georgia, October 27, 2005

(Appeared in Calculated Risk blog, "Remarks by John C. Dugan," November 9, 2005.)

...This dominance is increasingly reflected in the numbers. By some estimates, interest-only products constituted approximately 50 percent of all mortgage originations last year. In the first half of 2005, IOs started to decline in favor of payment-option ARMs, which, according to one source, comprised half of new mortgage originations. And roughly every other mortgage these days is also a “piggyback” or reduced documentation mortgage, which points to another development that concerns us: the trend toward "layering" of multiple risks. There is no doubt that when several risky features are combined in a single loan, the total risk is greater than the sum of the parts.

We can readily understand why these new products have become fixtures in the marketplace in such a short time. One reason is that they have helped sustain loan volume that would otherwise almost certainly be falling, because rising interest rates have brought an end to the refinance boom. More important, lenders have scrambled to find ways to make expensive houses more affordable – although there’s now a concern that the very availability of this new type of financing has done its share to help drive up house prices, which in turn stimulates demand for even more non-traditional financing."

~ John C. Dugan, Comptroller of the Currency, "Remarks by John C. Dugan Before an OCC Credit Risk Conference," Atlanta, Georgia, October 27, 2005

(Appeared in Calculated Risk blog, "Remarks by John C. Dugan," November 9, 2005.)

Paul Krugman blaming the subprime mess on greed and a lack of corporate governance

'What were they smoking?" asks the cover of the current issue of Fortune magazine. Underneath the headline are photos of recently deposed Wall Street titans, captioned with the staggering sums they managed to lose.

The answer, of course, is that they were high on the usual drug - greed. And they were encouraged to make socially destructive decisions by a system of executive compensation that should have been reformed after the Enron and WorldCom scandals, but wasn't.

The point is that the subprime crisis and the credit crunch are, in an important sense, the result of our failure to effectively reform corporate governance after the last set of scandals.

~ Paul Krugman, "Banks Gone Wild," International Herald Tribune, November 23, 2007

The answer, of course, is that they were high on the usual drug - greed. And they were encouraged to make socially destructive decisions by a system of executive compensation that should have been reformed after the Enron and WorldCom scandals, but wasn't.

The point is that the subprime crisis and the credit crunch are, in an important sense, the result of our failure to effectively reform corporate governance after the last set of scandals.

~ Paul Krugman, "Banks Gone Wild," International Herald Tribune, November 23, 2007

Thomas DiLorenzo on Paul Krugman blaming the mortgage mess on the free market

In [Paul] Krugman's article blaming the "subprime" mortgage mess on the free market, he claims that the Comptroller of the Currency should have been regulating the lending business more stringently. If so, this all might have been avoided, he says. As usual, he hasn't the foggiest idea of what he's talking about.

The fact is, the Comptroller of the Currency and the Fed itself have been busy enforcing the "Community Reinvestment Act" of 1977 for the past 30 years, which pressures banks to make uneconomical loans to uncreditworthy borrowers, euphemistically called "sub-prime" borrowers. They're not financial deadbeats, or people who never pay their bills on time. They're just a tiny, tiny bit below "prime" borrowers, in Governmentspeak.

Once again, Krugman gets everything ass backwards: Government regulation of the credit markets is a major CAUSE of the "subprime" mortgage debacle, not the solution. (Of course, the Greenspan Fed itself is the cause of the now-burst housing bubble).

~ Thomas DiLorenzo, "Crazed Keynesianism (and stupid, too)," LewRockwell.com blog post, December 21, 2007

The fact is, the Comptroller of the Currency and the Fed itself have been busy enforcing the "Community Reinvestment Act" of 1977 for the past 30 years, which pressures banks to make uneconomical loans to uncreditworthy borrowers, euphemistically called "sub-prime" borrowers. They're not financial deadbeats, or people who never pay their bills on time. They're just a tiny, tiny bit below "prime" borrowers, in Governmentspeak.

Once again, Krugman gets everything ass backwards: Government regulation of the credit markets is a major CAUSE of the "subprime" mortgage debacle, not the solution. (Of course, the Greenspan Fed itself is the cause of the now-burst housing bubble).

~ Thomas DiLorenzo, "Crazed Keynesianism (and stupid, too)," LewRockwell.com blog post, December 21, 2007

BusinessWeek on the repeal of Glass-Steagall

The implications of the new law [the repeal of Glass-Steagall] are enormous. For instance, like other deregulated businesses, a merger frenzy of potentially unprecedented scale and scope is likely to be unleashed in the financial-services industry. Regulators rightly worry that these new behemoths will be considered too big to fail, encouraging their managements to throw the dice by lending recklessly throughout the global economy. These companies would profit handsomely if the gambles pay off, and taxpayers pick up the tab if they don't -- shades of the 1980s savings-and-loan crisis.

~ BusinessWeek Online, "Goodbye Glass-Steagall, Hello Big Mergers -- and Big Fees?," October 29, 1999

~ BusinessWeek Online, "Goodbye Glass-Steagall, Hello Big Mergers -- and Big Fees?," October 29, 1999

Labels:

banking,

deregulation,

Glass-Steagall Act,

too big to fail

Frederic Mishkin: Housing market "bottoming out" (2007)

We do see some stabilization of demand in the housing market ... there is some indication that the market could be bottoming out.

~ Frederic Mishkin, Federal Reserve Governor, Reuters, April 20, 2007

(Quote provided by Kevin Depew, "Five Things You Need to Know: Housing Slump Well Contained; Well Contained to Existing Home Sales; Well Contained to Largest Cement Producer in U.S.; Well Contained to Spain; Well Contained to Auto Sales," Minyanville, April 24, 2007)

~ Frederic Mishkin, Federal Reserve Governor, Reuters, April 20, 2007

(Quote provided by Kevin Depew, "Five Things You Need to Know: Housing Slump Well Contained; Well Contained to Existing Home Sales; Well Contained to Largest Cement Producer in U.S.; Well Contained to Spain; Well Contained to Auto Sales," Minyanville, April 24, 2007)

Henry Paulson: Subprime troubles "largely contained" (2007)

I don't see (subprime mortgage market troubles) imposing a serious problem. I think it's going to be largely contained.

~ Henry Paulson, U.S. Treasury Secretary, Reuters, April 20, 2007

(Quote provided by Kevin Depew, "Five Things You Need to Know: Housing Slump Well Contained; Well Contained to Existing Home Sales; Well Contained to Largest Cement Producer in U.S.; Well Contained to Spain; Well Contained to Auto Sales," Minyanville, April 24, 2007)

~ Henry Paulson, U.S. Treasury Secretary, Reuters, April 20, 2007

(Quote provided by Kevin Depew, "Five Things You Need to Know: Housing Slump Well Contained; Well Contained to Existing Home Sales; Well Contained to Largest Cement Producer in U.S.; Well Contained to Spain; Well Contained to Auto Sales," Minyanville, April 24, 2007)

Richard Fisher: "Damage from subprime largely contained" (2007)

The damage from the subprime market has been largely contained.

~ Richard Fisher, Dallas Fed President, Dallas News, April 5, 2007

(Quote provided by Kevin Depew, "Five Things You Need to Know: Housing Slump Well Contained; Well Contained to Existing Home Sales; Well Contained to Largest Cement Producer in U.S.; Well Contained to Spain; Well Contained to Auto Sales," Minyanville, April 24, 2007)

~ Richard Fisher, Dallas Fed President, Dallas News, April 5, 2007

(Quote provided by Kevin Depew, "Five Things You Need to Know: Housing Slump Well Contained; Well Contained to Existing Home Sales; Well Contained to Largest Cement Producer in U.S.; Well Contained to Spain; Well Contained to Auto Sales," Minyanville, April 24, 2007)

Ben Bernanke: Subprime problems seem "contained" (2007)

At this juncture...the impact on the broader economy and financial markets of the problems in the subprime markets seems likely to be contained.

~ Ben Bernanke, Federal Reserve Chairman, AFX News, March 28, 2007

(Quote provided by Kevin Depew, "Five Things You Need to Know: Housing Slump Well Contained; Well Contained to Existing Home Sales; Well Contained to Largest Cement Producer in U.S.; Well Contained to Spain; Well Contained to Auto Sales," Minyanville, April 24, 2007)

~ Ben Bernanke, Federal Reserve Chairman, AFX News, March 28, 2007

(Quote provided by Kevin Depew, "Five Things You Need to Know: Housing Slump Well Contained; Well Contained to Existing Home Sales; Well Contained to Largest Cement Producer in U.S.; Well Contained to Spain; Well Contained to Auto Sales," Minyanville, April 24, 2007)

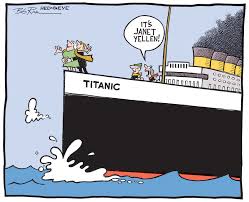

Janet Yellen: "Waking up less at night" over housing (2007)

I'm waking up less at night than I was [over the slowdown in housing]. So far, there's been remarkably little effect [from housing] on the rest of the economy.

~ Janet Yellen, San Francisco Fed President, MarketWatch, February 21, 2007

(Quote provided by Kevin Depew, "Five Things You Need to Know: Housing Slump Well Contained; Well Contained to Existing Home Sales; Well Contained to Largest Cement Producer in U.S.; Well Contained to Spain; Well Contained to Auto Sales," Minyanville, April 24, 2007)

~ Janet Yellen, San Francisco Fed President, MarketWatch, February 21, 2007

(Quote provided by Kevin Depew, "Five Things You Need to Know: Housing Slump Well Contained; Well Contained to Existing Home Sales; Well Contained to Largest Cement Producer in U.S.; Well Contained to Spain; Well Contained to Auto Sales," Minyanville, April 24, 2007)

James Madison on threats to liberty: gradualism and external enemies

I believe there are more instances of the abridgement of freedom of the people by gradual and silent encroachments by those in power than by violent and sudden usurpations.... The means of defense against foreign danger historically have become the instruments of tyranny at home.

~ James Madison

~ James Madison

Dec 27, 2007

Lew Rockwell on the assassination of Benazir Bhutto

The horrific assassination of Benazir Bhutto is a massive blow to the empire, since she was the handpicked US replacement for the hated Pervez Musharraf. The US had installed Musharraf as military dictator after kicking out his elected predecessor, Nawaz Sharif (ah yes, global democracy), who was considered insufficiently obedient. The US has spent many billions on Musharraf and his military, but it has only earned the contempt of Pakistanis who don't like being a US colony (and no, one does not have to be pro-terrorist to be opposed to foreign control). What will happen now in Pakistan? Nothing good. At the same time, the US occupations of Iraq and Afghanistan continue to go badly, and Turkey--with US support--is bombing the Kurds in Iraq, the most pro-American part of the population. All over the world, other occupied areas grow restive as well.

Meanwhile, thanks to the Fed, the dollar weakens every day, risking a key pillar of US hegemony. Domestically, housing heads into a 1930s-style crisis, with more of the economy to follow.

This is the way empires end: in blood and economic disaster. The regime will want to do more of the same: inflate and bailout at home, threaten and bomb abroad, which will only worsen everything.

There is only way out: cut spending, cut taxes, stop inflating, end the police state, bring the troops home. Peace and freedom: libertarianism, in other words. How blessed we are, at the very moment of crisis, to have Ron Paul.

Needless to say, only Ron Paul among the candidates has opposed US intervention in Pakistan, and the massive foreign aid to its government.

~ Lew Rockwell, "Ron Paul, Pakistan and the Fed," LewRockwell.com blog post, December 27, 2007

Meanwhile, thanks to the Fed, the dollar weakens every day, risking a key pillar of US hegemony. Domestically, housing heads into a 1930s-style crisis, with more of the economy to follow.

This is the way empires end: in blood and economic disaster. The regime will want to do more of the same: inflate and bailout at home, threaten and bomb abroad, which will only worsen everything.

There is only way out: cut spending, cut taxes, stop inflating, end the police state, bring the troops home. Peace and freedom: libertarianism, in other words. How blessed we are, at the very moment of crisis, to have Ron Paul.

Needless to say, only Ron Paul among the candidates has opposed US intervention in Pakistan, and the massive foreign aid to its government.

~ Lew Rockwell, "Ron Paul, Pakistan and the Fed," LewRockwell.com blog post, December 27, 2007

Dec 26, 2007

Murray Rothbard on economic ignorance

It is no crime to be ignorant of economics, which is, after all, a specialized discipline and one that most people consider to be a 'dismal science.' But it is totally irresponsible to have a loud and vociferous opinion on economic subjects while remaining in this state of ignorance.

~ Murray Rothbard, Egalitarianism as a Revolt Against Nature, and Other Essays

~ Murray Rothbard, Egalitarianism as a Revolt Against Nature, and Other Essays

Murray Rothbard on environmentalist hypocrites

My own observation is that most of the bellyachers about the ugliness of our cities and singers of paeans to the unspoiled wilderness stubbornly remain ensconced in these very cities. Why don't they leave? There are, even today, plenty of rural and even wilderness areas for them to live in and enjoy. Why don't they go there and leave those of us who like and enjoy the cities in peace. Furthermore, if they got out, it would help relieve the urban 'overcrowding' which they also complain about.

~ Murray Rothbard, Egalitarianism as a Revolt Against Nature, and Other Essays

~ Murray Rothbard, Egalitarianism as a Revolt Against Nature, and Other Essays

Dec 24, 2007

Casey Stengel on making predictions

Never make predictions, especially about the future.

~ Casey Stengel, famed baseball manager

~ Casey Stengel, famed baseball manager

Bernie Schaeffer on 2007 U.S. and global equity fund flows

As of December 19, TrimTabs Investment Research reports that U.S. equity funds had lost $51.1 billion year-to-date, on pace to be the largest annual outflow in industry history. This amounts to about 1% of total equity-fund assets of $5.3 trillion. Mutual-fund players seem to be taking the money overseas, as global equity funds saw inflows of $126.9 billion, equal to 7.5% of the $1.7 trillion in global equity fund assets. Since 2005 in fact, U.S. equity funds have lost $9 billion, even while the S&P 500 has grown from 1,212 at the end of 2004 to 1,485 today.

~ Bernie Schaeffer, Schaeffer's Monday Morning Outlook, December 24, 2007

~ Bernie Schaeffer, Schaeffer's Monday Morning Outlook, December 24, 2007

Bill Bonner and Lila Rajiva on the outcome of 9/11

The attacks of September 11 produced exactly the results the terrorists desired - the Bush administration panicked, got out the duct tape, and created what Leif Wenar at the University of Sheffield cleverly calls "a false sense of insecurity."

In short, they created panic - even terror - in the American people, which, of course, is precisely the aim of terrorists. In the language of the Marxist terrorists of the late 1960s, their real aim is to radicalize onlookers, moving them to join the cause. That is just what the Bush administration seems to have done. Rather than calmly and quietly proceeding to track down the perpetrators, it blundered right into Iraq and stirred up terrorist ambitions all over the Middle East. Where previously there had been only a handful of fanatics to worry about, now there are thousands of them.

~ Bill Bonner and Lila Rajiva, Mobs, Messiahs, and Markets, p. 57

In short, they created panic - even terror - in the American people, which, of course, is precisely the aim of terrorists. In the language of the Marxist terrorists of the late 1960s, their real aim is to radicalize onlookers, moving them to join the cause. That is just what the Bush administration seems to have done. Rather than calmly and quietly proceeding to track down the perpetrators, it blundered right into Iraq and stirred up terrorist ambitions all over the Middle East. Where previously there had been only a handful of fanatics to worry about, now there are thousands of them.

~ Bill Bonner and Lila Rajiva, Mobs, Messiahs, and Markets, p. 57

Dec 23, 2007

Henry David Thoreau on the foundation of liberty

Disobedience is the true foundation of liberty. The obedient must be slaves.

~ Henry David Thoreau

~ Henry David Thoreau

Louis Brandeis on threats to liberty

Experience should teach us to be most on our guard to protect liberty when the government's purposes are beneficent... The greatest dangers to liberty lurk in insidious encroachment by men of zeal -- well-meaning but without understanding.

~ Justice Louis D. Brandeis, 1928

~ Justice Louis D. Brandeis, 1928

John Philpot Curran on the price of liberty

Eternal vigilance is the price of liberty.

~ John Philpot Curran

~ John Philpot Curran

Henry Hazlitt on the broken gold promise

We have forgotten that our currency unit, the dollar, was originally a pledge. It was a solemn pledge by the U.S. Government to pay its bearer on demand 1/20th of an ounce of gold. Our government disdainfully repudiated that pledge in 1933. It made another pledge to pay 1/35th of an ounce, not to our own people but to foreign central banks. That pledge was repudiated in 1971.

~ Henry Hazlitt

~ Henry Hazlitt

Aden sisters on inflation and gold

The overall evidence strongly suggests that tons and tons of money would then flood into the system, further cheapening the currency while interest rates drop to near zero if they have to. That in turn will eventually fuel inflation and gold's long-term bull- market rise.

~ Aden Forecast, edited by Mary Anne and Pam Aden, "For Adens, gold isn't all that glitters;

Commentary: Veteran gold bugs also see short-term stock opportunities," MarketWatch, December 20, 2007

The Adens currently recommend:

- 40% Gold and silver physical and ETFs, and gold and silver shares

- 40% Natural resources, energy & other stocks

- 20% Cash: Euro, Canadian dollar, Australian, New Zealand and Singapore dollars or currency funds

Anatole France on the hemline indicator

If I should be able to choose one out of all the books published a hundred years after my death, I would take a fashion magazine to see how women were dressing. Their fripperies would tell me more about the society of that future day than all the philosophers and preachers.

~ Anatole France

~ Anatole France

Gene Epstein sees no recession in 2008

The metaphor of the drug clinic should not give us the impression that everybody in the economy is crashing. The fact of the matter is that retail sales are up, industrial production is holding. Most likely we are not going to suffer a recession in 2008. Most likely it will be a slowdown. There will be some rise in the interest rate. The central banks are indeed in their rehab phase and the economy will likely pull through and start expanding again more rapidly in 2009.

~ Gene Epstein, Barron's Video, December 24, 2007

~ Gene Epstein, Barron's Video, December 24, 2007

Gene Epstein on Greenspan the drug dealer

CAN FORMER FEDERAL RESERVE chairman Alan Greenspan be blamed for the current crisis in mortgage debt? The question is like asking whether the recently departed Mafia lord in charge of pushing drugs might be responsible for the fact that a lot of folks got addicted, and eventually overdosed.

Now suppose this same Mafia lord also manages the major methadone clinics and rehab facilities. This is good for his organization, which wants to sell to users whose habits are kept under control. It all makes for a system that runs like a well-oiled machine.

The "drug" in question is money and credit, which the central bank dispenses. And it's the ready availability of money and credit that lures the irrationally exuberant into committing finance capital to unsustainable projects that eventually bring on the sort of crisis we're now in.

~ Gene Epstein, "Study History, Mr. Greenspan," Barron's, December 24, 2007

Now suppose this same Mafia lord also manages the major methadone clinics and rehab facilities. This is good for his organization, which wants to sell to users whose habits are kept under control. It all makes for a system that runs like a well-oiled machine.

The "drug" in question is money and credit, which the central bank dispenses. And it's the ready availability of money and credit that lures the irrationally exuberant into committing finance capital to unsustainable projects that eventually bring on the sort of crisis we're now in.

~ Gene Epstein, "Study History, Mr. Greenspan," Barron's, December 24, 2007

Dec 22, 2007

John Bogle on the Go-Go Sixties

Q: What was your biggest mistake?

Bogle: When I was 38, I became head of Wellington Management, and I did an extremely unwise merger. I got wrapped up in the excitement of the go-go era, and the go-go era ended. As a result of that stupid decision, I got fired. The great thing about that mistake, which was shameful and inexcusable and a reflection of immaturity and confidence beyond what the facts justified, was that I learned a lot. And if I had not been fired then, there would not have been a Vanguard.

~ John Bogle, "Questions For John Bogle," Fortune, December 24, 2007

Labels:

Go-Go Sixties,

mistakes,

people - Bogle; John

Frederic Bastiat on government theft

If you and I can't steal from our neighbors, we don't have the moral right to ask our neighbor -- our government to do the same thing.

~ Frederic Bastiat

(This may be a paraphrase. Ron Paul quoted referred to this quote in an interview with Glenn Beck on December 18, 2007.)

~ Frederic Bastiat

(This may be a paraphrase. Ron Paul quoted referred to this quote in an interview with Glenn Beck on December 18, 2007.)

Labels:

government,

morality,

people - Bastiat; Frederic,

theft

Dec 21, 2007

C.S. Lewis on the tyranny of good intentions

Of all tyrannies, a tyranny sincerely exercised for the good of its victims may be the most oppressive. It would be better to live under robber barons than under omnipotent moral busybodies. The robber baron's cruelty may sometimes sleep, his cupidity may at some point be satiated; but those who torment us for our own good will torment us without end for they do so with the approval of their own conscience.

~ C.S. Lewis

~ C.S. Lewis

Groucho Marx on politics

Politics is the art of looking for trouble, finding it, misdiagnosing it and applying the wrong remedies.

~ Groucho Marx

~ Groucho Marx

Jim Cramer on Lloyd Blankfein

Lloyd Blankfein is money in the bank... He's the most underpaid CEO on Wall Street.

~ Jim Cramer, as appeared on CNBC, December 21, 2007

~ Jim Cramer, as appeared on CNBC, December 21, 2007

Dec 20, 2007

Neil Cavuto on the Iraq War and early victory (2003)

I want to talk to the French right now. And the Germans. And the Russians. I want to talk to all those who opposed the liberation of Iraq.

I want to show you all the joyous scene in downtown Baghdad today.

People oppressed. Now people free.

People once hopeless. Now hopeful.

People you forgot. But we remembered.

If you had things your way, they'd still be under the thumb of a dictator. And you were fine with that. We were not.

You had no problem telling them, live with it. We had a big problem telling them, get over it.

Look at their faces. See their smiles. Feel their joy. Their freedom. Their fervor. How do you feel now? Still sure going the extra mile for them wasn't worth it? I don't think they'd agree.

While you were debating, they were suffering.

~ Neil Cavuto, "Stomping on Saddam," FOX News, April 9, 2003

I want to show you all the joyous scene in downtown Baghdad today.

People oppressed. Now people free.

People once hopeless. Now hopeful.

People you forgot. But we remembered.

If you had things your way, they'd still be under the thumb of a dictator. And you were fine with that. We were not.

You had no problem telling them, live with it. We had a big problem telling them, get over it.

Look at their faces. See their smiles. Feel their joy. Their freedom. Their fervor. How do you feel now? Still sure going the extra mile for them wasn't worth it? I don't think they'd agree.

While you were debating, they were suffering.

~ Neil Cavuto, "Stomping on Saddam," FOX News, April 9, 2003

Morgan Stanley on MBIA's structured finance disclosure

We are shocked that management withheld this information for as long as it did. This new disclosure completely changes our view of MBIA being a more conservative underwriter relative to Ambac.

~ Ken Zerbe, Yoana Koleva, Morgan Stanley analysts, "MBIA details huge mortgage exposure, shares collapse ", Reuters, December 20, 2007

~ Ken Zerbe, Yoana Koleva, Morgan Stanley analysts, "MBIA details huge mortgage exposure, shares collapse ", Reuters, December 20, 2007

Dec 19, 2007

Robert Taft on liberty vs. central planning

After the American Revolution and the French Revolution the whole world became convinced that liberty was the key to progress and happiness for the peoples of the world, and this theory was accepted, even in those countries where there was, in fact, no liberty. People left Europe and came to this country, not so much because of the economic conditions as because they sought a liberty which they could not find at home. But gradually this philosophy has been replaced by the idea that happiness can only be conferred upon the people by the grace of an efficient government. Only the government, it is said, has the expert knowledge necessary for the people's welfare; only the government has the power to carry out the grandiose plans so necessary in a complicated world.

~ Senator Robert Taft, A Foreign Policy for Americans (1951)

~ Senator Robert Taft, A Foreign Policy for Americans (1951)

Robert Taft on liberty and progress

We cannot overestimate the value of this liberty of ideas and liberty of action. It is not that you or I or some industrial genius is free; it is that millions of people are free to work out their own ideas and the country is free to choose between them and adopt those which offer the most progress. I have been through hundreds of industrial plants in the last two or three years, and in every plant I find that the people running that plant feel that they have something in the way of methods or ideas or machinery that no other plant has. I have met men said to be the best machinists in the industry who have built special machines for a particular purpose in which that company is interested.

Thousands of wholly free and independent thinkers are working out these ideas and have the right and ability to try them out without getting the approval of some government bureau. You can imagine the difference between the progress under such a system and one in which the government ran every plant in the country as it runs the post offices today. There would be one idea for a hundred that are now developed. If any plant employee had an idea for progress and wrote to Washington, he probably would get back a letter referring him to Regulation No. 5201 (c), which tells him exactly how this particular thing should be done, and has been done for the past fifty years.

It is clear to me that the great progress made in this country, the tremendous production of our people, the productivity per man of our workmen have grown out of this liberty and the freedom to develop ideas. We have the highest standard of living, because we produce more per person than any other country in the world.

~ Senator Robert Taft, A Foreign Policy for Americans (1951)

Thousands of wholly free and independent thinkers are working out these ideas and have the right and ability to try them out without getting the approval of some government bureau. You can imagine the difference between the progress under such a system and one in which the government ran every plant in the country as it runs the post offices today. There would be one idea for a hundred that are now developed. If any plant employee had an idea for progress and wrote to Washington, he probably would get back a letter referring him to Regulation No. 5201 (c), which tells him exactly how this particular thing should be done, and has been done for the past fifty years.

It is clear to me that the great progress made in this country, the tremendous production of our people, the productivity per man of our workmen have grown out of this liberty and the freedom to develop ideas. We have the highest standard of living, because we produce more per person than any other country in the world.

~ Senator Robert Taft, A Foreign Policy for Americans (1951)

Albert Lord unplugged

It’s (margin calls) embarrassing and troublesome to me personally, the bank sold me out. It is not a sign of my disillusionment with the company. In fact, the exact reverse is the case.

Steve (McGarry, Managing Director of Investor Relations), let's go, there's no questions, let's get the f*ck outta here.

~ Albert Lord, CEO Sallie Mae, conference call discussing future of Sallie Mae, December 19, 2007

Steve (McGarry, Managing Director of Investor Relations), let's go, there's no questions, let's get the f*ck outta here.

~ Albert Lord, CEO Sallie Mae, conference call discussing future of Sallie Mae, December 19, 2007

Robert Taft on foreign policy

An unwise and overambitious foreign policy, and particularly the effort to do more than we are able to do, is the one thing which might in the end destroy our armies and prove a real threat to the liberty of the people of the United States...

~ Senator Robert Taft, A Foreign Policy for Americans (1951)

~ Senator Robert Taft, A Foreign Policy for Americans (1951)

Labels:

foreign policy,

imperialism,

Old Right,

people - Taft; Robert

On hypocrisy (anonymous)

Hypocrisy is the tribute that vice pays to virtue.

~ Unknown, possibly French proverb, or authored by François de La Rochefoucauld

~ Unknown, possibly French proverb, or authored by François de La Rochefoucauld

Subscribe to:

Posts (Atom)