In 2003, nobody that I knew of foresaw the crisis of subprime lending, and that is what caused this problem.

~ Rep. Barney Frank, chairman of the House Financial Services Committee, "Barney Frank feeling heat in crisis," BostonHerald.com, September 30, 2008

Sep 30, 2008

Lew Rockwell on the mainstream media's pro-bailout hysteria

The MSM have shown their despicable true colors in their bailout hysteria, and denunciation of the taxpayers for any resistance to being looted. On Morning Joe, they tout Fedista Andrea Mitchell as an independent journalist, never mentioning that her husband is Alan Greenspan. Greenspan was the Fed chairman who - with his partner in crime Bush - turned on the monetary hydrant after 9/11, to prevent he stock market from falling. Instead, they created the greatest bubble in history, and the current bust, which is correcting the excesses of the bubble. So in an attempt to keep the stock market and housing prices from falling, and plutocrats from losing their silk shirt, Bernanke is hyperinflating. He can't actually keep prices from falling, except in nominal terms, but he can wreck the world economy for a long period of time, and make us all far poorer. But instead of asking any questions, media shills like those on Morning Joe are backing the state-Wall Street combine, against the rest of us.

~ Lew Rockwell, "MSNBC's 'Morning Bailout'," LewRockwell.com Blog, September 30, 2008

~ Lew Rockwell, "MSNBC's 'Morning Bailout'," LewRockwell.com Blog, September 30, 2008

Labels:

bailouts,

mainstream media,

people - Rockwell; Lew

Lew Rockwell on the $700 billion bailout bill going down to defeat in the House

Yesterday was one of the worst days in decades for the power elite. It was one of the best for liberty.

~ Lew Rockwell, "The (Near) Death of the State," LewRockwell.com, September 30, 2008

~ Lew Rockwell, "The (Near) Death of the State," LewRockwell.com, September 30, 2008

Sep 29, 2008

Henry Ford on our banking and monetary system

It is well that the people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.

~ Henry Ford

~ Henry Ford

Labels:

banking,

monetary system,

people - Ford; Henry

Sep 27, 2008

Gerald Epstein on Ronald Reagan's role in setting up the "Plunge Protection Team"

By March of the following year [1988], President Reagan, an avowed free marketeer, issued the rather curious Executive Order 12631. This Executive Order set up the Working Group on Financial Markets. The Working Group was comprised of the Secretary of the Treasury, the Chairman of the Fed, the Chairman of the Commodity Futures Trading Commission and the Securities and Exchange Commission.

~ Gerald A. Epstein, Financialization and the World Economy (2006), p. 136

~ Gerald A. Epstein, Financialization and the World Economy (2006), p. 136

Alan Greenspan's response to the '87 Crash

The Federal Reserve, consistent with its responsibilities as the nation's central banker, affirmed today its readiness to serve as a source of liquidity to support the economic and financial system.

~ Alan Greenspan, Federal Reserve chairman, October 19, 1987

(On October 19, the Fed reversed their September 4 rate hike, lowering the Fed funds rate from 7.25% to 6.88% in an emergency inter-meeting move.)

~ Alan Greenspan, Federal Reserve chairman, October 19, 1987

(On October 19, the Fed reversed their September 4 rate hike, lowering the Fed funds rate from 7.25% to 6.88% in an emergency inter-meeting move.)

|

| June 15, 1987 |

Marc Faber on the U.S. dollar

My view is everything is bad in the United States, but elsewhere it's even worse. So relative to the rest of the world, also based on the price level, I think that the U.S. dollar is actually quite attractive.

~ Marc Faber, Bloomberg TV, September 26, 2008

~ Marc Faber, Bloomberg TV, September 26, 2008

Sep 26, 2008

Friedrich Hayek on credit expansion to combat the Great Depression (1932)

Instead of furthering the inevitable liquidation of the maladjustments brought about by the boom during the last three years, all conceivable means have been used to prevent that readjustment from taking place; and one of these means, which has been repeatedly tried though without success, from the earliest to the most recent stages of depression, has been this deliberate policy of credit expansion….

To combat the depression by a forced credit expansion is to attempt to cure the evil by the very means which brought it about; because we are suffering from a misdirection of production, we want to create further misdirection – a procedure that can only lead to a much more severe crisis as soon as the credit expansion comes to an end…. It is probably to this experiment, together with the attempts to prevent liquidation once the crisis had come, that we owe the exceptional severity and duration of the depression.

~ Friedrich Hayek, Prices and Production and Other Works (1932)

To combat the depression by a forced credit expansion is to attempt to cure the evil by the very means which brought it about; because we are suffering from a misdirection of production, we want to create further misdirection – a procedure that can only lead to a much more severe crisis as soon as the credit expansion comes to an end…. It is probably to this experiment, together with the attempts to prevent liquidation once the crisis had come, that we owe the exceptional severity and duration of the depression.

~ Friedrich Hayek, Prices and Production and Other Works (1932)

Marc Faber on the magnitude of the credit crisis

It's not the problem that home prices have gone down. The problem is excessive leverage. And somewhere, somehow the U.S. has to try to bring down the excess leverage that exists in the system, that incidentally was built over the last 7 to 15 years under Fed chairman Mr. Greenspan and then also under Mr. Bernanke. So now they try to solve the problem by having this credit bubble actually extended. And I think the $700 billion dollars will be like a drop in the bucket because the total credit market in the U.S. is something close to $60 trillion dollars. Then you have the CDS market - credit default swap - of around $62 trillion dollars. And then you have the whole derivatives worldwide, worth about notional $1,300 trillion dollars. So the $700 billion is really nothing and the Treasury's giving out this figure when actually the end figure may be $5 trillion dollars.

~ Marc Faber, Bloomberg TV, September 26, 2008

~ Marc Faber, Bloomberg TV, September 26, 2008

Labels:

credit crunch,

deleveraging,

leverage,

people - Faber; Marc

Sep 25, 2008

T. Boone Pickens on the $700 billion Paulson bailout plan

Q: The secretary of the treasury wants all the money up front. The government wants safeguards on it. They want to make sure there's protection for taxpayers. They want to limit executive compensation. Are you on board with all that?

A: I'm ready to go. I'd give [Treasury Secretary Henry] Paulson the money and tell him get it fixed.

Q: You believe that his plan will work?

A: I think it will work, yes. But I think it needs to work quickly. I think you've got to move on with it. I liked Warren Buffett's play into Goldman Sachs.

Q: Five billion dollars the other day.

A: That's right. That showed good confidence and all. So that's another leadership opportunity.

~ T. Boone Pickens, "Pickens: Natural gas, Warren Buffett could ease nation's woes," CNN.com, September 25, 2008

A: I'm ready to go. I'd give [Treasury Secretary Henry] Paulson the money and tell him get it fixed.

Q: You believe that his plan will work?

A: I think it will work, yes. But I think it needs to work quickly. I think you've got to move on with it. I liked Warren Buffett's play into Goldman Sachs.

Q: Five billion dollars the other day.

A: That's right. That showed good confidence and all. So that's another leadership opportunity.

~ T. Boone Pickens, "Pickens: Natural gas, Warren Buffett could ease nation's woes," CNN.com, September 25, 2008

Jack Welch on the economy and market sentiment

Q: What do you think of analysts who predict we'll be in recession in six months?

A: They should find another line of work.

Q: Do you think sentiment is too bullish?

A: I'm not here as a market timer. I'm hear to tell you this economy's in one helluva good shape.

~ Jack Welch, interview on CNBC, January 19, 2007

A: They should find another line of work.

Q: Do you think sentiment is too bullish?

A: I'm not here as a market timer. I'm hear to tell you this economy's in one helluva good shape.

~ Jack Welch, interview on CNBC, January 19, 2007

Sep 24, 2008

Henry Paulson on the $700 billion financial bailout and expanded powers at Treasury

I'm not looking for extraordinary power.

~ Henry Paulson, Treasury Secretary, House Panel Q & A, September 24, 2008

/PaulsonBernanke-591de8fb5f9b58f4c0866e0d.jpg)

~ Henry Paulson, Treasury Secretary, House Panel Q & A, September 24, 2008

/PaulsonBernanke-591de8fb5f9b58f4c0866e0d.jpg)

Thomas Jefferson on centralized government

When all government, domestic and foreign, in little as in great things, shall be drawn to Washington as the center of all power, it will render powerless the checks provided of one government on another and will become as venal and oppressive as the government from which we separated.

~ Thomas Jefferson, Letter to Charles Hammond (1821)

~ Thomas Jefferson, Letter to Charles Hammond (1821)

| Thomas Jefferson 1922-1925 |

Charles Dumas on Warren Buffett's $5 billion convertible preferred investment in Goldman Sachs

Buffett's move into Goldman supports our view that stocks finally offer good value. This is more powerful than Paulson's bazooka: people who think the U.S. needs a renewed free flow of credit are part of the problem, not the solution.

~ Charles Dumas, analyst at Lombard Street Research in London, "U.S. stock futures higher on Buffett's Goldman buy," MarketWatch, September 24, 2008

~ Charles Dumas, analyst at Lombard Street Research in London, "U.S. stock futures higher on Buffett's Goldman buy," MarketWatch, September 24, 2008

Sep 23, 2008

Vladimir Putin on the U.S. printing press as engine of the global economy

We all need to think about changing the architecture of internationalfinances and diversifying risks. The whole world economy cannot depend onone money-printing machine.

~ Vladimir Putin, Russian Prime Minister, Itar-Tass, September 20, 2008

~ Vladimir Putin, Russian Prime Minister, Itar-Tass, September 20, 2008

Labels:

global economy,

inflation,

people - Putin; Vladimir

Sep 22, 2008

John Jensen on excess

The trouble with life in the fast lane is that you get to the other end in an awful hurry.

~ John Jensen

Rudyard Kipling on overwork

Too much work and too much energy kill a man just as effectively as too much assorted vice or too much drink.

~ Rudyard Kipling

~ Rudyard Kipling

Somerset Maugham on moderation and excess

Excess on occasion is exhilarating. It prevents moderation from acquiring the deadening effect of a habit.

~ Somerset Maugham

~ Somerset Maugham

George Soros on the "too big to fail" banking doctrine

One of the reasons banking is getting so concentrated is because everyone wants to get to the point where they are too big to fail. I don’t think that is such a wonderful thing.

It should shrink. It has really got overblown. The size of the financial industry is out of proportion to the rest of the economy. It has been growing excessively over a long period, ending in this super-bubble of the last 25 years. I think this is the end of that era.

~ George Soros, "How to stop the next bubble," Prospect, July 2008

It should shrink. It has really got overblown. The size of the financial industry is out of proportion to the rest of the economy. It has been growing excessively over a long period, ending in this super-bubble of the last 25 years. I think this is the end of that era.

~ George Soros, "How to stop the next bubble," Prospect, July 2008

Labels:

banking,

people - Soros; George,

too big to fail

Nassim Taleb on on survival of the least fit and their vulnerability to the rare event

Recall that someone with only casual knowledge about the problem of randomness would believe that an animal is at the maximum fitness for the conditions of its time. This is not what evolution means; on average, animals will be fit, but not every single one of them, and not at all times. Just as an animal could have survived because its sample path was lucky, the "best" operators in a given business can come from a subset of operators who survived because of over-fitness to a sample path - a sample path that was free of the evolutionary rare event. One vicious attribute is that the longer these animals can go without encountering the rare event, the more vulnerable they will be to it.

~ Nassim Taleb, Fooled by Randomness, 2nd Edition, p. 92

~ Nassim Taleb, Fooled by Randomness, 2nd Edition, p. 92

Nassim Taleb on survival of the least fit traders

We tend to think that traders were successful because they are good. Perhaps we have turned causality on its head; we consider them good just because they make money. One can make money in the financial markets totally of out randomness.

Both Carlos (the economist) and John (the quant/statistician) belong to a class of people who benefited from a market cycle. It was not merely because they were involved in the right markets. It was because they had a bent in their style that closely fitted the properties of the rallies experienced in their market during the episode. They were dip buyers. That happened, in hindsight, to be the trait that was the most desirable between 1992 and the summer of 1998 in the specific markets in which the two men specialized. Most of those who happened to have that specific trait, over the course of that segment of history, dominated the market. Their score was higher and they replaced people who, perhaps, were better traders.

~ Nassim Taleb, Fooled by Randomness, 2nd Edition, pp. 89-90

Both Carlos (the economist) and John (the quant/statistician) belong to a class of people who benefited from a market cycle. It was not merely because they were involved in the right markets. It was because they had a bent in their style that closely fitted the properties of the rallies experienced in their market during the episode. They were dip buyers. That happened, in hindsight, to be the trait that was the most desirable between 1992 and the summer of 1998 in the specific markets in which the two men specialized. Most of those who happened to have that specific trait, over the course of that segment of history, dominated the market. Their score was higher and they replaced people who, perhaps, were better traders.

~ Nassim Taleb, Fooled by Randomness, 2nd Edition, pp. 89-90

Charles Darwin on "survival of the fittest"

Can we doubt (remembering that many more individuals are born than can possibly survive) that individuals having any advantage, however slight, over others would have the best chance of surviving and procreating their kind? On the other hand, we may feel sure that any variation in the least degree injurious would be rigidly destroyed. This preservation of favourable individual differences and variations, and the destruction of those which are injurious, I have called Natural Selection, or the Survival of the Fittest.

~ Charles Darwin, The Origin of Species (1859)

~ Charles Darwin, The Origin of Species (1859)

Nassim Taleb on evolution and continuous progress

One must be blind or foolish to reject the theories of Darwinian self-selection. However, the simplicity of the concept has drawn segments of amateurs (as well as a few professional scientists) into blindly believing in continuous and infallible Darwinism in all fields, which includes economics.

... Owing to the abrupt rare events, we do not live in a world where things "converge" continuously towards betterment. Nor do things in life move continuously at all.

~ Nassim Taleb, Fooled By Randomness, 2nd Edition, pp. 90-91

... Owing to the abrupt rare events, we do not live in a world where things "converge" continuously towards betterment. Nor do things in life move continuously at all.

~ Nassim Taleb, Fooled By Randomness, 2nd Edition, pp. 90-91

Sep 19, 2008

Jim Chanos on Wall Street's twisted version of capitalism

We seem to have capitalism on the upside and socialism on the downside. That's a pretty heady brew for a country that holds itself out as a free market paragon.

~ Jim Chanos, "Short Sellers Under Fire in U.S., U.K. After Lehman, AIG Fall," Bloomberg, September 19, 2008, by Michael Tsang

~ Jim Chanos, "Short Sellers Under Fire in U.S., U.K. After Lehman, AIG Fall," Bloomberg, September 19, 2008, by Michael Tsang

Bill Clinton on the bailouts of Bear Stearns, Fannie, Freddie, and AIG

I think the argument that we shouldn't do it because the taxpayers don't owe anything to Wall Street is rather short-sighted. The people that are getting the shaft out here are the home-owners, the people that live in their neighborhood whose home value is going down, the people who are losing their jobs. In other words, this is not about bailing out Wall Street. This is about restoring confidence in America.

I don't think there is any choice but for us to have the government to sit down with the private sector and all the stakeholders and do more. And I think the longer you wait, ironically, the more you have to do and the more money you have to spend. So in a funny way the people who are most against market intervention wind up having to preside over the biggest market intervention that costs the most money because we all know that markets without disclosure, without capital requirements, without market requirements - if you don't have these kinds of things to keep the market in tow - they all tend to unsustainable extremes.

~ Bill Clinton, interview with Maria Bartiromo, CNBC, September 19, 2008

I don't think there is any choice but for us to have the government to sit down with the private sector and all the stakeholders and do more. And I think the longer you wait, ironically, the more you have to do and the more money you have to spend. So in a funny way the people who are most against market intervention wind up having to preside over the biggest market intervention that costs the most money because we all know that markets without disclosure, without capital requirements, without market requirements - if you don't have these kinds of things to keep the market in tow - they all tend to unsustainable extremes.

~ Bill Clinton, interview with Maria Bartiromo, CNBC, September 19, 2008

Sep 16, 2008

Leonard Read on government power

If there be criminals among us, what is to keep them from gaining and using the power of government?

~ Leonard E. Read

~ Leonard E. Read

Labels:

corruption,

government,

people - Read; Leonard,

power

Chris Rock on stupidity

I don't get high, but sometimes I wish I did. That way, when I messed up in life I would have an excuse. But right now there's no rehab for stupidity.

~ Chris Rock

~ Chris Rock

Sep 15, 2008

Rich Karlgaard: "It is not clear that we are in a recession" (2008)

The U.S. economy is in better shape than the pundits, polls, and press say it is. It is not clear that we are in a recession. The Fed is on the case, bargain hunters like Warren Buffett are moving in, signalling a bottom. Small business is curiously robust despite the credit crunch. Employment is still pretty strong. Every commercial flight I've been on this year has been oversold. But there is a deeper cause of economic anxiety and it is the underlying rate of economic change. That rate is accelerating. Companies that are leaders in their industries - and this applies to leaders in all industries - are falling out of leadership faster than before. New and disruptive companies are popping up everywhere, like jaguars amid elephants.

~ Rich Karlgaard, Forbes Video, September 15, 2008

~ Rich Karlgaard, Forbes Video, September 15, 2008

Leonard Read on "worrycrats"

Worrycrats, as I call them, are a special breed of totalitarian bureaucrats who spawn rapidly as society is socialized. These people concern themselves with our health, education, welfare, auto safety, drug intake, diet, and what have you. Worrycrats today outnumber any other professionals in history, so rapidly have they proliferated.

~ Leonard E. Read, The Freeman (April 1971)

~ Leonard E. Read, The Freeman (April 1971)

Sep 14, 2008

Bethany McLean on Henry Paulson's intention not to go into politics

[Henry] Paulson says that he "wouldn't put a time limit" on his tenure at Goldman [Sachs], and that he has no intention of following in the Washington-bound footsteps of former Goldman CEOs like Bob Rubin, Steve Friedman, and [Jon] Corzine.

~ Bethany McLean, "Inside The Money Machine," Fortune, September 6, 2004

(Just to clarify, this was Paulson's lie, not McLean's.)

~ Bethany McLean, "Inside The Money Machine," Fortune, September 6, 2004

(Just to clarify, this was Paulson's lie, not McLean's.)

Vince Farrell recommends AIG and Bank of America on Nightly Business Report (2007)

Gharib: Let's go over your list of stock recommendations that you have for us tonight. At the top of your list you have AIG, the insurance company. Why do you like it?

Farrell: AIG had an analyst meeting last week in which they reported a very good quarter. And keep in mind, half their business is life insurance. We think of it as property casualty, but it is life insurance as well. They announced an $8 billion share repurchase and said under normal circumstances they would increase the dividend 20 percent a year. That is an extraordinary statement by management that it is very optimistic about the outlook for the next couple of years.

Gharib: Bank of America is another one of your stock picks. What is the attraction?

Farrell: They had an analyst meeting within the past week and the chairman said they'll be able to grow earnings organically, meaning from the businesses they have, no acquisitions, 10 percent a year and the stock trades at only 10 times earnings. The market is at 15 times earnings and the dividend yield on Bank America is almost 4.5 percent and the yield on the 10-year Treasury is just above 4.5, so you get a Treasury bond yield and the opportunity for growth at the same time.

~ Vince Farrell, managing director, Scotsman Capital Management, interview with Susie Gharib on the Nightly Business Report, March 9, 2007

Farrell: AIG had an analyst meeting last week in which they reported a very good quarter. And keep in mind, half their business is life insurance. We think of it as property casualty, but it is life insurance as well. They announced an $8 billion share repurchase and said under normal circumstances they would increase the dividend 20 percent a year. That is an extraordinary statement by management that it is very optimistic about the outlook for the next couple of years.

Gharib: Bank of America is another one of your stock picks. What is the attraction?

Farrell: They had an analyst meeting within the past week and the chairman said they'll be able to grow earnings organically, meaning from the businesses they have, no acquisitions, 10 percent a year and the stock trades at only 10 times earnings. The market is at 15 times earnings and the dividend yield on Bank America is almost 4.5 percent and the yield on the 10-year Treasury is just above 4.5, so you get a Treasury bond yield and the opportunity for growth at the same time.

~ Vince Farrell, managing director, Scotsman Capital Management, interview with Susie Gharib on the Nightly Business Report, March 9, 2007

Peter Bernstein on the perfect financial storm

Nothing like this has ever happened before. There have been credit crunches and housing crises and dollar crises, but having all the chickens coming home to roost at the same time and interacting with one another is unique. We have historical perspective on the parts, but not the whole, and that makes things both interesting and scary.

~ Peter Bernstein, author of risk management classic, Against the Gods, "Retirement: Safety First," Barron's, September 15, 2008

~ Peter Bernstein, author of risk management classic, Against the Gods, "Retirement: Safety First," Barron's, September 15, 2008

Peter Bernstein on inflation complacency in 1958

In 1958, I'd been in the business for seven years when, for the first time in history, bonds yielded more than stocks. My associates said, 'It's an anomaly, don't worry, it will be reversed.' It's 50 years later, and I'm still waiting.

~ Richard Bernstein, Founder, Peter L. Bernstein Inc., "Retirement: Safety First," Barron's, September 15, 2008

~ Richard Bernstein, Founder, Peter L. Bernstein Inc., "Retirement: Safety First," Barron's, September 15, 2008

Sep 12, 2008

Karl Case on calling the housing bottom

Anybody who tells you they know when the housing market will bottom is delusional, but anybody who denies there are some positives out there that could make the housing market bottom fairly soon is equally delusional.

~ Karl Case, professor at Wellesley College in Massachusetts and co-developer of the S&P/Case-Shiller home price indices, "Ray Of Hope Amid U.S. Gloom?," National Post, August 14, 2008

~ Karl Case, professor at Wellesley College in Massachusetts and co-developer of the S&P/Case-Shiller home price indices, "Ray Of Hope Amid U.S. Gloom?," National Post, August 14, 2008

Warren Buffett on investment opportunity and the upside of folly

Whether you achieve outstanding results will depend on the effort and intellect you apply to your investments, as well as on the amplitudes of stock-market folly that prevail during your investment career. The sillier the market's behavior, the greater the opportunity for the business-like investor.

~ Warren Buffett, preface to the 4th Edition of The Intelligent Investor, by Benjamin Graham

~ Warren Buffett, preface to the 4th Edition of The Intelligent Investor, by Benjamin Graham

Sep 10, 2008

Bill Gross: Pimco profits to the takeover of Fannie/Freddie to the tune of $8 billion

Joe Kernen: ... taxpayers are going to end up enriching Pimco to the tune of how many billion dollars on that one day?

Gross: Well, the Total Return Fund, as you mentioned, by a billion and a half plus, the company itself by probably about 8 billion. It was a big day for us. But I wouldn't suggest... that's coming from the taxpayers or the Treasury.

Joe Kernen: That was simplistic. But, um, it's just anyone basically could've done it if they were watching you on CNBC. It wasn't that hard to figure out.

Gross: Well, I think that's true. And I think that everyone should come back like Bill Clinton in their next life. They should come back as a bond manager. Right, Joe?

Nouriel Roubini: We bailed out the credit of Bear Stearns, Fannie and Freddie, now GM and Ford want to get bailed out and so on. At which point is the end of this thing, and aren't we in a situation in which there is a systemic banking and financial crisis? And at this point we can't just bail out everybody. What's going to be the end of this game?

Gross: Well, there is an end game. But I likened it to a situation where we've had a drunk driver - and face it, we're all in there in terms of driving drunk and using lots of debt, and poor regulation and all of that. We're all responsible. But a drunk driver that's now lying on the road bleeding - you don't just leave him there. You take him to the hospital and then you throw him in jail. Then, you throw him in the clinker, but not now.

Carl Quintanilla: Bill, Joe started out with that joke about the taxpayers and your good day at Total Return on Monday. Are you prepared, though, for some political pushback or to become some kind of flash point? You lobby the government to save Main Street and the biggest bond company in the world profits?

Gross: Well, we were lobbying, but only from the standpoint of a suggested solution... You know the lobbying has really taken place over the last 6 to 12 to 18 months. It's what we expected to happen, and so um, lobbying, yes. But you asked me on TV over the past several months exactly what I thought should happen and it did.

~ Bill Gross, Pimco founder, interview on CNBC, September 10, 2008

Gross: Well, the Total Return Fund, as you mentioned, by a billion and a half plus, the company itself by probably about 8 billion. It was a big day for us. But I wouldn't suggest... that's coming from the taxpayers or the Treasury.

Joe Kernen: That was simplistic. But, um, it's just anyone basically could've done it if they were watching you on CNBC. It wasn't that hard to figure out.

Gross: Well, I think that's true. And I think that everyone should come back like Bill Clinton in their next life. They should come back as a bond manager. Right, Joe?

Nouriel Roubini: We bailed out the credit of Bear Stearns, Fannie and Freddie, now GM and Ford want to get bailed out and so on. At which point is the end of this thing, and aren't we in a situation in which there is a systemic banking and financial crisis? And at this point we can't just bail out everybody. What's going to be the end of this game?

Gross: Well, there is an end game. But I likened it to a situation where we've had a drunk driver - and face it, we're all in there in terms of driving drunk and using lots of debt, and poor regulation and all of that. We're all responsible. But a drunk driver that's now lying on the road bleeding - you don't just leave him there. You take him to the hospital and then you throw him in jail. Then, you throw him in the clinker, but not now.

Carl Quintanilla: Bill, Joe started out with that joke about the taxpayers and your good day at Total Return on Monday. Are you prepared, though, for some political pushback or to become some kind of flash point? You lobby the government to save Main Street and the biggest bond company in the world profits?

Gross: Well, we were lobbying, but only from the standpoint of a suggested solution... You know the lobbying has really taken place over the last 6 to 12 to 18 months. It's what we expected to happen, and so um, lobbying, yes. But you asked me on TV over the past several months exactly what I thought should happen and it did.

~ Bill Gross, Pimco founder, interview on CNBC, September 10, 2008

Labels:

bailouts,

people - Gross; Bill,

political capitalism

David Lereah on the title of his real estate book published in 2006

Obviously I would change the title. There are places in the book where I actually say the boom is not healthy. But people don't read the book, and they just look at the title and they criticize it.

~ David Lereah, former chief economist of the National Association of Realtors and author of "Why the Real Estate Boom Will Not Bust -- And How You Can Profit From It," published in paperback in February 2006, "Why Real Estate Won't Go Bust, And Other Book-Title Bloopers," The Wall Street Journal, September 10, 2008, by Louise Radnofsky

(Mr. Lereah's book was served up in hardcover in February 2005 with the title "Are You Missing The Real Estate Boom? Why Home Values and Other Real Estate Investments Will Climb Through the End of the Decade -- And How to Profit From Them." That edition sold 12,000 copies. It was downhill from then. The paperback sold 2,300 copies in 2006 and 250 in 2007, according to Nielsen BookScan. So far this year, it's notched just 20 sales, Nielsen says.)

~ David Lereah, former chief economist of the National Association of Realtors and author of "Why the Real Estate Boom Will Not Bust -- And How You Can Profit From It," published in paperback in February 2006, "Why Real Estate Won't Go Bust, And Other Book-Title Bloopers," The Wall Street Journal, September 10, 2008, by Louise Radnofsky

(Mr. Lereah's book was served up in hardcover in February 2005 with the title "Are You Missing The Real Estate Boom? Why Home Values and Other Real Estate Investments Will Climb Through the End of the Decade -- And How to Profit From Them." That edition sold 12,000 copies. It was downhill from then. The paperback sold 2,300 copies in 2006 and 250 in 2007, according to Nielsen BookScan. So far this year, it's notched just 20 sales, Nielsen says.)

Sep 9, 2008

Karen De Coster and Eric Englund on the political makeup of Fannie Mae's Board

It is interesting to note that past and present Board members of Fannie Mae — some of whom are appointed by the president — have been highly representative of the Beltway elite: a former Reagan chief of staff, lobbyists, a former aide to Nixon, a Reagan Secretary of Labor, a US trade representative, and a top economic advisor to President Bush.

(Footnote. Naming names: Kenneth M. Duberstein, a lobbyist and former chief of staff to President Ronald Reagan; Frederick Malek, an investor and former aide to President Richard Nixon; Ann McLaughlin Korologos, a former secretary of labor under Reagan; Stephen Friedman, formerly President George W. Bush's top economic adviser and former co-chairman of Goldman Sachs with Robert Rubin; Robert Zoellick, US trade representative.)

~ Karen De Coster and Eric Englund, "Fannie Mae: Another New Deal Monstrosity," Mises.org, July 2, 2007

(Footnote. Naming names: Kenneth M. Duberstein, a lobbyist and former chief of staff to President Ronald Reagan; Frederick Malek, an investor and former aide to President Richard Nixon; Ann McLaughlin Korologos, a former secretary of labor under Reagan; Stephen Friedman, formerly President George W. Bush's top economic adviser and former co-chairman of Goldman Sachs with Robert Rubin; Robert Zoellick, US trade representative.)

~ Karen De Coster and Eric Englund, "Fannie Mae: Another New Deal Monstrosity," Mises.org, July 2, 2007

Fannie Mae and Freddie Mac removed from S&P 500

Federal Home Loan Mortgage Corp. [FRE] will be removed from the S&P 500 after the close of trading on Wednesday, September 10. Its place in the S&P 500 will be taken by Salesforce.com Inc. [CRM], which will be added after the close of trading on Friday, September 12. As of today's close of trading Federal Home Loan Mortgage Corp. had a market capitalization of approximately $614 million, whereas the minimum market cap a company must maintain in order to be eligible for admission to the index is $5 billion.

-- Federal National Mortgage Association [FNM] will be removed from the S&P 500 after the close of trading on Wednesday, September 10. Its place in the S&P 500 will be taken by S&P MidCap 400 constituent Fastenal Co. [FAST], which will be added after the close of trading on Friday, September 12.

~ Standard & Poor's, "Standard & Poor's Announces Changes to U.S. Indices," PRNewswire, September 9, 2008

-- Federal National Mortgage Association [FNM] will be removed from the S&P 500 after the close of trading on Wednesday, September 10. Its place in the S&P 500 will be taken by S&P MidCap 400 constituent Fastenal Co. [FAST], which will be added after the close of trading on Friday, September 12.

~ Standard & Poor's, "Standard & Poor's Announces Changes to U.S. Indices," PRNewswire, September 9, 2008

Karen De Coster and Eric Englund on Fannie Mae, New Deal monstrosity

Fannie Mae is not a free-market entity, nor is it a private body that must compete on the same playing field as its competitors. Fannie Mae is representative of all that's wrong with central planning institutions: it is a government-created conduit for carefully crafted financial and market socialism that the bureaucrats uphold for the purpose of propping up their fantasies for pandemic social engineering.

There's nothing "American" about this dream. In the eyes of the Republic's visionaries, this particular dream has turned into a nightmare.

~ Karen De Coster and Eric Englund, "Fannie Mae: Another New Deal Monstrosity," Mises.org, July 2, 2007

There's nothing "American" about this dream. In the eyes of the Republic's visionaries, this particular dream has turned into a nightmare.

~ Karen De Coster and Eric Englund, "Fannie Mae: Another New Deal Monstrosity," Mises.org, July 2, 2007

William Norman Grigg: What will happen to the CEOs of Fannie and Freddie in the wake of a government takeover

Fannie CEO Daniel H. Mudd, and Freddie CEO Richard Syron engaged in fraudulent bookkeeping right up to the eve of the federal takeover by deliberately overstating their capital holdings and financial health. However, neither of them faces criminal or civil prosecution. In fact, strictly speaking they're not even being fired: They will both eventually "step down" from their current posts, but will be given sinecures of some kind.

Solicitude of this kind is routinely displayed toward those who had helped generate hundreds of billions of dollars in perfectly rotten mortgage loans as part of a corrupt scheme to boost executive compensation through dishonest accounting methods. Fannie and Freddie practiced Enron-onomics and Arthur Andersen-style accounting on steroids, in the serene confidence that the taxpayers would eventually have to absorb the costs and that nobody of any consequence in those agencies would suffer significant repercussions.

That confidence, as we can see, was entirely justified.

~ William Norman Grigg, "Washington's Kleptocratic State: 'More Communist Than China'," LewRockwell.com, September 9, 2008

Solicitude of this kind is routinely displayed toward those who had helped generate hundreds of billions of dollars in perfectly rotten mortgage loans as part of a corrupt scheme to boost executive compensation through dishonest accounting methods. Fannie and Freddie practiced Enron-onomics and Arthur Andersen-style accounting on steroids, in the serene confidence that the taxpayers would eventually have to absorb the costs and that nobody of any consequence in those agencies would suffer significant repercussions.

That confidence, as we can see, was entirely justified.

~ William Norman Grigg, "Washington's Kleptocratic State: 'More Communist Than China'," LewRockwell.com, September 9, 2008

Kevin Duffy on the Henry Paulson led government takeover of Fan/Fred

It's official: The U.S. economy is headed for its worst recession in three decades. Henry Paulson's scheme to keep Fannie Mae and Freddie Mac on government life support and bail out its creditors (i.e. Wall Street, Big Banks, and Bill Gross at PIMCO) removes any doubt. The only question remaining: Will this downturn rival the Big Kahuna of the 1930s? Paulson was interviewed today on Bloomberg. Here is the money quote:

The initial reaction of the stock market was to celebrate with a 300 point rally in the DJIA. Our guess is the euphoria will fade quickly as investors realize bailout money does not grow on trees, and the cash will either be taxed, borrowed or printed. The only question: How much will the final tab run?

The more pressing concern, however, is the economy. This economy needs to break its addiction to cheap credit, remove the waste of the previous credit binge, shed its political parasites (e.g., friends of Hank), and rebuild on a solid foundation. Every intervention prolongs the process and deepens the malaise. A wholesale government takeover of the mortgage market virtually guarantees the economy will be mired in deep recession for years.

The only winners (besides whiners like Bill Gross)? Those who are short the market.

Note to self: Move those inflation hedges from the attic to the front hall closet.

~ Kevin Duffy, Bearing Asset Management, "Paulson's gift to the bears," Azimuth blog, September 8, 2008

“No one likes to put the taxpayer into situations like this. No one does; I certainly don't. Government intervention is not something I came down here wanting to espouse, but it sure is better than the alternative.”The alternative, of course, is that Paulson’s friends are actually forced to take huge losses on their reckless, ill-fated loans to Fannie and Freddie. Unthinkable! Paulson assures the naïve interviewer that the taxpayer will come before the shareholder, forgetting to mention the shareholder has already been wiped out, putting the taxpayer last in line behind the creditors. Under Hanky Pank’s scheme, the taxpayer is simply the bagholder of last resort. Paulson was obviously a quick study under former Goldman Sachs CEO and Treasury Secretary, “Mr. Bailout” himself, Robert Rubin.

The initial reaction of the stock market was to celebrate with a 300 point rally in the DJIA. Our guess is the euphoria will fade quickly as investors realize bailout money does not grow on trees, and the cash will either be taxed, borrowed or printed. The only question: How much will the final tab run?

The more pressing concern, however, is the economy. This economy needs to break its addiction to cheap credit, remove the waste of the previous credit binge, shed its political parasites (e.g., friends of Hank), and rebuild on a solid foundation. Every intervention prolongs the process and deepens the malaise. A wholesale government takeover of the mortgage market virtually guarantees the economy will be mired in deep recession for years.

The only winners (besides whiners like Bill Gross)? Those who are short the market.

Note to self: Move those inflation hedges from the attic to the front hall closet.

~ Kevin Duffy, Bearing Asset Management, "Paulson's gift to the bears," Azimuth blog, September 8, 2008

Stephan Kinsella on libertarianism and property rights

[U]nless you are pro-market, pro-private property, you have no basis to oppose the state, for the state is simply the agency of institutionalized aggression against private property rights. To oppose the state is to support property rights, since opposing aggression means opposing the invasion of property. Conversely, those who oppose property rights inevitably support the state or other forms of aggression.

~ Stephan Kinsella, "Down with anti-market "anarchists," LewRockwell.com Blog, September 9, 2008

~ Stephan Kinsella, "Down with anti-market "anarchists," LewRockwell.com Blog, September 9, 2008

Sep 8, 2008

Warren Buffett on Henry Paulson's plan to takeover Fannie Mae and Freddie Mac

I think the Secretary did exactly the right thing. I don't think there was an alternative that was anywhere close to this one in terms of calming the markets, in terms of providing an ongoing function for the two that makes any change less abrupt... I wouldn't change anything in the plan myself.

~ Warren Buffett, interview on CNBC, September 8, 2008

~ Warren Buffett, interview on CNBC, September 8, 2008

Alexander Rekeda (structured finance expert) on the 2007 vintage of RMBS

The 2007 vintage of residential mortgage-backed securities is looking to be one of the best vintages in 10 years.

~ Alexander Rekeda, Mizuho Financial Group, interview with Dow Jones Newswires, April 2007

(Quote was cited in WSJ article, "How Mizuho Loved and Lost in CDOs," May 14, 2008, p. C1. "Looking to charge into the red-hot business of subprime debt two years ago, Mizuho Financial Group Inc.'s brokerage poached 11 bankers, traders and salespeople, headed by structured finance ace Alexander Rekeda, from investment bank Calyon.)

~ Alexander Rekeda, Mizuho Financial Group, interview with Dow Jones Newswires, April 2007

(Quote was cited in WSJ article, "How Mizuho Loved and Lost in CDOs," May 14, 2008, p. C1. "Looking to charge into the red-hot business of subprime debt two years ago, Mizuho Financial Group Inc.'s brokerage poached 11 bankers, traders and salespeople, headed by structured finance ace Alexander Rekeda, from investment bank Calyon.)

Glenn Greenwald on propaganda and the media

Propaganda thrives -- predominates -- in our democracy for many reasons, the principal reason being that we don't have the sort of journalist class devoted to exposing it. Anyone who wants to contest that should examine the empirical data... or more convincingly, just look at what the Bush administration has easily gotten away with over the last eight years -- the systematic deceit, the radicalism, the corruption, the crimes.

~ Glenn Greenwald, "The mighty, scary press corps ," Salon.com, September 6, 2008

~ Glenn Greenwald, "The mighty, scary press corps ," Salon.com, September 6, 2008

Justin Raimondo on John McCain and his top advisors

McCain and his top advisors are ideologues who care about one thing and one thing only: war. The glory of it, the utility of it, the necessity of it. It's the McCain panacea, like "free silver" was to William Jennings Bryan and socialism was to Eugene Debs. It's his answer to everything: it solves all problems, and, more importantly, stifles all criticism. If you doubt his veracity, question his good intentions, or point out his inconsistencies, you're attacking a war hero, doubting the divine wisdom suffering is supposed to impart.

~ Justin Raimondo, "Sarah Palin: The Xena of the War Party," Antiwar.com, September 5, 2008

~ Justin Raimondo, "Sarah Palin: The Xena of the War Party," Antiwar.com, September 5, 2008

Henry Paulson on the government takeover of Fannie Mae and Freddie Mac

No one likes to put the taxpayer into situations like this. No one does; I certainly don't. Government intervention is not something I came down here wanting to espouse, but it sure is better than the alternative.

~ Henry Paulson, Treasury Secretary, Bloomberg TV, September 8, 2008

~ Henry Paulson, Treasury Secretary, Bloomberg TV, September 8, 2008

Sep 6, 2008

Laurence Vance on the Republican Party and limited government

It wouldn’t normally matter whom the Republican Party nominated. Bigger government and less liberty have always been the result. And if you think Reagan was an exception then you are sadly mistaken.

This time, however, the Republicans had a chance to nominate the only candidate who embodies everything good that the Republican Party has ever claimed to stand for. Ron Paul is undoubtedly the most pro-life, pro-family, pro-property, pro-liberty, pro-Constitution candidate in history.

The Republican Party and its apologists that write for the red-state fascist blogs and magazines and host the reich-wing nationalist TV and radio talk shows did everything they could to persuade people from voting for Dr. Paul in the Republican primaries.

The nomination of John McCain over Ron Paul means that the Republican Party should never again be taken seriously when it comes to even the slightest pretense of being a friend of liberty, free markets, and limited government.

~ Laurence M. Vance, "Ichabod!," LewRockwell.com, September 5, 2008

Sheldon Richman on war in Georgia and the failure of U.S. foreign policy

The tragic events in the nation of Georgia show that U.S. foreign policy is a bust. In particular, NATO must go. This may seem counterintuitive, but this relic of the Cold War has nothing to contribute to peace. On the contrary, it is a destabilizing tool of America’s provocative imperial foreign policy.

~ Sheldon Richman, "War in Georgia Shows U.S. Foreign Policy Is a Bust," FFF Commentaries, August 15, 2008

~ Sheldon Richman, "War in Georgia Shows U.S. Foreign Policy Is a Bust," FFF Commentaries, August 15, 2008

Washington Post: Henry Paulson's plan to rescue Fannie Mae and Freddie Mac is really a bailout of the banks

Investor uncertainty over the long-term fate of the companies has left a pall over credit markets. It has been unclear which investors, if any, would suffer should the government intervene to prop up the firms.

The answer, in Paulson's plan, is that holders of preferred shares and subordinated debt, a riskier but higher-paying class of debt, might be made whole. Government leaders were reluctant to allow holders of those assets to incur major losses because they are widely held by banks, and major losses could cause a wave of bank failures.

~ Washington Post, "U.S. nears rescue plan for Fannie, Freddie," September 5, 2008

The answer, in Paulson's plan, is that holders of preferred shares and subordinated debt, a riskier but higher-paying class of debt, might be made whole. Government leaders were reluctant to allow holders of those assets to incur major losses because they are widely held by banks, and major losses could cause a wave of bank failures.

~ Washington Post, "U.S. nears rescue plan for Fannie, Freddie," September 5, 2008

Richard Russell: "We are not breaking the January lows"

The very near-term picture is that the market will hold here, and so far, and this is not my opinion, the market is saying, "This is it, we are not breaking the January lows." How much more bad news can we get? The market may have discounted the worst that can be seen ahead.

~ Richard Russell, editor, Dow Theory Letters, "Is the Bear Dead?," EQUITIES, May 2008

~ Richard Russell, editor, Dow Theory Letters, "Is the Bear Dead?," EQUITIES, May 2008

Barton Biggs: U.S. stocks "close to a bottom"

[The U.S. stock market is] pretty close to a bottom [and may mount a] powerful [rally].

This is not the end of the world. There's a possibility out there that with oil down as much as it is, we're going to get a push in consumer spending.

~ Barton Biggs, hedge-fund manager, "Biggs Says U.S. Stocks 'Close to Bottom,' May Rally," Bloomberg Television, September 5, 2008, by Eric Martin and Kathleen Hays

(Biggs, a former Morgan Stanley strategist, now runs the hedge fund Traxis Partners LLC, which is down about 10 percent this year through Aug. 31. )

This is not the end of the world. There's a possibility out there that with oil down as much as it is, we're going to get a push in consumer spending.

~ Barton Biggs, hedge-fund manager, "Biggs Says U.S. Stocks 'Close to Bottom,' May Rally," Bloomberg Television, September 5, 2008, by Eric Martin and Kathleen Hays

(Biggs, a former Morgan Stanley strategist, now runs the hedge fund Traxis Partners LLC, which is down about 10 percent this year through Aug. 31. )

Sep 5, 2008

Fritz Meyer: Buy "when the news flow is the worst"

Buy the market. You said embrace the fear. It's the toughest thing for investors to do. But for those of us who are trying to get from point A to point B, meaning retirement over a number of years, absolutely - bear markets have presented terrific buying opportunties. This bear market will prove to be no different than earlier bear markets. But, again, it means investing in stocks when the news flow is the worst. That's where I guess we are today.

~ Fritz Meyer, senior investment strategist, Invesco, as appeared on CNBC, September 5, 2008

~ Fritz Meyer, senior investment strategist, Invesco, as appeared on CNBC, September 5, 2008

Nassim Taleb on treating the social science of economics like a physical science

It was confidently believed that the scientific successes of the industrial revolution could be carried through into the social sciences, particularly with such movements as Marxism. Psuedoscience came with a collection of idealistic nerds who tried to create a tailor-made society, the epitome of which is the central planner. Economics was the most likely candidate for such use of science; you can disguise charlatanism under the weight of equations, and nobody can catch you since there is no such thing as a controlled experiment.

~ Nassim Taleb, Fooled By Randomness, 2nd Edition, p. 108

~ Nassim Taleb, Fooled By Randomness, 2nd Edition, p. 108

Sep 4, 2008

Bill Gross on intervention needed to prevent "financial tsunami"

Unchecked, it can turn a campfire into a forest fire, a mild asset bear market into a destructive financial tsunami. If we are to prevent a continuing asset and debt liquidation of near historic proportions, we will require policies that open up the balance sheet of the U.S. Treasury.

~ Bill Gross, "U.S. Must Buy Assets to Prevent 'Tsunami'," Bloomberg, September 4, 2008

~ Bill Gross, "U.S. Must Buy Assets to Prevent 'Tsunami'," Bloomberg, September 4, 2008

Thomas Jefferson on banking and paper money

I have ever been the enemy of banks; not of those discounting for cash [that is, charging interest on loans of real money], but of those foisting their own paper into circulation, and thus banishing our cash. My zeal against these institutions was so warm and open at the establishment of the bank of the U.S. that I was derided as a Maniac by the tribe of bank-mongers, who were seeking to filch from the public their swindling and barren gains. ... Shall we build an altar to the old paper money of the revolution, which ruined individuals but saved the republic, and burn on that all the bank charters present and future, and their notes with them? For these are to ruin both republic and individuals. This cannot be done. The Mania is too strong. It has seized by its delusions and corruptions all the members of our governments, general, special and individual.

~ Thomas Jefferson in a letter to John Adams in 1814

(Quoted by G. Edward Griffen, The Creature from Jekyll Island, page 341.)

~ Thomas Jefferson in a letter to John Adams in 1814

(Quoted by G. Edward Griffen, The Creature from Jekyll Island, page 341.)

Governeur Morris on aristocracy and government

The rich will strive to establish their dominion and enslave the rest. They always did. They always will. ... They will have the same effect here as elsewhere, if we do not, by such a government, keep them within their proper spheres. We should remember that the people never act from reason alone. The rich will take advantage of their passions, and make these the instruments for oppressing them. The result of the contest will be a violent aristocracy, or a more violent despotism.

~ Governeur Morris, New York delegate to the Constitutional Convention and drafter of the Constitution, reflecting on the new federal government

(Quoted by G. Edward Griffen, The Creature from Jekyll Island, page 335.)

~ Governeur Morris, New York delegate to the Constitutional Convention and drafter of the Constitution, reflecting on the new federal government

(Quoted by G. Edward Griffen, The Creature from Jekyll Island, page 335.)

Thomas Jefferson on government borrowing

I wish it were possible to obtain a single amendment to our Constitution. I would be willing to depend on that alone for the reduction of the administration of our government to the general principle of the Constitution; I mean an additional article, taking from the federal government their power of borrowing.

~ Thomas Jefferson

(Quoted by G. Edward Griffen, The Creature from Jekyll Island, page 332.)

~ Thomas Jefferson

(Quoted by G. Edward Griffen, The Creature from Jekyll Island, page 332.)

Sep 3, 2008

Henry Paulson on GSE bailout

If you have a bazooka in your pocket and people know it, you probably won't have to use it.

~ Henry Paulson, US Senate meeting, July 15, 2008

~ Henry Paulson, US Senate meeting, July 15, 2008

Thomas Jefferson on private central banking

A private central bank issuing the public currency is a greater menace to the liberties of the people than a standing army.

~ Thomas Jefferson

(Quoted by G. Edward Griffen, The Creature from Jekyll Island, page 329.)

~ Thomas Jefferson

(Quoted by G. Edward Griffen, The Creature from Jekyll Island, page 329.)

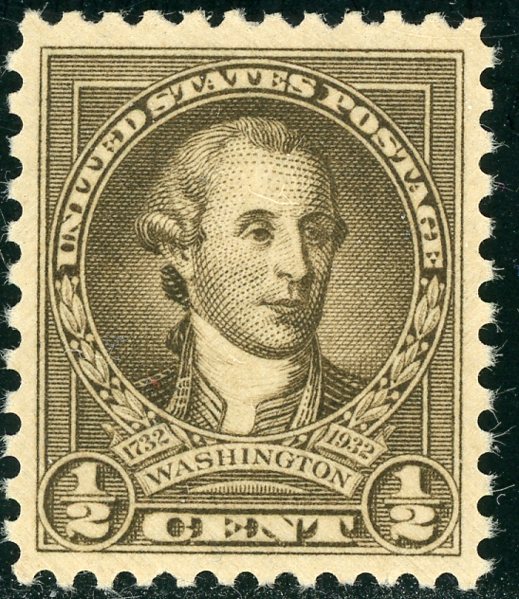

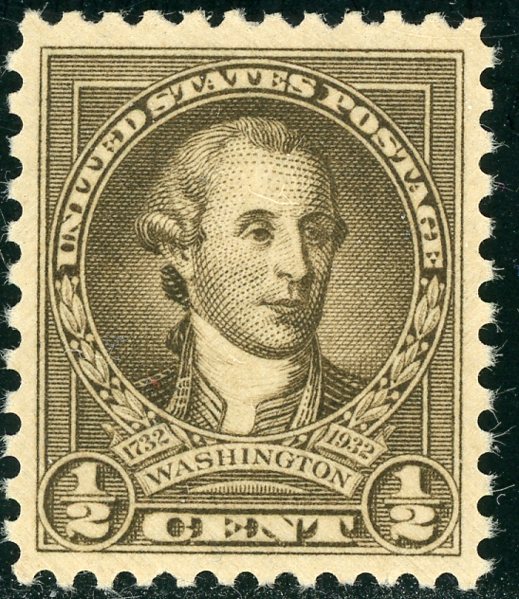

George Washington on paper money

We may one day become a great commercial and flourishing nation. But if in the pursuit of the means we should unfortunately stumble again on unfunded paper money or similar species of fraud, we shall assuredly give a fatal stab to our national credit in its infancy.

~ George Washington

(Quoted by G. Edward Griffen, The Creature from Jekyll Island, page 323.)

~ George Washington

(Quoted by G. Edward Griffen, The Creature from Jekyll Island, page 323.)

Oliver Ellsworth on paper money

This is a favorable moment to shut and bar the door against paper money. The mischief of the various experiments which have been made are now fresh in the public mind and have excited the disgust of all of the respectable parts of America.

~ Oliver Ellsworth, representative from Connecticut to the Constitutional Convention, subsequently Chief Justice of the Supreme Court

(Quoted in G. Edward Griffen, The Creature from Jekyll Island, page 315. Ellsworth was referencing various paper money schemes that were tried and failed during the War of Independence and in the period between the war and the beginning of the Constitutional Convention.)

~ Oliver Ellsworth, representative from Connecticut to the Constitutional Convention, subsequently Chief Justice of the Supreme Court

(Quoted in G. Edward Griffen, The Creature from Jekyll Island, page 315. Ellsworth was referencing various paper money schemes that were tried and failed during the War of Independence and in the period between the war and the beginning of the Constitutional Convention.)

Thomas Jefferson on paper money and inflation

It will be asked how will the two masses of Continental and state money have cost the people of the United States seventy-two millions of dollars, when they are to be redeemed now with about six million? I answer that, the difference beeing sixty-six millions, has been lost on the paper bills separately by the successive holders of them, Every one, through whose hands a bill passed, lost on that bill what it lost in value during the time it was in his hands. This was the real tax on him; and in this way the people of the United States actually contributed those sixty-six millions of dollars during the war, and by a mode of taxation the most oppressive of all because the most unequal of all.

~ Thomas Jefferson

(Quoted by G. Edward Griffen, The Creature of Jekyll Island, page 313. Jefferson was describing the danger of printing money with no metal backing, an arrangement in which Congress and The Federal Reserve System now participate.)

~ Thomas Jefferson

(Quoted by G. Edward Griffen, The Creature of Jekyll Island, page 313. Jefferson was describing the danger of printing money with no metal backing, an arrangement in which Congress and The Federal Reserve System now participate.)

Andrew Jackson on central banking

Is there no danger to our liberty and independence in a bank that in its nature has so little to bind it to our country? ... [Is there not] cause to tremble for the purity of our elections in peace and for the independence of our country in war? ... Controlling our currency, receiving our public monies, and holding thousands of our citizens in dependence, it would be more formidable and dangerous than a naval and military power of the enemy.

~ Andrew Jackson

(Quoted by G. Edward Griffen, The Creature from Jekyll Island, page 257.)

~ Andrew Jackson

(Quoted by G. Edward Griffen, The Creature from Jekyll Island, page 257.)

|

| Andrew Jackson |

Guicciardini on democracy

To speak of the people is to speak of madmen, for the people is a monster full of confusion and error, and its vain beliefs are as far from truth as is Spain from India ... Experience shows that things rarely come to pass according to the expectations of the multitude ... The reason is that the effects ... commonly depend on the will of the few, whose intentions and purposes are nearly always different from those of the many.

~ Francesco Guicciardini, History, III, page 104, as quoted in Will Durant, The Renaissance, page 547. Guicciardini was a renowned historian during the Italian Renaissance.

~ Francesco Guicciardini, History, III, page 104, as quoted in Will Durant, The Renaissance, page 547. Guicciardini was a renowned historian during the Italian Renaissance.

Alexis de Tocqueville on the American work ethic

In the United States, as soon as a man has acquired some education and pecuniary resources, he either endeavors to get rich by commerce or industry, or he buys land in the bush and turns pioneer. All that he asks of the state is, not to be disturbed in his toil, and to be secure of his earnings.

~ Alexis de Tocqueville, Democracy in America (1835)

~ Alexis de Tocqueville, Democracy in America (1835)

|

| Hardships of Emigration 1898 |

Daniel McCarthy on mixing beauty and politics and the McCain-Palin ticket

Well, if you must vote, other things being equal, cast your ballot for the most repellent politician available. Let’s have more stumpy, squinty, sausage-fingered Denny Hasterts and Bella Abzugs. Inner beauty and outer beauty don’t always accord, but let’s do our best to see to it that they do in politics. There shouldn’t be anything glamorous about the class that inflates away our currency and stirs up hornets’ nests around the world. It probably is no coincidence that the more presentable our blow-dried pols have become the more complacent the public has grown.

Which is why Sarah Palin may actually be worse than her superannuated running-mate. No one has shown any substantial policy differences between the two of them. But whereas McCain is cranky, stale, and cadaverous, Palin puts a sweet seductive smile on executive aggrandizement and perpetual war. She’s a spoonful of sugar to mask the bitter taste of strychnine. But, make no mistake, that’s what a John McCain presidency will be – lethal poison for what’s left of our republic.

~ Daniel McCarthy, "Sugar and Spice and Everything Nice? ," LewRockwell.com, September 3, 2008

Which is why Sarah Palin may actually be worse than her superannuated running-mate. No one has shown any substantial policy differences between the two of them. But whereas McCain is cranky, stale, and cadaverous, Palin puts a sweet seductive smile on executive aggrandizement and perpetual war. She’s a spoonful of sugar to mask the bitter taste of strychnine. But, make no mistake, that’s what a John McCain presidency will be – lethal poison for what’s left of our republic.

~ Daniel McCarthy, "Sugar and Spice and Everything Nice? ," LewRockwell.com, September 3, 2008

Labels:

beauty,

people - McCain; John,

people - Palin; Sarah,

politics

Subscribe to:

Posts (Atom)