~ Bill Fleckenstein, November 11, 2024

Nov 26, 2024

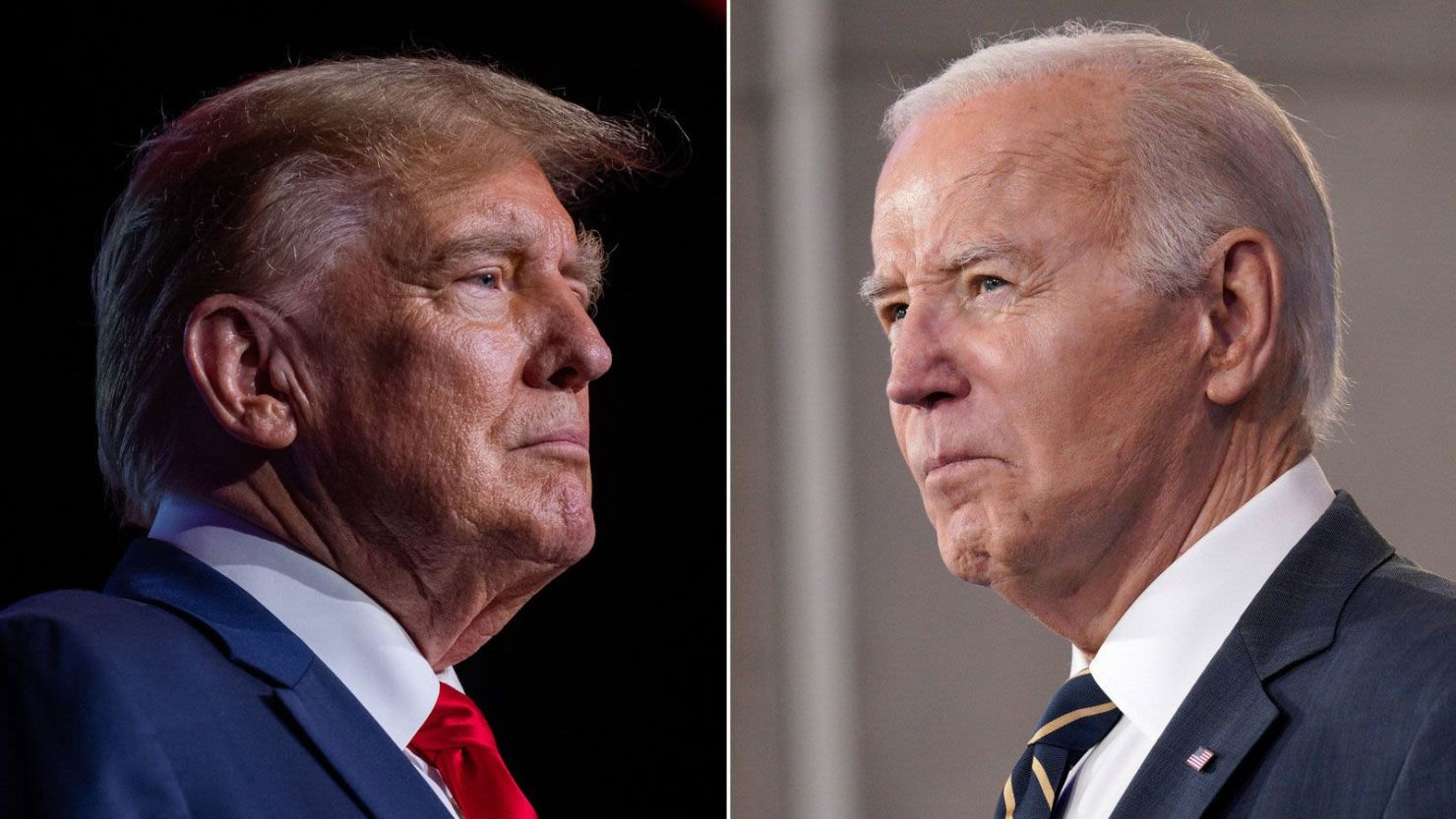

Bill Fleckenstein on Trump 2.0

I am most likely going to have plenty of negative things to say about some of Trump's policies, and positives things to say about others, but it's going to be based on economic and financial analysis. Hopefully, we can keep the political histrionics out of the comments I get. Despite my thinking that the Trump administration will be a vast improvement over the Biden administration, that doesn't mean that the problems we face aren't serious or that they will be solved easily. I can root for progress and be skeptical about easily achieving it at the same time. The bottom line is, the Trump administration will be a big improvement, but their policies may not work as they envision them.

Nov 25, 2024

Liu Xueliang on Trump's tariff policies

The tariff policies ultimately harm consumers, not us. BYD will still endeavor to offer quality products at reasonable prices in all countries based on their own tariff guidelines.

~ Liu Xueliang, general manager of BYD Asia Pacific auto sales division, "China's BYD not afraid of Trump tariffs: 'They harm consumers, not us'," Korea Joongang Daily, November 24, 2024

Labels:

automobiles,

BYD,

import tariffs,

people - Trump; Donald

Nov 24, 2024

Michael Lewis on knowledge

In the arenas of human ambition, in Hollywood or Silicon Valley, or Washington or Wall Street, there's a knowingness about people. They don't want to seem like they don't know. They think that if they don't know, they're going to seem stupid. And that leads to greater stupidity.

~ Michael Lewis, "Michael Lewis on what he learned by studying the elites," Brief But Spectacular, November 4, 2024

Nov 18, 2024

Marc Faber on China's rise as a manufacturing superpower (2002)

I'll start with emerging markets, where valuations are attractive and expectations are very low. Since 1990 the markets in the developed countries of Western Europe and the U.S. are up, say, five times. In emerging economies most markets are down 80% in dollar terms, and earnings are bottoming out. Money has been flowing out of emerging-market funds for 2-3 years.

One concern is that Chinese competition will continue to erode the market share of other Asian exporters to Western Europe and the U.S. In the long run, very few emerging economies will be able to compete with China. I wouldn't rule out, in 5-10 years' time, the possibility that China becomes the workshop of the world, the way Lancashire [England] did in 1830s. But China will also become the customer of other emerging economies. China has a population of 1.2 billion people. Today less than 1% of the population is outbound, but 5%-10% could be traveling over the next 10-15 years. That would mean a meaningful influx of tourists into the surrounding countries of Asia, and Australia, New Zealand, the United States and Western Europe. Food and plantation companies will benefit from Chinese demand. Companies that cater to domestic consumer demand -- cigarette companies, pharmaceutical companies, software companies -- will also be helped.

~ Marc Faber, "Past and Presents Four pros speak their minds on history, science and compelling stocks," interview by Laura Rublin, Barron's, January 21, 2002

(Emphasis mine.)

Nov 17, 2024

Richard Lawrence on active investing

We're just going to keep doing what we're doing. There's no real reason for us to change. My dad was a stockpicker, John Bush [my mentor] was a stockpicker, I'm a stockpicker, my younger colleagues are stockpickers. In 20 years, the world is going to need stockpickers. The financial market, Wall Street, might want to turn us all into obsolete things with AI and ETFs and whatnot, but I can tell you it's not going to happen.

~ Richard Lawrence, "Betting Big on China & Lessons from Bear Markets," We Study Billionaires, 1:11:20 mark, September 19, 2024

Richard Lawrence on China's competitiveness

In the U.S., there's a certain arrogance that China's weak and has been brought to its knees and doesn't have technology and is massively overlevered and I think that's not really realistic. If you look carefully at the semiconductor [industry], which is something I've been tracking for nearly 24 years, we can try to restrict advanced semiconductors from China, but China takes a very long view of this stuff. And I guess in 8-10 years they're going to have similar levels of technology. And that will have happened faster than if we had really sat down and talked about what are the uses in China for the advanced technology, the advanced chips, how to keep them out of the military.

Well, if we ask them to keep the advanced chips out of the military, well then they're going to ask us to keep our chips out of our advanced military. So that just hits loggerheads because our military in the U.S., there's a certain arrogance that comes with it. So those are complicated problems that need to be resolved.

But to me I would say there are five semiconductor markets and the advanced one that goes into military equipment is really probably the smallest of all of them. And so let's talk about the other four markets and see what we can do on that. But there's basically no talking at this point.

~ Richard Lawrence, "Betting Big on China & Lessons from Bear Markets," We Study Billionaires, 59:30 mark, September 19, 2024

Richard Lawrence on the macro situation in China

Q: How would you describe the current macro situation in China?

A: Let's start off with the stuff that really matters, which is things like balance sheets. They've got $3 trillion of Forex reserves. The household bank deposits are double the size of market capitalization of the stock markets and it nearly tripled the size of annual retail sales. So the individual Chinese consumer has a lot of firepower in the bank deposit... Loan-to-deposit ratios are conservative, the capital adequacy ratio at the banks is okay. So those balance sheet items are all in very good order. Current account surplus, small government deficit. So that's not the problem. The problem is really a lack of confidence.

~ Richard Lawrence, "Betting Big on China & Lessons from Bear Markets," We Study Billionaires, 54:30 mark, September 19, 2024

Nov 15, 2024

Edwin Dorsey on the importance of long-term thinking in business

The single idea, and we've touched on this a little bit, is I believe there's a lot of things that businesses can do to make the numbers better in the short-term, but hurt the long-term value. You can raise prices, you can make it more difficult to cancel, you can make it more difficult to get refunds, you can cut corners on content moderation. All these things help the numbers in the short-term, so they make the stock more attractive in the short-term while harming long-term value. And seeing that disconnect when it occurs is where I think a lot of investors can profit.

The final idea is businesses can easily do things that help the short-term numbers and hurt long-term value.

~ Edwin Dorsey, "Simple Yet Powerful Tips for Short Selling - Exposing the Red Flags," Stansberry Investor Hour, 57:30 mark, November 4, 2024

Nov 13, 2024

The Economist on growing anxiety in America

Ordinary Americans are anxious. Gallup, a polling firm, regularly asks Americans if they are satisfied with how things are going. From 1980 until the early 2000s, a little more than 40%, on average, said they were. Over the past two decades that has dropped to 25%.

~ "The envy of the world: The American economy has left other rich countries in the dust. Expect that to continue...," The Economist, October 19, 2024

Labels:

America's decline,

anxiety,

happiness,

stagnation

Nov 12, 2024

Harris Kupperman on the hedge fund business

It's a lifestyle business. I'm going to be doing this for the rest of my life probably. I actually enjoy it. Like I said, this is my hobby. Made a bunch of money. I don't do it because I want to make more money. I make it because I want to be in the game. I want to beat the S&P 500, but more important, I want to beat all my friends who I think are top-notch, 0.1% hedge fund managers. I want to beat them, too. That's what I'm passionate about.

~ Harris Kupperman, "How to Scale a Hedge Fund | Harris Kupperman on Praetorian Capital," The Monetary Matters Network, November 6, 2024

Labels:

hedge funds,

passion,

people - Kupperman; Harris

Harris Kupperman on politics and investing

I tend to wear my politics on my sleeve; I hate both parties. I don't like government regulation. I don't like rules. I'm more of a Ron Paul kind of guy.

[...]

We're going to own gun stocks, we're going to own oil and gas, we don't do ESG.

[...]

It's a trust-based business. You can't really hide who you are.

~ Harris Kupperman, "How to Scale a Hedge Fund | Harris Kupperman on Praetorian Capital," The Monetary Matters Network, November 6, 2024

Nov 9, 2024

Kevin Duffy on Donald Trump, the "new boss," and the left-right political spectrum

The problem is that people choose a side and lose their objectivity. Trump started the vaccines under Operation Warp Speed. He also got the stimulus ball rolling with the CARES Act (which sent out stimmie checks directly to people). The Fed under his watched expanded its balance sheet 68% in 6 months to pay for it.

What did the Biden administration do? Did it change course? No, it added to the stimulus, rolled out the vaccines using an intense marketing campaign, and kept printing money (Fed assets grew 20% in year 1). Biden also expanded Trump's tariffs on trade with China.

Objectively, how well did these policies work? 1) The vaccines at best were ineffective. At worst they led to an inordinate number of adverse reactions. 2) The stimulus drug wore off. 3) Inflation was unleashed.

All we have to show for this orgy of government intervention into our lives is a 50% jump in the national debt, higher interest rates, and interest expense on that debt that now exceeds the entire military budget. So of course the incumbent party lost!

"Meet the new boss, same as the old boss."

~ Kevin Duffy, Facebook post, November 9, 2024

YouTube comment on anti-China western media headlines since 1990

Here's what western magazines have been saying about China since 1990:

1990. The Economist: China's economy has come to a halt.

1996. The Economist: China's economy will face a hard landing.

1998. The Economist: China's economy entering a dangerous period of sluggish growth.

1999. Bank of Canada: Likelihood of a hard landing for the Chinese economy.

2000. Chicago Tribune: China currency move nails hard landing risk coffin.

2001. Wilbanks, Smith & Thomas: A hard landing in China.

2002. Westchester University: China Anxiously Seeks a Soft Economic Landing.

2003. New York Times: Banking crisis imperils China.

2004. The Economist: The great fall of China?

2005. Nouriel Roubini: The Risk of a Hard Landing in China.

2006. International Economy: Can China Achieve a Soft Landing?

2007. TIME: Is China's Economy Overheating? Can China avoid a hard landing?

2008. Forbes: Hard Landing In China?

2009. Fortune: China's hard landing. China must find a way to recover.

2010: Nouriel Roubini: Hard landing coming in China.

2011: Business Insider: A Chinese Hard Landing May Be Closer Than You Think.

2012: American Interest: Dismal Economic News from China: A Hard Landing.

2013: Zero Hedge: A Hard Landing In China.

2014. CNBC: A hard landing in China.

2015. Forbes: Congratulations, You Got Yourself A Chinese Hard Landing.

2016. The Economist: Hard landing looms for China.

2017. National Interest: Is China's Economy Going To Crash.

2018. The Daily Reckoning: China's Coming Financial Meltdown.

2019. BBC: China's Economic Slowdown: How worried should we be?

2020. New York Times: Coronavirus Could End China's Decades-Long Economic Growth Streak.

2021. Bloomberg: Chinese economy risks deeper slowdown than markets realize.

2022. Bloomberg: China Surprise Data Could Spell RECESSION.

2023. Bloomberg: No word should be off-limits to describe China's faltering economy.

...

Yet it's already 2024 and China's economy is still going strong.

~ @Shenzhou, "Harvard Economist Reveals Shocking SECRET About China in 2025," YouTube, November 8, 2024

Nov 8, 2024

Connor O'Keeffe on the Trump election victory

Trump’s win represents another major and well-deserved repudiation of the Washington establishment. In 2016, Republican voters decisively rejected Jeb Bush—the establishment’s chosen GOP candidate—and sent Donald Trump to the White House on a refreshingly anti-establishment platform.

While he largely governed like an establishment Republican in his first term, his occasionally anti-establishment rhetoric was enough to prompt a full-court press from the political class to first force him out of office and later to disqualify him from ever holding power again. In the realm of public opinion, the establishment’s chosen tactic was to label Trump a racist, misogynist, wanna-be fascist whose supporters back him simply because they hate everyone who isn’t straight, white, and male.

~ Connor O'Keeffe, "Why Trump's Victory Matters, and Why It Doesn't," Mises Wire, November 8, 2024

Subscribe to:

Comments (Atom)