~ Larry McDonald, "Buy What Wall Street Hates," Stansberry Investor Hour, 26:40 mark, July 29, 2024

Jul 31, 2024

Larry McDonald on the AI capital spending binge

Yesterday, we had an interesting chat where, it was a private conversation with a guy in the Valley [Silicon Valley] that is really good friends with all of the CFOs of the Mag 7. He's been out to dinner with them hundreds of times, he's been in the Valley for over 30 years and he's run hedge fund money... And we had another guy who's been trading semiconductors for 20 years professionally and they were having this conversation around artificial intelligence. And the one thing they both said... it's like the Manhattan Project where if you're a CFO in the Valley and you're not doubling or tripling your capex the last year and a half in artificial intelligence, you're fired. They're so terrified to be, two years from now, left on the outside. So what's fascinating is... the capex has gone from like $30 billion a year to $160 billion a year with no visibility... There's zero visibility on return on capital. So this is capital expenditures just being deployed at a sick, aggressive, insane pace. He called it a "Reagan-Gorbachev arms race" where the CFOs have a gun to their head. They have to invest... It's created these distortions where Wall Street analysts are falling all over themselves to upgrade Nvidia, but this capex trajectory is just not sustainable. And the market's starting to figure it out now.

Jul 28, 2024

Jeremy Siegel dismisses possibility of another technology bubble

Q: The valuations of leading technology stocks are more reasonable today than in the dot-com years of 1999 and early 2000, even if some are stretched. Are you concerned about the possibility of another technology bubble?

Jeremy Siegel: We have always had momentum traders in the market, and momentum investing can be a fairly successful strategy. People ride the wave with the belief that they can jump off before it crashes. That, of course, doesn’t often happen. But we are nowhere near the internet bubble. That was a much more severe situation in 1999 and 2000. That was the biggest momentum wave that I’ve ever seen.

It’s difficult to beat the indexes, given the momentum for the artificial-intelligence-related tech stocks. In some ways, that has taken all the oxygen out of the room, although they are delivering the bacon. Earnings are coming through, and their valuations are nowhere near the stratospheric valuations that we saw 20 to 25 years ago.

~ Jeremy Siegel, "Tech is 'Nowhere Near' the Dot-Com Bubble," Barron's, July 29, 2024

Jul 22, 2024

Tony Deden on the tech bubble (1999)

Let there be no doubt, that what we are witnessing is, indeed, history's greatest financial bubble. The indescribable financial excesses, the massive increase in debt, the monstrous use of leverage upon leverage, the collapse in private savings, the incredulous current account deficits, and the ballooning central bank assets all describe the very severe financial imbalances which no amount of statistical revision nor hype from CNBC can erase.

As it happened in 1929 - a boom and bust with which this bubble is often compared to but which pales into insignificance when compared with it - as it happened in 1972, in 1989 in Japan, or in 1998 in East Asia, booms are followed by busts - they are called recessions, depressions, etc. - because booms sow the seeds of every succeeding bust.

Their cause is not the fault of capitalism as it has been suggested, but an excessive amount of money and credit created by central banks. Yet, this seems to escape the understanding of those who will, in one day, convene congressional hearings to determine what caused this destruction. The culprit is, as it always has been, the same organization, which professes interest in bringing about price stability and low inflation: The Federal Reserve Bank and its policies of money market intervention, credit creation and loose money.

~ Tony Deden, "Reflections on Prosperity," Safe Haven, December 29, 1999

Jul 20, 2024

Alvin Toffler on past and future

If we do not learn from history, we shall be compelled to relive it. True. But if we do not change the future, we shall be compelled to endure it. And that could be worse.

~ Alvin Toffler

Jul 19, 2024

Jul 16, 2024

Robert Malone on Hannah Arendt's "banality of evil"

The concept of the “banality of evil” was introduced by Hannah Arendt in her 1963 book Eichmann in Jerusalem: A Report on the Banality of Evil. Arendt, a German-American philosopher and political theorist, was tasked with reporting on the trial of Adolf Eichmann, a former Nazi official responsible for the logistics of the Holocaust.

Arendt’s thesis was that Eichmann, who was considered a “normal” and “boring” individual, was not a fanatic or a sociopath, but rather an average and mundane person who relied on clichéd defenses rather than thinking for himself. He was motivated by professional promotion rather than ideology, and believed in success, which he considered the chief standard of “good society.”

Arendt argued that Eichmann’s actions were not driven by a desire for evil, but rather by a kind of complacency and thoughtlessness. He was able to commit atrocities because he was not driven by a strong sense of morality or a desire to do good or evil, but rather by a desire to fit in and be successful.

~ Robert Malone, "Assassination and the Banality of Evil," July 16, 2024

Hans-Hermann Hoppe on democracy

What is true, just, and beautiful is not determined by popular vote. The masses everywhere are ignorant, short-sighted, motivated by envy, and easy to fool. Democratic politicians must appeal to these masses in order to be elected. Whoever is the best demagogue will win. Almost by necessity, then, democracy will lead to the perversion of truth, justice and beauty.

Jul 13, 2024

Scott Black on the consumer

My one concern is that the consumer is stretched. The savings rate has dropped to 3.8%, and credit-card debt is at a record $1.12 trillion, while student-loan debt is at a near-record $1.75 trillion. It is hard to see how the consumer will continue to drive the economy in a big way. Thus my GDP forecast is modest.

~ Scott Black, Barron's, July 13, 2024

Labels:

consumer,

consumer debt,

people - Black; Scott

Jul 10, 2024

Jeremy Hammond on the left-right political spectrum

People like to think that there's a free press. People like to think that this is a free country. But you're not free if your mind is being controlled. And that's really what I aim to do with my work is to free peoples' minds from mental slavery so that they can see the real world around them because people are really deluded into believing fictional narratives and outright falsehoods. So people have this worldview that is outright delusional and I want to do what I can to help free minds and to help people see what is really happening.

What really shocks me, in this day and age, when we have the internet at our fingertips, how so many Americans are so trapped in this mindset of viewing everything through this lens, this narrow political spectrum, of left vs. right, liberal vs. conservative, Democrat vs. Republican. If you can't even escape that narrow framework of thinking - that shouldn't be too challenging - I think that's how most Americans view anything political, through that narrow linear spectrum.

My point of view is completely off that linear chart. It doesn't fall anywhere along that narrow linear line. I'm not left or right or center; it doesn't even apply to me in the way that I think. So people just need to escape this mental box that they've been trapped in and that's really what I aim to do with my work.

The state religion is how I often refer to it. We're indoctrinated from early childhood into the state religion. What I mean by that is this belief - religious-like, cult-like faith - that the government is good, it's this benevolent force and we need the government to take care of us, and we need the government to be intervening in every aspect of our lives. There are so many people who really fervently belief that as a matter of faith because they've been so deeply indoctrinated into that state religion. And so we need to free people from that mental slavery.

~ Jeremy Hammond, "Interview: Assange Freed + Palestine's Ancient History," jeremyrhammond.com, 14:40 mark, July 10, 2024

(For 2 minute clip of the actual quote, click here.)

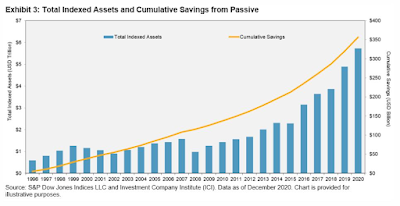

Whitney Tilson on holding on to winning stocks

Almost no human being has the ability to do this. If you want to know the main reason index funds outperform almost all active managers over a long period of time, it's because they never sell their winners. They let their winners run. Just look at the S&P 500 index. The S&P 500 index has never sold a share of Apple, Nvidia, Microsoft, Berkshire Hathaway, Visa, Mastercard, Lilly. I just named almost all the top 10 stocks in the S&P that drive its entire return.

~ Whitney Tilson, "Be Greedy and Let Your High-Quality Winners Run," Stansberry Investor Hour, 26:35 mark, July 8, 2024

Jul 9, 2024

Clyde Prestowitz on Joe Biden's support of Israel

Joe was not a bad senator, but neither was he an outstanding one. He had a major distinction as a big backer of Israel and was the all time champion for collection of campaign funding from the America Israel Political Action Committee.

As a Vice President and adviser to the young President Obama, he provided, I thought, valuable experiential advice and realism. He also, of course, had the opportunity to spend eight years in the White House watching how it worked, absorbing all the intelligence reports of the years and meeting all the world’s top leaders.

This is where I thought Joe gained a real geo-political edge. No one except a President, and in this case a Vice President, gets this experience and this view of the world and the world’s leaders. Joe was well ready to run and win in 2020 and was, in my mind, the best guy for the job at the time.

He has done a decent job over the past four years. But he has also slipped badly physically and mentally over the past two years. He is not the Joe we elected in 2020.

But there are two things even more important. One is great danger that he cannot beat Trump in his present state. The second is that Joe and his undying commitment to Israel are at odds with what is good for America, for Israel, and for the middle east. He does not understand that Prime Minister Netanyahu is running rings around him (Joe). He does not understand that Israel is not only a genocidal country but that it is making America one too. By standing steadfastly with the Zionist drive to destroy Palestine and Palestinians, he is destroying American credibility globally and driving domestic division.

This is why I say now, TIME TO GO JOE.

~ Clyde Prestowitz, "Gotta Go Joe: Determination is not enough," July 9, 2024

John Naisbitt on Japan's rise (1982)

Japan has seized from us the position as the world's leading industrial power, having surpassed the United States both in steel and automobile production. On a per capita basis, Japan's GNP is about even with ours, with Japan having the growth edge. We are ahead only because of the sheer size of our economy.

Japan is number one, but that is like a new world champion in a declining sport.

~ John Naisbitt, Megatrends

Jul 8, 2024

Tom DiLorenzo on the Sherman Antitrust Act and myth of monopolies

I was studying antitrust at the time. And, of course, when I was teaching, I was teaching the Austrian theory of competition, not the perfect competition theory of competition. And I noticed that every single textbook said that in the late nineteenth century, there was a rampant monopolization of American industry, and that justified the antitrust laws.

I was the very first person to dig up the actual statistics on such things as production and prices of the industries that were accused of being monopolies by the Senate and the House of Representatives in the late 1880s before they passed the Sherman Act. And I published this article showing that instead of output restriction, there was massive expansion. These industries were the fastest-growing and most productive industries in America at the time, which is why they were being picked on by their less successful rivals, who got the politicians to pass a law that would hamper them. The same with prices. They dropped prices faster than the CPI dropped for ten years prior to the Sherman Act and ten years after the Sherman Act. The only reason I was the first one to do that is that no one else had asked this question from an Austrian perspective every before.

So if you have Austrian economics and libertarian theory in your educational background, you look at history very differently.

~ Tom DiLorenzo, "The Importance of Human Action To Me," The Misesian, May-June 2024

Subscribe to:

Comments (Atom)