Apr 29, 2024

David Swensen on the investment industry

Apr 22, 2024

Gary Mishuris on sticking to the investment process

Savita Subramanian on the brain drain from active equity investing

Apr 21, 2024

Patti Domm on the decline of active investing

Burton Malkiel on how the AI revolution is different from the internet bubble of 2000

Fred Hickey begins buying gold stocks

Apr 20, 2024

Kevin Duffy on economics and investing

Apr 19, 2024

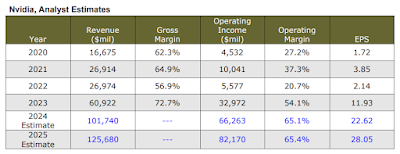

Kevin Duffy on Nvidia's $2.2 trillion valuation

Kevin Duffy on bitcoin

Apr 16, 2024

Jeffrey Evan Brooks on socialism

Apr 15, 2024

Kevin Duffy on gold

Cathie Wood on supply and demand slowing Nvidia's growth

Apr 13, 2024

Alasdair Macleod on BRICS (China's Plan B)

Apr 12, 2024

Rick Rule on the disconnect between gold price and equities

Rick Rule on the long bull market in commodities

Apr 11, 2024

Jim Grant on Asian central bank buying of gold

Jim Grant on how interest expense was removed from CPI in 1983

Dan Ferris on decision making

Jeremy Hammond: Biden's concerns for humanitarian situation in Gaza is a cynical PR ploy

John Hathaway on central banks replacing U.S. dollars with gold

John Hathaway on the recent gold breakout

The Economist on the decline of active investing

Apr 9, 2024

Apr 8, 2024

Meb Faber on investing in China

John Zolidis on top retailers signaling economic distress

Apr 5, 2024

Sarah Katilyn on the evolution of modern man

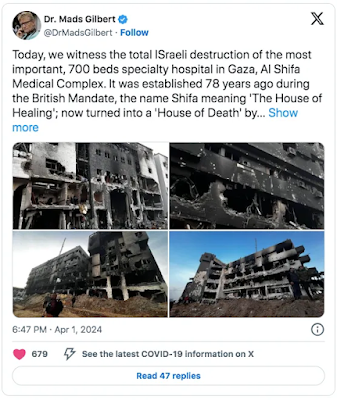

Mahmoud Issa on the economic costs of the Gaza invasion

Apr 4, 2024

The Economist: "the supposed decoupling between America and China is in fact illusory"

Michael Fritzell on China's economic experiment: "A return to Mao-era governance seems unlikely"

Bloomberg Businessweek on muted impact of stimulus in China

The Economists: "Foreign investors are fleeing Chinese stocks"

Foreign investors are fleeing. They have been net sellers for months, dumping $2 bn-worth of shares in January alone… As miserable as the performance of Chinese stocks has been for most of their three-decade history, the present downturn feels different. That is because China’s economic prospects are gloomier than at any point in recent history.

~ “Fanning the flames: China’s stockmarket nightmare is nowhere near over,” The Economist, March 2, 2024

The Economist: China's retail investors have lost interest in risk assets

Mutual funds, which invest in stocks and are hard to redeem, saw their smallest inflows in a decade last year. Money-market funds, which can be sold instantly, grew from 8.1 trn yuan in 2020 to 12.3 trn in July... Retail investors’ hitherto growing interest in stocks, bonds and investment funds, which the government had hoped would reduce Chinese savers’ fixation with property, has reversed.

~ “Disrupting dreams: Markets are pummeling China’s well-to-do,” The Economist, March 2, 2024