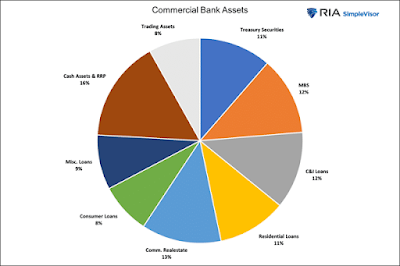

Further, given the Fed’s new BTFP facility, banks are incented to hold on to Treasury and mortgage assets. As such, other asset types will be sold or, at a minimum, not added to. The other assets are loans which drive economic activity.

[...]

If banks significantly tighten standards, the Fed may be dealing with disinflationary pressures sooner than expected. Banks, not the Fed, create money as they make loans. If fewer loans are made, less money is created. Subsequently, the nation’s money supply will decline further.

Yes, we said, “further.” The year-over-year change in the money supply has declined for the first time since the Depression, as the reventure consulting graph shows. Each previous decline was met with an economic depression or financial crisis.

~ Michael Lebowitz, "Aftershock Life in the Wake of Silicon Valley Bank," Investing.com, March 15, 2023

No comments:

Post a Comment