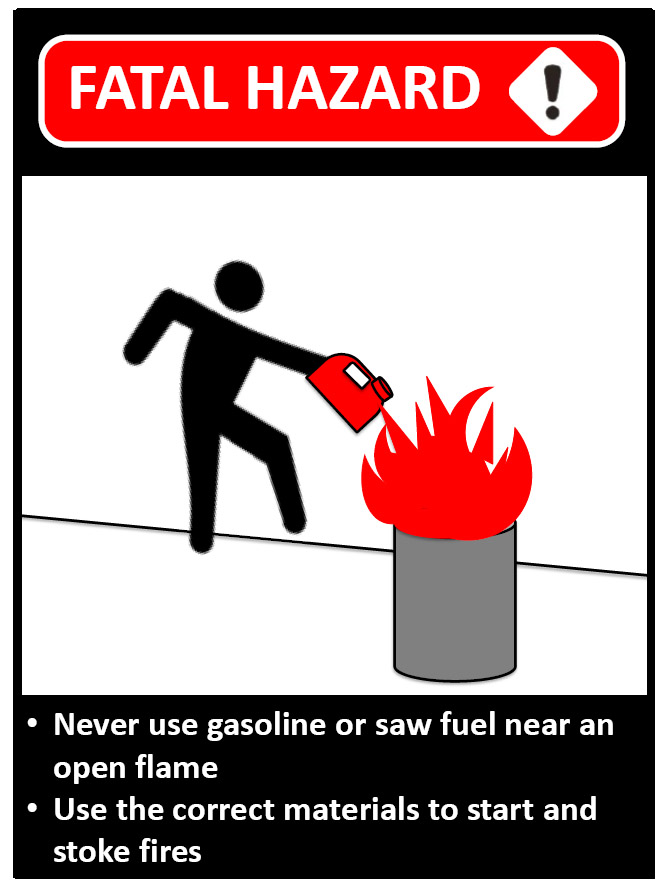

In the past, Fed interest rate reductions and rumors of government interventions into the economy could be guaranteed to accelerate financial markets upward. The latest number for federal giveaways is $1 trillion which under the best scenario would saddle the government with a $2 trillion deficit, double the currently projected deficit. Never before in U.S. history has this occurred. Meanwhile the Fed has dropped interest rates effectively to zero and announced a $700 billion program of "quantitative easing" (purchasing of questionable assets). The desperation in that move sparked greater panic in financial markets with the Dow falling another 913 points. Clearly the federal government has run out of bullets and is only throwing gasoline on the economic fire.

We have reached the fork in the road for this nation. Either the people step in and tell government they have had enough, or they will pay the price of going down the road to Venezuela.

~ Phil Duffy, March 20, 2020

No comments:

Post a Comment