~ Sheldon Richman, "James Buchanan's Subjectivist Economics," Future of Freedom Foundation, April 1, 2013

Aug 27, 2023

Sheldon Richman on utilitarianism vs. social cooperation

Putting social cooperation at the center of the [economics] discipline… is highly significant. If the economic problem to be solved is seen as one of allocating resources among competing uses, attention may easily move to central decision-making, with bureaucracies filled with economists and computers. The social calculus of utilitarianism becomes prominent. But if the spotlight is on cooperation among individual persons, one’s orientation is different. Central decision-making is quickly seen as interference with cooperation among free individuals.

Aug 26, 2023

Manuel García Gojon on Javier Milei's influence in Latin America

Tho Bishop: Javier Milei is a self-professed Rothbardian who has had some very strong polling in recent months. Some pundits have compared his populist style with that of Donald Trump and Brazil's Jair Bolsonaro. Given that Argentina has had recurring monetary and economic issues, including the current period of prolonged inflation, do you think Milei's political rise is real, and is it a model for other Latin American countries?

Manuel García Gojon: Even if Milei does not win the election, his attempt will have a deep and lasting effect. I would speculate the campaign to be even more significant than the 2012 Ron Paul campaign.

The core of Milei's support can be found in young men, regardless of socioeconomic background. Over 40 percent of men 18 to 30 years of age support Milei as their first choice among four competitive candidates.

Even people whose main occupation is food delivery are saving up to buy books on Austrian economics and are conversant in the arguments behind Milei's plans to reduce government spending, loosen labor laws, end protectionist measures, and abolish the central bank...

The youth is generally rebelling against the progressive status quo, as is also occurring in some parts of continental Europe. It is possible that this phenomenon will spread across Latin America, especially in countries where economic conditions are dire, but a figure with the specific combination of characteristics that Milei has might be a once-in-a-generation phenomenon.

Milei does not like to be perceived as a populist because of the negative connotation it carries, saying that people confuse being a populist with being popular. What makes him particularly interesting from an Austrian point of view is that he is a late convert. He was as neoclassical as they come for over two decades, and when he came into contact with the Austrian school in 2014, he had the intellectual humility to recognize that a lot of what he been teaching was wrong...

It does feel to me as if the present is pregnant with a significant paradigm shift in Latin America. That is a positive beginning.

~ Manuel García Gojon, Q&A, The Austrian, July-August 2023

Aug 21, 2023

Kevin Duffy on the predictive value of financial markets

Most times financial markets are vaguely right, sometimes wildly wrong. The key to successful investing is recognizing the difference.

~ Kevin Duffy, tweet, August 19, 2023

Labels:

financial markets,

future,

investing,

people - Duffy; Kevin

Ron Paul on Biden asking for another $24 billion to support Ukraine in war with Russia

As Maui Burns, Biden Demands Another $24 Billion…For Ukraine!

I am not a big fan of Federal Government disaster relief. Too much of the time the money never gets to those who need it most, and too often Washington’s armies of disaster “experts” are more interested in pushing people around than helping them.

Nevertheless, it’s hard to look at recent footage of the devastation in Maui and then hear President Biden tell Congress that he needs another $24 billion for Ukraine. How can this Administration continue to justify tens of billions of dollars for this losing war that is not in our interest while the rest of the United States disintegrates?

Biden’s new $24 billion request comes on top of well over $120 billion already spent to fight the US proxy war on Russia in Ukraine. Heritage Foundation budget expert Richard Stern has done the math and determined that Biden’s spending on the Ukraine war thus far will cost each and every American household $900. How many Americans would rather have those 900 dollars back in their pocket rather than in the pockets of Lockheed-Martin, Raytheon, and Ukraine’s oligarchs?

Recent surveys have shown that a majority of Americans could not afford to cover a sudden $1,000 emergency. Will Americans connect the dots and realize that the reason they can’t find that $1,000 for an emergency is because the neocons have already sent it to Ukraine?

Ukraine has long been known as among the most corrupt countries on earth and not long ago investigative journalist Seymore Hersh wrote that Ukrainian president Vladimir Zelensky has embezzled at least $400 million in aid from the American people. Corruption scandals continue to break in Ukraine. Just last week Zelensky fired the heads of all local draft boards for corruption. Some press reports suggest that sales of luxury cars in Ukraine have broken all previous records. I wonder why.

No wonder the tide of U.S. public opinion is turning against further involvement in the war. Recently CNN found that among all Americans, more than 55 percent are opposed to continued aid to Ukraine. Among Republicans the number opposing more aid to Ukraine rises to three-out-of-four. That is why we are finally starting to see more Republican Members raising concerns. I’d like to think they have seen the light that an aggressive and interventionist foreign policy is not in America’s interest, but most likely they are worried about losing elections. Whatever their motivation, this turning tide should be welcomed.

Yet the Biden Administration persists in backing Ukraine even as the U.S. mainstream media is increasingly pointing out the obvious: Ukraine is not winning and cannot win, and continuing to pour money into a losing cause will just result in bankruptcy at home and more dead Ukrainians overseas.

Last week Newsweek published an article asking, “Does Ukraine Have Kompromat on Joe Biden?” In the article, Northeastern University Professor Max Abrahms wonders out loud whether Biden’s continued support for Ukraine might be related to compromising information held in Kiev about the many Biden family shady business ventures in Ukraine and the region. It is certainly worth considering.

Meanwhile, the residents of Maui who survived the recent horrific fire will take little comfort knowing that the Biden Administration is more interested in sending their money to Ukraine than in helping them recover.

~ Ron Paul, Campaign For Liberty, August 20, 2023

Aug 15, 2023

WSJ on how Tesla alums are cleaning up on green energy

Governments everywhere are trying to build domestic clean-energy industries, from electric cars to solar panels. No company has had more recent success doing that than Tesla, and no executives are in greater demand than the auto maker’s alumni.

More than 30 companies led or launched by former Tesla employees have raised more than $26 billion in the past decade, most in the past few years, a Wall Street Journal analysis of data from PitchBook shows. Much of that money went to a handful of companies in the electric-car and battery supply chain: luxury electric-vehicle company Lucid Group, European battery upstart Northvolt and battery-recycling firm Redwood Materials.

Many of these companies focus on domestic manufacturing, as Tesla has for more than a decade. They are well-positioned to take advantage of last year’s U.S. climate law and Europe’s response to it. A key goal for both is to whittle away at China’s dominance in critical clean-energy industries.

~ The Wall Street Journal, "Tesla Alums Win Big in Green Energy Bonanza: Executives who survived EV maker’s dark days have raised billions from investors," by Ed Ballard and Amrith Ramkumar, August 15, 2023

Labels:

electric vehicles,

green energy,

onshoring,

Tesla,

venture capital

Aug 9, 2023

Gerard Cassidy on the Moody's downgrade of U.S. banks

I'm not saying it's wrong. The timing seems very odd. It's kind of late to the game... If we really are going to see the Fed reach its terminal rate for fed funds, let's say in September, and there is no hard landing in the economy next year, then the banks are in really good shape.

~ Gerard Cassidy, RBC Capital Markets, CNBC interview, 0:55 mark, August 9, 2023

Aug 8, 2023

Kevin Duffy's rules for civil debate

- It's ok to attack an idea, but not the person.

- Pursuit of the truth has to matter. People are entitled to their own opinions, but not their own facts.

- Respect each other's time. It takes far less time to spew falsehoods than to refute them.

- Get down to the level of underlying assumptions and foundational beliefs. Otherwise you'll be talking in circles and spinning your wheels.

- Try to at least find some common ground. Leave understanding where you agree as well as disagree.

Aug 7, 2023

Morgan Housel on the investment game

The biggest thing is realizing that there are a million different games to play and you have to figure out the game that works for you. A lot of investors get tripped up because they start to emulate maybe somebody on TV, maybe somebody on Twitter, maybe someone in their own household, and they start playing a game that is the wrong game for them.

~ Morgan Housel, "The Secret to Good Investing? Look Within" by Lauren Foster, Barron's, August 5, 2023

Aug 3, 2023

Arthur Schopenhauer on reading

The art of not reading is a very important one. It consists in not taking an interest in whatever may be engaging the attention of the general public at any particular time. When some political or ecclesiastical pamphlet, or novel, or poem is making a great commotion, you should remember that he who writes for fools always finds a large public. A precondition for reading good books is not reading bad ones; for life is short.

~ Arthur Schopenhauer

Aug 2, 2023

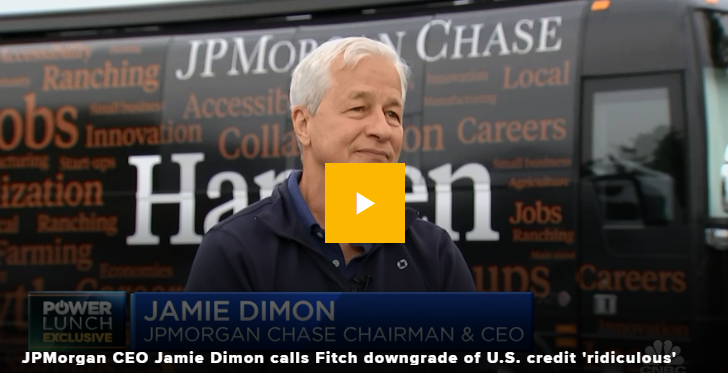

Jamie Dimon on the U.S. government debt downgrade by Fitch

It doesn't really matter that much. The markets decide; it's not the rating agencies who make these big decisions. Number two, they point out some issues which we all knew about, about our debt ceiling crisis and things like that. Number three and most important to the American public, this is the most prosperous nation on the planet. It's still the most prosperous nation on the planet. It's the most secure nation on the planet. And I would point out to the rating agencies, if I could, there are a bunch of countries rated higher than us - I think AAA - but they live under the American enterprise military system. To have them be AAA and not America, it's kind of ridiculous.

[...]

This is the most prosperous nation on the planet. North America. We have the Atlantic and Pacific, the best military, the best economy the world's ever seen, the most innovation. The credit is sound. It should be the highest rated credit in the world. And, yes, there are issues about it [the debt ceiling] being raised publicly. I agree with that. We should get rid of the debt ceiling... We need certainty in the world and should have more of it.

Jamie Dimon, CNBC interview, 1:50 mark, August 2, 2023

Labels:

debt ceiling,

debt downgrades,

people - Dimon; Jamie

Guy Adami on the U.S. government debt downgrade by Fitch

140%, 150% debt-to-GDP in this country, that's an atrocity. No developed country in the history of mankind since the Roman empire's been able to recover from numbers like that and yet we don't even talk about it. So good for Fitch. Maybe they're late to the dance, which they are. And that Janet Yellen response, it sounds like that had that at the ready.

~ Guy Adami, CNBC's Fast Money, August 1, 2023

Ed Mills on the U.S. government debt downgrade by Fitch

My understanding has been that after the S&P downgrade a lot of these contracts were reworked to say 'triple-A' or 'government-guaranteed', and so the government guarantee is more important than the Fitch rating.

~ Ed Mills, Raymond James analyst

Keith Lerner on the U.S. government debt downgrade by Fitch

This was unexpected, kind of came from left field. As far as the market impact, it's uncertain right now. The market is at a point where it's somewhat vulnerable to bad news.

~ Keith Lerner, co-chief investment officer, Truist Advisory Services in Atlanta, August 2, 2023

Larry Summers on the U.S. government debt downgrade by Fitch

The United States faces serious long-run fiscal challenges. But the decision of a credit rating agency today, as the economy looks stronger than expected, to downgrade the United States is bizarre and inept.

~ Lawrence H. Summers, tweet, August 1, 2023

Janet Yellen on the U.S. government debt downgrade by Fitch

I strongly disagree with Fitch's decision. The change announced today is arbitrary and based on outdated data. Fitch's quantitative ratings model declined markedly between 2018 and 2020 - and yet Fitch is announcing its change now, despite the progress that we see in many of the indicators that Fitch relies on for its decision. Many of these measures, including those related to governance, have shown improvement over the course of this administration, with the passage of bipartisan legislation to address the debt limt, invest in infrastructure and make other investments in America's competitiveness.

~ Janet Yellen, Treasury Secretary, August 1, 2023

Karine Jean-Pierre on the U.S. government debt downgrade by Fitch

It defies reality to downgrade the United States at a moment when President Biden has delivered the strongest recovery of any major economy in the world.

~ Karine Jean-Pierre, White House press secretary, August 2, 2023

Mohamed El-Erian on the U.S. government debt downgrade by Fitch

Overall, this announcement is much more likely to be dismissed than have a lasting disruptive impact on the U.S. economy and markets.

~ Mohamed El-Erian, President at Queens' College, LinkedIn post, August 2, 2023

Fitch on downgrading long-term U.S. government debt from AAA to AA+

The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to 'AA' and 'AAA' rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.

Erosion of Governance: In Fitch's view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025. The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management.

[...]

Tighter credit conditions, weakening business investment, and a slowdown in consumption will push the U.S. economy into a mild recession in 4Q23 and 1Q24, according to Fitch projections. The agency sees U.S. annual real GDP growth slowing to 1.2% this year from 2.1% in 2022 and overall growth of just 0.5% in 2024.

~ Fitch Ratings, "Fitch Downgrades the United States' Long-Term Ratings to 'AA+' from 'AAA'; Outlook Stable," August 1, 2023

Aug 1, 2023

Views on proposed legislation to screen foreign investment in China

“Creating an outbound investment review mechanism is a critical tool as Congress works to provide guardrails on taxpayer funds and safeguard our supply chains from countries of concern, including the People’s Republic of China.”

~ Sens. Bob Casey (D., Pa.) and John Cornyn (R., Texas) who sponsored the bill and five House members

“The bill stretches the concept of national security and abuses state power. It runs severely against market competition and other international economic and trade rules that the U.S. claims to value.”

~ Liu Pengyu, Chinese embassy spokesman in Washington, DC

"The push to regulate U.S. business activity abroad reflects the solidifying consensus in Washington that China aims to supplant U.S. global leadership and that American capital and expertise are aiding the buildup of Chinese military and economic power."

~ Kate O'Keeffe and Natalie Andrews, The Wall Street Journal

~ "Lawmakers Make Bipartisan Push for New Government Powers to Block U.S. Investments in China: Draft measure in Congress intends to limit U.S. involvement in China’s technology sector, rebuild supply chains," by Kate O'Keeffe and Natalie Andrews, The Wall Street Journal, June 14, 2022

Subscribe to:

Comments (Atom)