Nov 29, 2010

George W. Bush encouraging consumers to spend after 9/11

~ President George W. Bush, September 22, 2001

Rudy Giuliani encouraging consumers to spend after 9/11

~ New York City Mayor Rudy Giuliani, September 21, 2001

Paul Krugman on Milton Friedman's inflationary advice

Mr. Bernanke and his colleagues seem stunned to find themselves in the cross hairs. They thought they were acting in the spirit of none other than Milton Friedman, who blamed the Fed for not acting more forcefully during the Great Depression — and who, in 1998, called on the Bank of Japan to “buy government bonds on the open market,” exactly what the Fed is now doing.

~ Paul Krugman, "Axis of Depression," The Opinion Pages, The New York Times, November 18, 2010

Nov 22, 2010

Adrian Day on the commodity "super-cycle" (2010)

China is at the takeoff phase.

[...]

China being twenty percent of the world’s population is probably going to take longer than the ['super-cycles'] of Japan and Korea, which were both 10 years. The good news for commodity investors is that once China matures and [its] demand for resources plateaus, behind [it] you’ve got India.[...]

Supply simply cannot keep up with demand.

[...]

~ Adrian Day, "'Just Stick With It': Commodity 'Super-Cycle' Will Last Decades, Day Says," Yahoo! Finance tech/ticker, November 22, 2010

Friedrich Wilhelm Nietzsche on the state and its lies

~ Friedrich Wilhelm Nietzsche, Also Sprach Zarathustra [1896]

Nov 19, 2010

Bruce Charlton on mass media addiction

Habituation is a basic principle-repeated stimuli cease to command attention. So the media must generate novelty - novelty is imperative. This leads to endemic dishonesty - truth must continually be sacrificed to novelty. This leads to endemic ugliness-beauty must continually be sacrificed to novelty. This leads to moral corruption-virtue must continually be sacrificed to novelty.

It is obvious why society is undergoing progressive corruption and how far we are away from a good society - so far that we have lost the ability (an ability common to all previous societies) of even conceptualising the nature of things, of the human condition.

~ Bruce Charlton, "Mass Media Addiction, Habituation, Tolerance - Here, Now," November 19, 2010

Nov 17, 2010

Joseph Goebbels on propaganda

~ Joseph Goebbels, Reich Minister of Propaganda in Nazi Germany from 1933-1945

Nov 16, 2010

Michael Steinhardt on when to sell GM IPO

"Michael Steinhardt on GM IPO", CNBC, November 16, 2010

Nov 13, 2010

Doug Casey on gold

[...]

Consider the alternatives – they're quite unattractive. Another old market rule, since I'm quoting old market rules, is: Don't fight the Fed. And never since the Fed was created has there been a more clear signal from the Fed. People have made fun of Bernanke for saying he would drop hundred-dollar bills from helicopters, but that is in essence what he's doing – but with a lot more hundred-dollar bills than you could fit in a helicopter, or even a squadron of helicopters.

You don't want to fight the Fed: buy gold.

[...]

To use poker jargon, Bernanke has made an all-in bet that's going to be inflationary. So I'm inclined to make an all-in bet myself, on gold and gold stocks.

[...]

Hundreds of billions in new liquidity at the stroke of a pen – of course it will impact the stock market, and you don't want to fight the Fed.

~ Doug Casey, "Doug Casey on Gold’s New High, the Fed, and the Greater Depression,"

Nov 12, 2010

Kevin Duffy on the end of QE2

After today’s wild run-ups and reversals in commodities at the tail end of the QE2 bubble, tomorrow could be a bloodbath. With the 30-year T-bond collapsing, commodities flying, and European sovereign debt problems reemerging, the world’s central bankers have lost control. Worse, sentiment measures show frightening levels of bullishness, with QE2 providing the hook for both bulls and bears.

~ Kevin Duffy, Bearing Asset Management, November 9, 2010

Nov 11, 2010

Fred Hickey on short selling in the current market

[...]

What is worth mentioning is that this market is currently near-impossible to short.

~ Fred Hickey, "The Smartest Dumb People in the World," The High-Tech Strategist, November 5, 2010

Bethany McLean on the anti-Fed movement

[...]

Murray Rothbard, the controversial libertarian economist who many consider the intellectual father of the anti-Fed movement, wrote in 1994 ("The Case Against the Fed") that if the Fed were to be abolished, then "the banks would, at last, be on their own, each bank responsible for its own actions. There would be no lender of last resort, no taxpayer bailout [italics mine]."

~ Bethany McLean, "Fed-Bashing Three Ways," Slate.com, November 9, 2010

Ned Riley says he's no permabull

When people start saying that equities are the best long-term investment for your portfolio, I'm gonna run for the hills.

~ Ned Riley, Riley Asset Management, CNBC's "The Kudlow Report", November 4th, 2010

Ned Riley says the cold housing market is a big problem for the economy

The banks are still parsimonious in handing out any money toward the housing market. A purist, somebody that has high credit ratings and everything else, can't get an equity line of credit for about two months. So, Bernanke's nice to give us all this money, but the banks have pressure, big pressure, because the lending offices aren't giving the money away.

~Ned Riley, Riley Asset Management, CNBC's "The Kudlow Report", November 4th, 2010

Art Hogan on GDP growth in 2011

~Art Hogan, director of global equities, Jefferies, CNBC, November 9th, 2010

Ron Insana sees upside surprise in financial markets going into 2011

~Ron Insana, CNBC, November 8th, 2010

Tony Dwyer sees strong economic activity throughout 2011

~Tony Dwyer, chief equity strategist, Collins Stewart, CNBC "Market Breakdown", November 8th, 2010

Brian Belski on synchronized global growth

~Brian Belski, chief investment strategist, Oppenheimer Asset Management, CNBC, November 2nd, 2010

Jim Cramer roots for Ben Bernanke, the earnest underdog

~Jim Cramer, CNBC's Mad Money with Jim Cramer, November 9th, 2010

Jim Cramer says the market isn't fooled by negative sentiment and neither should you be

The bottom line, here's what really matters: the market itself isn't focused on the new negatives. It's focused on what's truly important, not faddishly important, which means the employment claims and the buyouts, not the bogus, blown-out-of-proportion, doom-and-gloom stories that the media's addicted to, including now the G20.

The market isn't fooled, which is why it spent the rest of the day rallying from the ugly open. You shouldn't be fooled, either.

~Jim Cramer, CNBC's Mad Money with Jim Cramer, November 10th, 2010

Jim Cramer makes a "contrarian" call for investors to pile into bank stocks

Wow, I just said something pretty inconceivable. I said that you should fear missing a move in the banks. Now that's a breath of fresh air!

~Jim Cramer, CNBC's Mad Money with Jim Cramer, November 10th, 2010

Jim Cramer says the fear is all priced in in bank stocks

Think of it: this morning there was a big story about the shocking FDIC-fees for the big banks, "shocking." There was nothing shocking about it at all. We all know about that, it's been written about forever. Right next to the story though about the FDIC-fees was an article about how the big banks are making tens of millions of dollars trading each day. You know what? That's real money. They can pay the FDIC bill and a lot more.

The mortgage morass? Jobs cure the morass. I'm sick of hearing about weaker pricing and more foreclosures, they're totally in the cards of the banks, the reserves have been taken.

~Jim Cramer, CNBC's Mad Money with Jim Cramer, November 10th, 2010

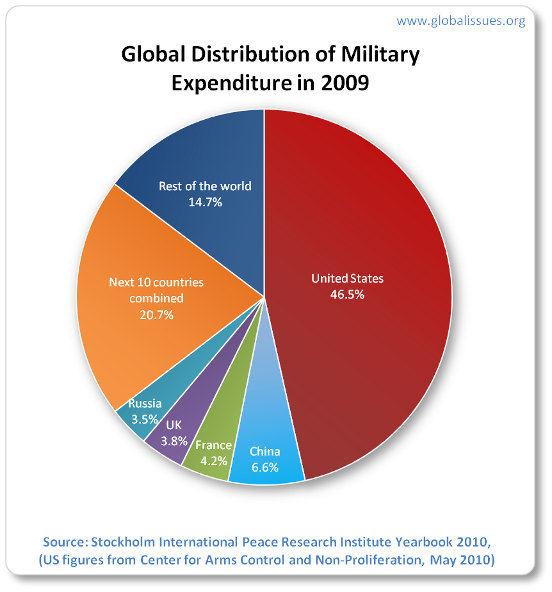

Kevin Duffy on the world's military expenditures

So why the need to support an empire that bankrupts us financially and morally, requires surrendering our freedoms, and makes us less secure? Threats like Iraq whose military spending is less than Oman's? Or Iran whose military is half the size of Turkey's?

H.L. Mencken got it right, "The whole aim of practical politics is to keep the populace alarmed – and thus clamorous to be led to safety – by menacing it with an endless series of hobgoblins, all of them imaginary."

~ Kevin Duffy, November 11, 2010 (Veteran's Day)

Nov 10, 2010

Frederic Bastiat on intervention

Frédéric Bastiat, “The Law”, 1850

Economist sees job recovery in 2011 thanks to QE2

~Joel Naroff, president of Naroff Economic Advisors, Bloomberg.com, November 10th, 2010

Economist sees a brighter future thanks to QE2

~Chris Rupkey, chief financial economist at Bank of Tokyo- Mitsubishi UFJ Ltd. in New York, Bloomberg.com, November 10th, 2010

Michael Aronstein on the reality of QE for savers and borrowers

~Michael Aronstein, president of Marketfield Asset Management, Bloomberg Television's "Surveillance Midday", November 9th, 2010

Robert Albertson on the Fed as the only adult in Washington

~Robert Albertson, head of investment strategy at Sandler O'Neill & Partners LP, Bloomberg Television's "Surveillance Midday", November 9th, 2010

Nov 5, 2010

Billionaire Ken Fisher sees 16% S&P 500 rally after elections

~Ken Fisher, Fisher Investments, Bloomberg.com, November 3rd, 2010

Mark Haines on George W. Bush's comment that "TARP saved the economy"

~ Mark Haines, CNBC, 10:55 AM Eastern time, November 5, 2010

Nov 4, 2010

A hedge fund manager describes the incentives of Ben Bernanke as he embarks on QE2

The person in charge of flying the balloon could:

a) Land, fix the hole, then take off again, or

b) Keep firing the gas cannister thereby keeping the balloon in the air as long as possible before the gas runs out and the balloon suffers a catastrophic crash.

Now imagine the person in charge of the gas cannister:

a) Is responsible for the hole in the balloon and will be found out if the balloon lands.

b) Has a parachute

c) Gets money for every second the balloon stays in the air.

~"CP", hedge fund manager and author of CreditBubbleStocks.com, November 3rd, 2010

Nov 2, 2010

Steve Jobs on "how to live before you die"

Rick Santelli on the 2010 mid-term elections

~ Rick Santelli, as appeared on CNBC discussing Tea Party movement, November 2, 2010