[...]

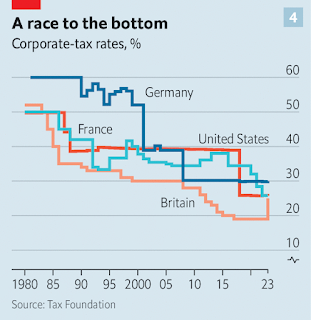

Yet much of this strong performance is, in a sense, a mirage. Politicians have reduced the tax burden facing corporations. From 1989 to 2019 the effective corporation-tax rate on American firms dropped by three-fifths. Since corporations were giving less money to the state, corporate profits rose, leaving them with more money to pass over to shareholders. Meanwhile, over the same period borrowing became cheaper. From 1989 until 2019 the average interest rate facing American corporations fell by two-thirds... We find that in America the difference in profit growth between the 1962-1989 period and the 1989-2019 period is entirely due to the decline in interest rates and corporate-tax rates.

~ "Problems on the horizon: Stockmarkets are booming. But the good times are unlikely to last," The Economist, March 2, 2024

No comments:

Post a Comment