As we speak, Nvidia commands a market value of $2.20 trillion, roughly 3.5 times the annual sales of the entire semiconductor industry.

[...]

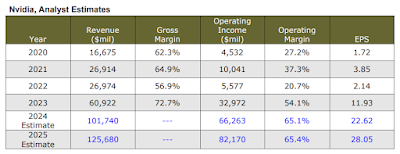

As the table below shows, the 40 or so analysts who follow Nvidia expect the company to sustain 65% operating margins this year and next, more than twice the average of the past five years. The bear case rests on capitalism’s knack for hammering down excess profits. If 2025 revenue comes in 15% light with margins closer to 40%, analysts will be forced to cut their earnings estimates in half. Add some valuation compression and Nvidia could easily lose its trillion dollar market cap status.

As Bob Farrell, a keen observer of investor sentiment, would say, “When all the experts and forecasts agree – something else is going to happen.”