Dec 30, 2008

John McCain on the economy (2008)

~ Sen. John McCain, former Republican presidential candidate, Sept. 15, 2008

George W. Bush on bailouts (2008)

~ President George W. Bush, July 15, 2008

Alan Schwartz on Bear Stearns: No liquidity crisis (2008)

~ Alan Schwartz, CEO of Bear Stearns, March 12, 2008

John Thain on Merrill Lynch: "We have more capital than we need" (2008)

~ John Thain, former CEO, Merrill Lynch, March 16, 2008

Dec 26, 2008

Norman Thomas on the importance of propaganda in bringing about socialism in America

~ Norman Thomas, a one time US presidential candidate

Pat Buchanan on Ronald Reagan protecting the auto industry

Believing Japan was dumping to destroy U.S. companies, Reagan put patriotism before ideology and imposed quotas on Japanese imports. He, too, was castigated by the same commentariat that is berating Bush.

~ Patrick J. Buchanan, "George Bush, Protectionist," Townhall.com, December 26, 2008

Pat Buchanan on the auto bailout

~ Patrick J. Buchanan, "George Bush, Protectionist," Townhall.com, December 26, 2008

George W. Bush on loaning $17 billion to the Big Three auto companies

~ President George W. Bush, interview with CNN, December, 2008

Dec 24, 2008

Martin Feldstein on using defense spending to stimulate the economy

That logic is exactly backwards. As President-elect Barack Obama and his economic advisers recognize, countering a deep economic recession requires an increase in government spending to offset the sharp decline in consumer outlays and business investment that is now under way. Without that rise in government spending, the economic downturn would be deeper and longer. Although tax cuts for individuals and businesses can help, government spending will have to do the heavy lifting. That's why the Obama team will propose a package of about $300 billion a year in additional federal government outlays and grants to states and local governments.

~ Martin Feldstein, "Defense Spending Would Be Great Stimulus," The Wall Street Journal, December 23, 2008

Dec 19, 2008

Stephen Jen on the dollar

~ Stephen Jen, economist, Morgan Stanley, "What's Driving Up the Dollar," BusinessWeek, December 8, 2008

Todd Salamone on the stock market (2008)

~ Todd Salamone, Schaeffer's Investment Research, "Reading the Market's Signposts," BusinessWeek, November 20, 2008 (December 8 issue)

Dec 17, 2008

Ken Fisher on comparisons to the 1929-1932 bear market and limited downside (2008)

There is no doubt, you could see the market down before it goes up. But my point is the bottom of bear markets is a very short time period with a steep "V," and you can't time the bottom of that with any precision. Anybody who thinks he can is an overconfident fool. And the fact is, you gotta be in it to win it. And you might lose it before you win it. But you gotta remember, that the next bull market is huge compared to any downside from here.

~ Ken Fisher, Fisher Investments, "Ken Fisher touts 'road to riches' despite meltdown," MarketWatch.com, October 10, 2008, interview with Steve Gelsi

(Fisher, 57, who went to Humboldt State University to study forestry and graduated with a degree in economics, said the current credit crisis could be eased considerably with better monetary policy.

The U.S. Federal Reserve under Ben Bernanke should consider dropping its discount rate so it's lower than both the Federal Funds Rate and the rate on Treasurys, he said. Together with a drop in reserve requirements for banks, the measures would help free up lending, he said.)

Paul McCulley: Bernanke won't allow a depression

~ Paul McCulley, Pimco, as appeared on CNBC, December 27, 2008

Dec 14, 2008

Arnold Schwarzenegger on economic girly-men

~ Arnold Schwarzenegger, September 1, 2004

Dec 10, 2008

Jim Chanos bearish on China and infrastructure plays

~ Gabriel Sherman, "The Catastrophe Capitalist," New York Magazine, December 7, 2008

Dec 9, 2008

BusinessWeek on billionaire Kirk Kerkorian's ill-fated bets on Ford Motor and Las Vegas

~ BusinessWeek, "Kerkorian's Other Problem," October 22, 2008 (Nov. 3 issue)

BusinessWeek on hedge fund dumping of leveraged loans

Highland Capital Management, a $38 billion money-management shop that invested heavily in this arena, has been among the most aggressive sellers of leveraged loans. Highland declined to comment.

The sell-off by hedge funds and other investors is depressing loan prices. In recent weeks the value of the typical loan, according to research firm Standard & Poor's LCD, quickly dropped from 85¢ on the dollar to just 66¢, a deeply distressed price usually reserved for companies that are in bankruptcy. (Historically, investors have recovered 70¢ on the dollar when a company defaults.)

Yet few of the companies whose loans are trading near those prices, including utility TXU Energy and credit-card processor First Data, are in such dire straits. "The loan market is a very funny place right now," says David Ford, a founding member of Latigo Partners, a hedge fund that buys distressed investments. "It's not being driven by fundamental forces."

In essence, the market is suggesting that owners of such securities won't get their money back. That unlikely scenario has some market observers scratching their heads. In the event of bankruptcy, investors in leveraged loans are the first to be repaid, outranking other holders of corporate debt and stock. And many companies today have more than enough assets on hand to make their loan investors whole. For example, Tennessee-based Community Health Systems (CYH), whose loans are selling for roughly 75¢ on the dollar, has $9 billion in assets, far more than its $6 billion in loans.

~ BusinessWeek, "The Hedge Fund Contagion," October 22, 2008 (Nov 3. issue)

Richard Kovacevich on bailouts and who should be first in line

A: It's important to invest in the banks because banks are the grease that keeps the real economy moving. If there is no financing available for corporations, for consumers, for municipalities, if that does not exist, then no industry can be successful, right? You've got to have that backbone. And that's what you have to do first. Who else you do it with, or for, is for other people to decide. But I think almost everyone agrees, until you fix the financial system, helping others won't make a difference.

~ Richard Kovacevich, CEO, Wells Fargo, "Wells Fargo's Kovacevich: The Importance of Hitting Bottom," BusinessWeek, October 22, 2008 (Nov. 3 issue), interview with Maria Bartiromo

Richard Kovacevich on Wells Fargo's financial strength

A: We just didn't make some of the mistakes that others did. We still made some mistakes, and that's very unfortunate. In some cases, we should have known better. In general—and I don't know if I take much pride in this—we're probably the least ugly of the ugly ducks because we did not participate in some of the excesses, particularly related to subprime borrowers and [collateralized debt obligations] and highly leveraged loans.

~ Richard Kovacevich, CEO, Wells Fargo, "Wells Fargo's Kovacevich: The Importance of Hitting Bottom," BusinessWeek, October 22, 2008 (Nov. 3 issue), interview with Maria Bartiromo

Richard Kovacevich (Wells Fargo's CEO) on deleveraging

~ Richard Kovacevich, CEO, Wells Fargo, "Wells Fargo's Kovacevich: The Importance of Hitting Bottom," BusinessWeek, October 22, 2008 (Nov. 3 issue), interview with Maria Bartiromo

Neel Kashkari on stemming the credit crisis

~ Neel Kashkari, oversees the US Treasury’s $700 billion financial-rescue plan, "Kashkari defends $700-billion financial rescue plan," Bloomberg, December 8, 2008

Neel Kashkari on managing the TARP

We're not day traders, and we're not looking for a return tomorrow. Over time, we believe the taxpayers will be protected and have a return on their investment.

~ Neel Kashkari, the director of Treasury's Office of Financial Stability, which oversees the $700 billion financial rescue fund, "U.S. taxpayers will see a return from bailout," AP, December 5, 2008

(The Treasury Department has received preferred stock and warrants to buy additional shares in return for the $150 billion it has invested so far in 52 banks, including Bank of America Corp, Citigroup Inc and JPMorgan Chase & Co Inc. But an Associated Press analysis yesterday showed that the warrants to purchase about 1.2 billion additional shares in those banks have so far lost about one-third of their value.)

Nassim Taleb on deflation and Henry Paulson

~ Nassim Taleb, "A conversation about economics with Nassim Taleb," Charlie Rose, December 3, 2008

Nassim Taleb on hedge funds

~ Nassim Taleb, "A conversation about economics with Nassim Taleb," Charlie Rose, December 3, 2008

Hiromasa Nakamura on deflation

~ Hiromasa Nakamura, a senior investor in Tokyo at Mitsubishi UFJ Trust & Banking Corp., "Obama Bonds to Give Buyers Taste of Japan Lost Decade," Bloomberg.com, December 8, 2008, by Wes Goodman

Wan-Chong Kung on deflation

~ Wan-Chong Kung, who helps oversee $76 billion in fixed income as a money manager at FAF Advisors Inc. in Minneapolis, the asset-management arm of U.S. Bancorp, "Obama Bonds to Give Buyers Taste of Japan Lost Decade," Bloomberg.com, December 8, 2008, by Wes Goodman

Ken Heebner on the credit crunch

~ Ken Heebner, "Heebner the Contrarian," The Wall Street Journal, December 6, 2008, by Diya Gullapalli

(About 40% of Heebner's $4.3 billion CGM Focus Fund was in financial stocks as of Sept. 30, according to its portfolio report.)

Dec 7, 2008

Mark Cuban on the need for public works

Instead, having the government spend money on public works, which in turn creates jobs, will have a quick and positive economic impact. As much as it pains me to write those words, a drowning economy can’t worry about its form as it tries to get back to the surface. Sometimes you have to win ugly.

Private money is going to stay on the sidelines because we all know that there are unbelievable bargains available out there. Our money is waiting to go to equity and debt where we think we will get outsized returns. If and when those returns happen, money will come back in as new capital investment. Until then, the only liquid investor willing to put non current assets on their balance sheet is the government.

My little idea on where the government should spend money in public works projects?

Parks and Schools.

~ Mark Cuban, "Public Works, The Inauguration, and the next BailOut Scandal," blog maverick, November 28, 2008

Dec 5, 2008

Sean Duffy on auto bailouts, failure, and the ultimate Christmas present

I would like GM, Ford, & Chrysler to close for good. No more bailouts and sorry litanies about how important these assholes are to the economy.(They are a huge liability.) My impression of the domestic auto industry is like looking into a black hole. Resources get poured in with no return .... never to be seen or heard from again.

Eliminating the so called domestic auto industry by letting them fail....

Now THAT's a Christmas present!

~ Sean Duffy, December 5, 2008

Joshua Powell on the Skyscraper Index

~ Joshua Powell, "The Dollar and the Tower Get in Bed," LewRockwell.com, December 5, 2008

Mark Zandi on the policy response to recession

Dec 4, 2008

Bill Miller on a miserable 2008

~ Bill Miller, portfolio manager, Legg Mason Value Trust, ""Bottom's been made" in stocks: Legg Mason's Miller," December 3, 2008

(For the year, Miller's flagship Value Trust (LMVTX) fund was down 59.7 percent as of Tuesday, compared to a 41 percent decline in the reinvested returns of the S&P 500 index, according to Lipper Inc., a unit of Thomson Reuters.

Performance over the year-to-date, one-, three- and five-year periods for Value Trust put it at the bottom of the barrel among its peers, Lipper data shows.)

Dec 3, 2008

Johnny Kramer on the persecution of Plaxico Burress for shooting himself in the leg

The despicable treatment by the State of Burress, and the equally despicable threatening of those who went out of their way to help him with his accidental injury, is another example of the State's hegemonic relationship with the people it "serves," as Butler Shaffer has quipped, "the way a cannibal 'serves' his neighbor."

In a free society, Burress would be responsible for paying his hospital bill and for any damage to the nightclub, after which he could put the whole unpleasant accident behind him and get on with his life.

Instead, the State is going to ruin Burress' career and life, and cause unspeakable anguish for his loved ones, by locking him in a cage inside a socialist hellhole for a "crime" that hurt no one except for himself – and even that, just barely. The only victim in this "crime" is Burress.

~ Johnny Kramer, "The Persecution of Plaxico Burress," LewRockwell.com, December 3, 2008

Sheldon Richman on national pride

But for that very reason, so much about “America” deserves not love or pride but contempt. From the start, people in power have sought to nullify the ideals that distinguished America from other countries. The record of U.S. interventionist foreign policy, which has required coercion of the American people and others, is a record of shame. American presidents have supported and even installed dictators to advance the U.S. government’s imperial agenda. Their military policy has regarded civilian lives as expendable in the pursuit of an international regime amenable to the American ruling elite’s mercantile interests. Of course, that was justified as spreading freedom and democracy, a charade that fooled far more Americans than foreigners.

Domestically, freedom and free enterprise have taken back seats to other objectives, such as economic stability or national security. Capitalism in practice has meant a system of mercantilist privilege for wealthy interests, with harmful consequences at home and abroad. That is not something to be proud of. It is something to be condemned.

~ Sheldon Richman, "How Can You Love a Country?," Freedom Daily, December 3, 2008

Sheldon Richman on conservatives and nationalism

That conservatives relish almost any foreign activism shows how un-Jeffersonian they are. They are nationalists and state-worshipers. For them, to love America is to love the government (at least if it is run by one of their own) because it is the government that embodies the nation and the nation is great and deserving of reverence.

~ Sheldon Richman, "How Can You Love a Country?," Freedom Daily, December 3, 2008

Dec 2, 2008

Benjamin Franklin on virtue and freedom

~ Benjamin Franklin

|

| Benjamin Franklin 1847 |

Alexis de Tocqueville on individual rights

~ Alexis de Tocqueville, Democracy in America (1835)

Ron Paul on capitalism

~ Ron Paul

Nov 29, 2008

Mary Shafer on security

~ Mary Shafer, NASA engineer

Madonna on ambition

~ Madonna

Nov 28, 2008

Dr. Johnson on learning the truth

~ Samuel Johnson (1709-1784)

Nov 25, 2008

Marc Faber on propping up failed enterprises

~ Marc Faber, Bloomberg TV, November 25, 2008

Jim Rogers on how the financial system needs to allow failure

Why are we bailing out Citibank? Why are 300 million Americans having to pay for Citibank's mistakes? The way the system is supposed to work... People fail, and then the competent people take over the assets from the failed people and you start again from a new, stronger base. What we're doing this time is they're taking the assets from the competent people, giving them to the incompetent people, and saying, "Ok, now you can compete with the competent people." So everybody's weakened. The whole nation is weakened. The whole economy's weakened. That's not the way it's supposed to work.

There are many banks, many brokers, many homeowners, many citizens who've been sitting there, doing what they were supposed to do, minding their manners, not getting extended, waiting for this to happen, knowing that someday all of this foolishness is going to wind up as a disaster. Now, instead of being rewarded, they're being punished. All these homeowners who did nothing wrong are now having to pay for the people who did crazy things like buying four homes with no job. This is weakening America dramatically.

~ Jim Rogers, Bloomberg TV, November 24, 2008

Stephanie Pomboy on how the TARP is encouraging the banks to drag their feet on deleveraging

The upshot is that while hedge fund deleveraging is nearly complete, as implied by the massive reduction in total spec positions in any number of markets (like currencies), banks haven’t even begun.

~ Stephanie Pomboy, "Send in the Clowns," MacroMavens, November 20, 2008

Report from Iron Mountain and stabilizing society

~ Leonard Lewin, editor, Report from Iron Mountain, as quoted by G. Edward Griffin, The Creature from Jekyll Island, page 517. Griffin has this to say about the origins of the report - "Although the origin of the report is highly debated, the document itself hints that it was commissioned by the Department of Defense under Defense Secretary Robert McNamara and was produced by the Hudson Institute located at the base of Iron Mountain in Croton-on-Hudson, New York. The Hudson Institute was founded and directed by Herman Kahn, formerly of the Rand Corporation. Both McNamara and Kahn were members of the CFR."

Alan Greenspan on the cause of the Great Depression

~ Alan Greenspan as quoted by G. Edward Griffin, The Creature from Jekyll Island, page 474

The Club of Rome on pollution and global warming

~ Alexander King and Bertron Schnieder, The First Global Revolution, a Report by the Council of the Club of Rome, as quoted by G. Edward Griffin, page 528

Ron Paul and Lewis Lehrman on the Progressive Era

~ Ron Paul and Lewis Lehrman, as quoted in G. Edward Griffin, The Creature of Jekyll Island, page 434

John D. Rockefeller on competition

~ John D. Rockefeller, as quoted by G. Edward Griffin in The Creature from Jekyll Island, page 434

Andrew Jackson in vetoing the charter for the Second Bank of the United States

~ Andrew Jackson, as quoted in G. Edward Griffin, The Creature from Jekyll Island, page 350

Thomas Jefferson on banking and paper money

~ Thomas Jefferson, as quoted in G. Edward Griffin, The Creature from Jekyll Island, page 338

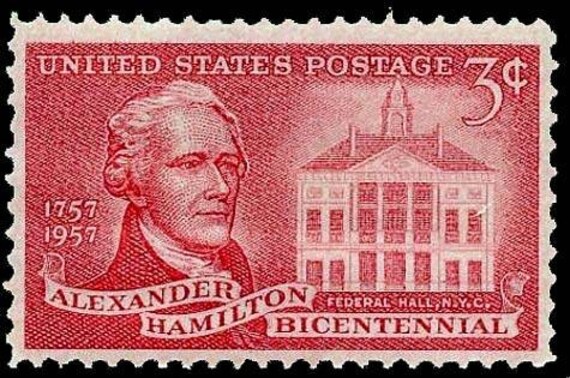

Alexander Hamilton on Fiat Money

~ Alexander Hamilton, as quoted in G. Edward Griffin, The Creature from Jekyll Island, page 316

|

| Alexander Hamilton Bicentennial 1757-1957 |

Paul Kasriel on the Troubled Asset Relief Program (TARP)

~ Paul Kasriel, chief economist, Northern Trust, "U.S. Pledges Top $7.7 Trillion to Ease Frozen Credit ," Bloomberg.com, November 24, 2008

Ben Bernanke on the Troubled Asset Relief Program (TARP)

~ Ben Bernanke, Federal Reserve chairman, talking before the House Financial Services Committee, November 18, 2008

(Quote sited in "U.S. Pledges Top $7.7 Trillion to Ease Frozen Credit ," Bloomberg.com, November 24, 2008.)

Nov 23, 2008

John Maynard Keynes on economic stimulus

~ John Maynard Keynes, The General Theory of Employment, Interest and Money (1936), p. 129

Nov 22, 2008

Rich Tucker on auto industry subsidies

Washington wouldn’t be the first capitol to pour taxpayer capital into the automotive business. In the 1970s and ’80s, the British government took an ownership stake in British Leyland. Before all was said and done, the government had spent $16.5 billion in inflation-adjusted money on the company, which ended up folding, anyway.

“I’m not telling the U.S. what to do, but the lessons of the British experience is don’t throw good money after bad,” Leon Brittan, an aide to former Prime Minister Margaret Thatcher, told The New York Times. “British Leyland carried on for a few more years, but they’re not there now, are they?”

Under government ownership, British cars were notoriously bad. We could expect the same thing here, once members of Congress are acting as automotive engineers. If you thought federal regulations hampered car makers, wait until the government’s in the room during the design process.

~ Rich Tucker, "Driven to Destruction," Townhall.com, November 21, 2008

Nov 20, 2008

Charles Gasparino on the securities industry

~ Charles Gasparino, CNBC, November 20, 2008

Kevin Duffy on the lesson of the collapses of Fannie Mae and Freddie Mac

~ Kevin Duffy, Bearing Asset Management, November 20, 2008

Nov 18, 2008

Robert Prechter on credit expansion

~ Robert Prechter, Conquer the Crash, p. 105

Nov 17, 2008

Kevin Duffy on bubbles

- Parabolic rise in prices and/or related metrics

- Valuations that detach from underlying fundamentals

- Broad public participation (subjective and can vary from a narrow company- or industry-specific bubble to a full-blown mania)

- Rationalizations for the boom and/or high valuations continuing (“it’s different this time”)

The bubble can manifest itself in price (e.g., tech, Internet and growth stocks in 2000) or earnings (e.g., homebuilding stocks in 2005, credit-related stocks in 2007, commodity-related stocks in 2008). One should also see signs that economic actors are changing their behavior (e.g., demand destruction, college students flocking to an industry, families melting down their silverware, criminals stealing D-RAM chips, etc.). The ultimate test of a bubble is after the fact: in real terms all of the gains of the bubble period are wiped out.

~ Kevin Duffy, Bearing Asset Management, November 17, 2008

Ron Paul on freedom's last line of defense

~ Ron Paul, The Revolution: A Manifesto (2008)

Nov 16, 2008

Herbert Hoover jawboning business to keep people employed and factories running

~ President Herbert Hoover, shortly after the '29 crash

(Quote sited by Martin D. Weiss, "Why Washington Cannot Prevent Depression," Money and Markets, November 10, 2008.)

Nov 14, 2008

Kevin Duffy on hedge funds

~ Kevin Duffy, Bearing Asset Management, November 14, 2008

Nov 12, 2008

Henry Paulson on TARP changes

~"Paulson Shifts Focus of Rescue to Consumer Lending", Bloomberg, November 12, 2008

Mark Hulbert on how the doomsayers got it wrong in 2008

Just ask Harry Schultz. Or Howard Ruff. Or Jim Dines.

All three advisers, each of whom has been editing an investment newsletter at least since the 1970s, have built their investment careers by questioning conventional wisdom's trust in the soundness of the financial system. Not surprisingly, all three have been vociferous champions of gold and other precious metals.

You'd think that they would have cleaned up over the last year, since the disintegration of the financial system in recent months is almost exactly what they have been warning us about for decades.

But you'd be wrong.

Of the 181 newsletters on the Hulbert Financial Digest's monitored list, these three advisers' newsletters are in 173rd, 175th, and 176th places for year-to-date performances through October 31, with losses ranging from minus 64.9% to minus 70.0%.

~ Mark Hulbert, "Getting it right and still losing," MarketWatch, November 12, 2008

Nov 10, 2008

Ken Fisher on solving the credit crunch (he failed to see coming)

The other thing you do [is] manipulate, planfully, the spread between the discount rate, the Fed funds rate, and the T-bill rate…The way to end the liquidity crisis is to drop the discount rate relative to the Fed fund rate, which then motivates banks which are troubled to go to the discount window, plead baby shoes, get cheap money at the discount window, and then turn their rear ends around and lend it out at the Fed fund market rate because it’s free money. You borrow at the discount window cheap, you lend it to the safest bank you know, and now that bank has excess reserves, and they lend it out. The way the Fed has always unlocked liquidity freezes is to increase the spread between the discount rate and the fund rate. If you want to get more extreme, drop the discount rate below the T-bill rate, and now you have a riskless transaction.

~ Ken Fisher, "Catching Up With: Ken Fisher," Investment Adviser, November 1, 2008, by James J. Green

Ken Fisher on the credit crunch

~ Ken Fisher, "Catching Up With: Ken Fisher," Investment Adviser, November 1, 2008, by James J. Green

Nov 8, 2008

Murray Rothbard on the source of the business cycle and how to end a depression

~ Murray Rothbard, "Economic Depressions: Their Cause and Cure," 1969

Ludwig von Mises on the futility of attempting to emerge from an economic crisis through interventionist measures

~ Ludwig von Mises, The Causes of the Economic Crisis (1931)

Heritage Auction Galleries: Aluminum was once a precious metal

~ Heritage Auction Galleries, September 20, 2008

Nov 5, 2008

Emma Goldman on the right to vote

~ Emma Goldman

Nov 3, 2008

Laurence Fink: "We are trading liquidity for illiquidity" (2007)

~ Laurence D. Fink, CEO, BlackRock, FT.com, April 26, 2007

Nov 2, 2008

Ed Yardeni: "Greatest global boom of all time" (2006)

It's better than Goldilocks quite honestly. This is the greatest global boom of all time.

~ Ed Yardeni, Oak Investments, as appeared on CNBC, October 18, 2006

Art Laffer: "It's a beautiful economy" (2006)

Art Laffer, as appeared on CNBC, November 15, 2006

Jason Trennert: Nervousness is "good news from a contrarian standpoint" (2006)

Jason Trennert, as appeared on CNBC, October 17, 2006

Abby Joseph Cohen: Economic slowdown good for investors (2006)

~ Abby Joseph Cohen, as appeared on CNBC, October 17, 2006

Oct 31, 2008

Andrew Horowitz on bailout money going towards year-end bonuses

There are many feathers in a ruffle over this and New York Attorney General Andrew Cuomo and several congressmen are furious that over $20 billion has already been earmarked as bonus funds for management and employees. Unbelievably, that is just the estimates from Goldman Sachs, Morgan Stanley and Merrill Lynch. There are six more banks that are also working on similar heists.

~ Andrew Horowitz, "$50 billion of bailout going to employee bonuses," MSN.Money Blog, October 31, 2008

AEI's Desmond Lachman on the housing bust

~ Desmond Lachman, American Enterprise Institute, "Nev., Mich., Fla. lead ‘underwater’ homes list; New report underscores staggering depth of U.S. housing recession," msnbc.com, October 31, 2008

Oct 30, 2008

Bill Laggner on hedge funds, SEC disclosure fight

~ Bill Laggner, "Hedge funds gird for SEC disclosure fight," Forbes.com, October 3, 2008

Oct 29, 2008

Friedrich Hayek on class exploitation

~ Friedrich A. Hayek, The Road to Serfdom, page 129

Oct 27, 2008

Karen De Coster on Warren Buffett, stock tout

~ Karen De Coster, "Warren Buffett, Government Propagandist," LewRockwell.com, October 23, 2008

Citadel's Ken Griffin on market sentiment

Ken Griffin, founder, Citadel Investment Group, "Citadel's Griffin says firm will change amid turmoil," MarketWatch, October 27, 2008

Despite big losses from Citadel's main hedge fund this year, Griffin said that the recent turmoil has created the best opportunities he's seen since he started trading roughly 20 years ago:

"We're very excited about the positions in our portfolio in the months and years ahead."

(Citadel's largest hedge fund, known as Kensington/Wellington, fell 35% this year, through Oct. 17, according to Chief Operating Officer Gerald Beeson.)

Noriel Roubini on the need for fiscal stimulus to prevent a financial meltdown

Since the private sector is not spending, and since the first fiscal stimulus plan (tax rebates for households and tax incentives to firms) failed miserably as households and firms are saving rather than spending and investing, it is necessary now to boost public consumption of goods and services via a massive spending program (a $300 billion fiscal stimulus).

The U.S. government should have a plan to immediately spend on infrastructure and new green technologies; also unemployment benefits should be sharply increased, together with targeted tax rebates only for lower income households at risk; and federal block grants should be given to state and local government to boost their infrastructure spending (roads, sewer systems, etc.). If the private sector does not or cannot spend, old-fashioned, traditional Keynesian spending by the government is necessary. It is true that the U.S. already has large and growing budget deficits; but $300 billion of public works is more effective and productive than spending $700 billion to buy toxic assets.

… Radical action can – and should – be taken to control the damage and prevent this meltdown from occurring.

~ Nouriel Roubini, "The New New Deal," Forbes.com, October 9, 2008

Nouriel Roubini on the need for monetary stimulus to stop the bleeding in world markets

~ Nouriel Roubini, "The New New Deal," Forbes.com, October 9, 2008

Oct 26, 2008

Thomas Jefferson on public debt

To preserve our independence we must not let our rulers load us with perpetual debt... We must make our choice between economy and liberty or profusion and servitude.

~ Thomas Jefferson

|

| Thomas Jefferson 1873 |

Presidents

- Washington, George (1789-1797)

- Adams, John (1797-1801)

- Jefferson, Thomas (1801-1809)

- Madison, James (1809-1817)

- Monroe, James (1817-1825)

- Adams, John Quincy (1825-1829)

- Jackson, Andrew (1829-1837)

- Van Buren, Martin (1837-1841)

- Harrison, William Henry (1841-1841)

- Tyler, John (1841-1845)

- Polk, James K. (1845-1849)

- Taylor, Zachory (1849-1859)

- Fillmore, Millard (1850-1853)

- Pierce, Franklin (1853-1857)

- Buchanan, James (1857-1861)

- Lincoln, Abraham (1861-1865)

- Johnson, Andrew (1865-1869)

- Grant, Ulysses S. (1869-1877)

- Hayes, Rutherford B. (1877-1881)

- Garfield, James A. (1881-1881)

- Arthur, Chester A. (1881-1885)

- Cleveland, Grover (1885-1889)

- Harrison, Benjamin (1889-1893)

- Cleveland, Grover (1893-1897)

- McKinley, William (1897-1901)

- Roosevelt, Theodore (1901-1909)

- Taft, William Howard (1909-1913)

- Wilson, Woodrow (1913-1921)

- Harding, Warren G. (1921-1923)

- Coolidge, Calvin (1923-1929)

- Hoover, Herbert (1929-1933)

- Roosevelt, Franklin D. (1933-1945)

- Truman, Harry S. (1945-1953)

- Eisenhower, Dwight D. (1953-1961)

- Kennedy, John F. (1961-1963)

- Johnson, Lyndon B. (1963-1969)

- Nixon, Richard (1969-1974)

- Ford, Gerald (1974-1977)

- Carter, Jimmy (1977-1981)

- Reagan, Ronald (1981-1989)

- Bush, George H.W. (1989-1993)

- Clinton, Bill (1993-2001)

- Bush, George W. (2001-2009)

- Obama, Barack (2009-17)

- Trump, Donald (2017-

Cicero on public debt

Cicero, 63 BC

Oct 25, 2008

Forbes: Philip Fisher as growth investor and pioneer in qualitative analysis

Although Fisher focused on the qualitative characteristics of a company, he was first and foremost a growth stock investor. He felt the greatest investment returns did not come from the purchase of stocks that were undervalued, since a stock that is undervalued by as much as 50% would only double in price to reach fair market value.

Instead, he sought much higher returns from those companies that could achieve growth in sales and profits greater than the overall market over a long period of time. Furthermore, Fisher did not seek companies showing promise of short-term growth due to cyclical events or one-time factors. He felt that the timing was too risky and the promised returns too small.

~ Forbes, "Ken Fisher's Dad's Lucky 13," October 20, 2008, by Wayne A. Thorpe

Oct 21, 2008

Saint Augustine on government and criminality

~ Saint Augustine of Hippo in The City of God against the Pagans, in th early 5th century

Oct 15, 2008

Alan Greenspan on the gold standard, savings and inflation

~ Alan Greenspan, Federal Reserve Chairman (1987-2006), in 1966