The greatest threat facing America today is not is not terrorism, or foreign economic competition, or illegal immigration. The greatest threat facing America today is the disastrous fiscal policies of our own government, marked by shameless deficit spending and Federal Reserve currency devaluation. It is this one-two punch - Congress spending more than it can tax or borrow, and the Fed printing money to make up the difference - that threatens to impoverish us by further destroying the value of our dollars.

~ Congressman Ron Paul, April 10, 2007

Mar 31, 2008

Ron Paul on the economic crisis

Make no mistake, the problems faced by the American people are not caused by unscrupulous mortgage brokers or the rising price of oil. These are symptoms of an economic disease caused by a spendthrift Congress enabled by loose monetary policy.

~ Congressman Ron Paul, November 3, 2007

~ Congressman Ron Paul, November 3, 2007

Thomas Jefferson on power

I hope our wisdom will grow with our power, and teach us that the less we use our power, the greater it will be.

~ Thomas Jefferson

~ Thomas Jefferson

|

| Thomas Jefferson 1965-1968 |

Thomas Jefferson on the nanny state

I predict future happiness for Americans if they can prevent the government from wasting the labors of the people under the pretense of taking care of them.

~ Thomas Jefferson

~ Thomas Jefferson

Labels:

nanny state,

people - Jefferson; Thomas,

security

Jeff Tucker on politicians vs. entrepreneurs

To compare politicians with entrepreneurs is like comparing two runners in a race, one who stands at the starting line and makes a speech, and another who runs the full distance around the track without saying a word.

~ Jeffrey Tucker, "Politicians Promise; Enterprise Delivers," InsideCatholic.com, March 4, 2008

~ Jeffrey Tucker, "Politicians Promise; Enterprise Delivers," InsideCatholic.com, March 4, 2008

Labels:

entrepreneurs,

people - Tucker; Jeffrey,

politicians

Mar 30, 2008

Bill Bonner on the historical shift to neoconservatism

After the war [World War II], there was no going back. America was the leading world power. "Isolationism" became a kind of insult. A few of the old conservatives – such as Frank Chodorov, Robert Taft and Warren Buffett's father, a US Congressman – kept wearing their old starched collars. But the fashion had clearly changed. They could vote against government spending programs...and they opposed further military adventures abroad... but they couldn't win national elections and they couldn't participate in the great fun of having an empire – getting to boss people around all over the world. There was no glory in being a conservative. No power. No money. No style.

Then, with the Cold War, even the old die-hards went shopping for new clothes. In their minds, it was a contest between good and evil...freedom and communism...black and white.

Indeed, the Cold War played roughly the same roll as the War on Terror would half a century later – it perverted the old conservative values.

"We are again being told to be afraid," wrote Frank Chodorov. "As it was before the two world wars so it is now; politicians talk in frightening terms, journalists invent scare-lines, and even next-door neighbors are taking up the cry: the enemy is at the city gates; we must gird for battle. In case you don't know, the enemy this time is the USSR."

Few Americans had even met a communist, but they were certain that if they didn't go toe to toe with them in places like Korea, Berlin and Vietnam, they'd soon be stealing the family silver in Dubuque. The urbane, witty, charming and cosmopolitan William F. Buckley:

The "invincible aggressiveness of the Soviet Union" imminently threatens the United States, he said. "We have to accept Big Government for the duration – for neither an offensive nor a defensive war can be waged...except through the instrument of a totalitarian bureaucracy within our shores."

And thus was the fabric laid out...cut and sewn...for America's new conservative outfits. Now, they could fight totalitarians by being totalitarians.

~ Bill Bonner, "Listening to Bill Buckley Give a Speech Was a Painful Experience," LewRockwell.com, March 27, 2008

Then, with the Cold War, even the old die-hards went shopping for new clothes. In their minds, it was a contest between good and evil...freedom and communism...black and white.

Indeed, the Cold War played roughly the same roll as the War on Terror would half a century later – it perverted the old conservative values.

"We are again being told to be afraid," wrote Frank Chodorov. "As it was before the two world wars so it is now; politicians talk in frightening terms, journalists invent scare-lines, and even next-door neighbors are taking up the cry: the enemy is at the city gates; we must gird for battle. In case you don't know, the enemy this time is the USSR."

Few Americans had even met a communist, but they were certain that if they didn't go toe to toe with them in places like Korea, Berlin and Vietnam, they'd soon be stealing the family silver in Dubuque. The urbane, witty, charming and cosmopolitan William F. Buckley:

The "invincible aggressiveness of the Soviet Union" imminently threatens the United States, he said. "We have to accept Big Government for the duration – for neither an offensive nor a defensive war can be waged...except through the instrument of a totalitarian bureaucracy within our shores."

And thus was the fabric laid out...cut and sewn...for America's new conservative outfits. Now, they could fight totalitarians by being totalitarians.

~ Bill Bonner, "Listening to Bill Buckley Give a Speech Was a Painful Experience," LewRockwell.com, March 27, 2008

Mar 29, 2008

Lily Hamourtziadou on civilian casualties in the Iraq War

We, who have lost very little, who have sacrificed very little, who have paid very little,... we continue to speak of ‘our’ war, of ‘our’ fight against the terrorists, ‘our’ ideals, ‘our’ kindness, ‘our’ courage; things that we value far more than the lives of millions of others, people whose deaths do not hurt us, whose loss does not affect us, and whose sacrifice we do not see bloodying our own hands.

~ Lily Hamourtziadou, "The Price of Loss: How the West Values Civilian Lives in Iraq," IraqBodyCount.org, November 12, 2007

~ Lily Hamourtziadou, "The Price of Loss: How the West Values Civilian Lives in Iraq," IraqBodyCount.org, November 12, 2007

Mar 28, 2008

Haley Barbour on the economy: Expect a "brief, shallow downturn"

We've actually had a very good economy for the last 25 years. Now we've had an event in the credit markets where, candidly, some of the most respected financial institutions in America created a bunch of investment vehicles they didn't really understand. That concerns me, and I think it will cause a brief, shallow downturn. But when we are talking about a recession with 5% unemployment—if in fact we have a recession—that is starting from an awfully strong economic position. President Bush has proposed the right kind of remedies, and, in fairness, the Democrats in Congress have embraced them, too.

~ Haley Barbour, Republican governor of Mississippi, "Haley Barbour: The GOP Insider on Election 2008," BusinessWeek, February 25, 2008

~ Haley Barbour, Republican governor of Mississippi, "Haley Barbour: The GOP Insider on Election 2008," BusinessWeek, February 25, 2008

Carl Weinberg on monetary stimulus: "Give the Fed an A for effort"

You have to look at of the impact on the financial markets and then on the economy. This crisis is something we've never seen before. What the Fed is doing is a good idea; it's a good try. It aims to affect the part of the economy that is hurting the most, namely asset-backed securities. So I give the Fed an A for effort. The big negative is that it transfers the credit risk of these securities from the private sector to the Fed's balance sheet, and some people believe that is a bad thing. My own view is that the Federal Reserve is doing its job as the lender of last resort in the financial system, which is stuck and can't lend to itself.

~ Carl Weinberg, chief economist, High Frequency Economics, "Coming: Cheaper Oil and a Stronger Buck: Interview with Carl Weinberg," Barron's, March 24, 2008

~ Carl Weinberg, chief economist, High Frequency Economics, "Coming: Cheaper Oil and a Stronger Buck: Interview with Carl Weinberg," Barron's, March 24, 2008

Carl Weinberg on declining profitability among Chinese exporters

[Chinese] companies in the export sector are facing a cost squeeze. They are seeing exports to the U.S., as measured in yuan terms, generating less revenue as the dollar depreciates. They've also seen a rise in labor costs, as well as materials, and they've seen a change in tax policy, which has increased taxes by as much as 7% of their cost of goods sold. Altogether, they are looking at less profitability, and they are dealing with U.S. importers like Wal-Mart and Target, which are insensitive to cost increases and unwilling to give price concessions. As a result, they are being squeezed.

~ Carl Weinberg, chief economist, High Frequency Economics, "Coming: Cheaper Oil and a Stronger Buck: Interview with Carl Weinberg," Barron's, March 24, 2008

~ Carl Weinberg, chief economist, High Frequency Economics, "Coming: Cheaper Oil and a Stronger Buck: Interview with Carl Weinberg," Barron's, March 24, 2008

Mar 27, 2008

Bob Rodriguez sitting on 43% cash

Bob Rodriguez, manager of the $1.9 billion FPA Capital Fund, is 43% in cash, up from 40% more than a year ago.

~ The Wall Street Journal, "Cash-Rich Mutual Funds May Battle Bear," January 19, 2008, by Diva Gullapalli

~ The Wall Street Journal, "Cash-Rich Mutual Funds May Battle Bear," January 19, 2008, by Diva Gullapalli

David Tice on the coming recession or depression

Q: What needs to happen to get us back on track?

A: We're going to have to take some pain. We'll have to reconfigure our economy less towards consumption and more towards manufacturing more products that can be sold abroad. Our standard of living is going to have to come down.

Q: What's the worst-case scenario?

A: The Federal Reserve's policy to always bail out the economy was a big mistake. The dollar is a huge problem because foreigners see us continuing to debase our currency. It's going to be a massive recession if not a depression. The fixes don't really fix anything; they just make it worse.

~ David Tice, "Prudent Bear's Approach Delivers Payoff," WSJ, March 27, 2008

A: We're going to have to take some pain. We'll have to reconfigure our economy less towards consumption and more towards manufacturing more products that can be sold abroad. Our standard of living is going to have to come down.

Q: What's the worst-case scenario?

A: The Federal Reserve's policy to always bail out the economy was a big mistake. The dollar is a huge problem because foreigners see us continuing to debase our currency. It's going to be a massive recession if not a depression. The fixes don't really fix anything; they just make it worse.

~ David Tice, "Prudent Bear's Approach Delivers Payoff," WSJ, March 27, 2008

Malancton Smith on Congress and taxes

Congress will ever exercise their powers to levy as much money as the people can pay. They will not be restrained from direct taxes by the consideration that necessity does not require them.

~ Malancton Smith

~ Malancton Smith

Mar 26, 2008

Patrick Henry on the right to bear arms

The great object is that every man be armed.... Everyone who is able may have a gun.... Are we at last brought to such humiliating and debasing degradation, that we cannot be trusted with arms for our defense?

~ Patrick Henry

Patrick Henry on freedom

Perfect freedom is as necessary to the health and vigor of commerce as it is to the health and vigor of citizenship.

~ Patrick Henry

~ Patrick Henry

|

| Patrick Henry 1954-1968 |

Georges Yared sees Google stock hitting 1,200 in 2009 (2007)

[Google's] 40%-50% growth rate gives it a category-killer status, so we think the stock will hit 1,200 in 2009. [His bold forecast is based on his 2009 earnings estimate of $29 a share on revenues of $29 billion, up from his 2008 estimate of $21 on $16.8 billion, and 2007's $15.60 on $15.6 billion.]

~ Georges Yared, Yared Investment Research, "After a Long Gallop, Is Google Winded?," BusinessWeek, December 3, 2007, by Gene Marcial

(Of 37 analysts who track Google, 33 tag it a buy. None rates the stock a sell.)

~ Georges Yared, Yared Investment Research, "After a Long Gallop, Is Google Winded?," BusinessWeek, December 3, 2007, by Gene Marcial

(Of 37 analysts who track Google, 33 tag it a buy. None rates the stock a sell.)

Ludwig von Mises on coercion

History has witnessed the failure of many endeavors to impose peace by war, cooperation by coercion, unanimity by slaughtering dissidents.... A lasting order cannot be established by bayonets.

~ Ludwig von Mises, Omnipotent Government (1944)

~ Ludwig von Mises, Omnipotent Government (1944)

Bill Laggner on fundamental analysis

The P&L is the past; the balance sheet is the future.

~ Bill Laggner, Bearing Asset Management, March 26, 2008

~ Bill Laggner, Bearing Asset Management, March 26, 2008

George Washington on arbitary power

Arbitrary power is most easily established on the ruins of liberty abused to licentiousness.

~ George Washington

~ George Washington

Mar 25, 2008

Paul Strebel on wealth management and avoiding bubbles

To be a great wealth manager, you need to err on the side of prudence and forgo the big returns that come from speculating on bubbles.

~ Paul Strebel, chair of the Board of Directors Program at IMD, the Lausanne-based business school, "Behind the Mess at UBS," BusinessWeek, March 3, 2008

~ Paul Strebel, chair of the Board of Directors Program at IMD, the Lausanne-based business school, "Behind the Mess at UBS," BusinessWeek, March 3, 2008

Jeremy Grantham on private equity

Q: I understand you are most concerned with further fallout in the private-equity arena?

A: Yes. I have yet to meet a private-equity firm that put into its spreadsheet the assumption that system-wide profit margins could decline by 20% to 30%. They have taken the current, abnormally high profit margins as a given and then determined to improve them by, let's say, 15% and assume everything works out pretty well.

But if the base declines by 20%, even if they end up improving margins by 15%, they are going backwards. And if they pay the 25% premium up front, which was normal, and if they leverage 4-to-1, which was normal, then they almost precisely wipe out all of the clients' money, all of the 20% in equity and if, perish the thought, they don't add 15%, but add perhaps zero to 5%, then they do more than wipe out the equity, they leave the underlying debt in ragged disarray. That is the next shoe to drop on the credit side.

~ Jeremy Grantham, "This Credit Crisis Has a Long Way to Run," Barron's, February 11, 2008

A: Yes. I have yet to meet a private-equity firm that put into its spreadsheet the assumption that system-wide profit margins could decline by 20% to 30%. They have taken the current, abnormally high profit margins as a given and then determined to improve them by, let's say, 15% and assume everything works out pretty well.

But if the base declines by 20%, even if they end up improving margins by 15%, they are going backwards. And if they pay the 25% premium up front, which was normal, and if they leverage 4-to-1, which was normal, then they almost precisely wipe out all of the clients' money, all of the 20% in equity and if, perish the thought, they don't add 15%, but add perhaps zero to 5%, then they do more than wipe out the equity, they leave the underlying debt in ragged disarray. That is the next shoe to drop on the credit side.

~ Jeremy Grantham, "This Credit Crisis Has a Long Way to Run," Barron's, February 11, 2008

Jeremy Grantham on the twin Greenspan/Bernanke bubbles

Greenspan and Bernanke have taken a hands-off approach for two consecutive great bubbles, first in TMT -- telecommunications, media and technology -- and second, in housing. A hands-off approach is a polite way of saying they facilitated this. And what is the point of a 125-basis-point rate reduction, other than to provide reinforcement for the people who borrow short and lend long? From bankers who have committed every crime you could possibly accuse a banker of, to hedge funds who borrow short, leverage, and invest long in the stock market -- that's who really benefits from the interest-rate reduction. The economy, broadly defined, does not.

~ Jeremy Grantham, "This Credit Crisis Has a Long Way to Run," Barron's, February 11, 2008

~ Jeremy Grantham, "This Credit Crisis Has a Long Way to Run," Barron's, February 11, 2008

Jeremy Grantham on housing prices being tied to median incomes

A: The other near certainty is that house prices will go back to a normal multiple of family income. In the end, we, the people, have to be able to afford the houses and they are affordable at something around 2.8 times family income. When they peak in Boston at 6 times and nationally at 3.9 times, you know you are in for tough times.

Incidentally, it was late in '06 when [Fed Chairman Benjamin] Bernanke said he thought the high prices of homes in the U.S. merely reflected a strong U.S. economy. Was he not looking at the data? Did he not measure long-term house prices? Had he not seen how they ebbed and flowed as a multiple of family income, which they do here and in the U.K. and everywhere else? And with it being so obviously a bubble, how could he have said that?

Q: Where else does this housing crisis lead us?

A: It has a lot to go. It still has to drop 20% to 25% to reach more normal levels, or if you prefer, it could wait five years for income to catch up, barring no big recessions.

~ Jeremy Grantham, "This Credit Crisis Has a Long Way to Run," Barron's, February 11, 2008

Incidentally, it was late in '06 when [Fed Chairman Benjamin] Bernanke said he thought the high prices of homes in the U.S. merely reflected a strong U.S. economy. Was he not looking at the data? Did he not measure long-term house prices? Had he not seen how they ebbed and flowed as a multiple of family income, which they do here and in the U.K. and everywhere else? And with it being so obviously a bubble, how could he have said that?

Q: Where else does this housing crisis lead us?

A: It has a lot to go. It still has to drop 20% to 25% to reach more normal levels, or if you prefer, it could wait five years for income to catch up, barring no big recessions.

~ Jeremy Grantham, "This Credit Crisis Has a Long Way to Run," Barron's, February 11, 2008

Alan Greenspan on the financial crisis

The current financial crisis in the U.S. is likely to be judged in retrospect as the most wrenching since the end of the Second World War. The crisis will leave many casualties.

Alan Greenspan, Former US Federal Reserve chairman, Bloomberg TV, March 17, 2008

Alan Greenspan, Former US Federal Reserve chairman, Bloomberg TV, March 17, 2008

Mar 24, 2008

History of the Middle East: World War I to present

World War I:

- Arab independence movement - Lawrence of Arabia and others

- Political documents - Demascus Protocol (mid-1915), Hussein-McMahon correspondence (July, 1915-January, 1916), Sykes-Picot Agreement (January 3, 1916), Balfour Declaration (November 2, 1917), The Fourteen Points of President Wilson (January 8, 1918), The Four Principles (February 11, 1918), The Four Ends (July 4, 1918)

- The Armistice (November, 1918)

- Paris Peace Conference - Feisel-Weizmann Agreement, King-Crane Commission recommendations, San Remo Conference (April, 1920), Anglo-French Oil Agreement (April, 1920), Treaty of Versailles (June 28, 1920)

- Post-Versailles peace talks - Cairo Conference (March, 1921), Palestine Mandate (July 22, 1922), First Anglo-Iraqi Treaty (October 10, 1922), Second Anglo-Iraqi Treaty (June 30, 1930)

- The Exodus (1945)

- Formation of State of Israel (1948)

- Muhamed Mossadegh - popular election (1951?), CIA-led overthrow (1953?)

- Suez Canal Crisis (1956)

- Ba'th Party coup (1963)

- Iranian hostage crisis (1979)

- 9/11/2001

- Afghanistan War

- Iraq War (2003-present) - weapons of mass destruction (WMDs)

- war on terror

- neoconservative movement

Charley Reese on the 5-year anniversary of the Iraq War

We have passed the five-year anniversary of George W. Bush's bungled war in Iraq. What has it gained the American people? I'm afraid the answer is nothing. Let's look at the accomplishments.

We delivered a new ally to Iran. We lost nearly 4,000 American lives and suffered another 29,000 wounded. We spent $400 billion, by Pentagon accounting. We increased the federal deficit to $9 trillion. We've made the Middle East more, not less, unstable. American prestige is in the trash can. Oil is more than $100 a barrel. The military is strained to the breaking point, so we are now recruiting high-school dropouts and people with criminal records. The American economy is on the tipping point of disaster. Bush's disapproval rating is at 65 percent.

~ Charley Reese, "The Bungled War," LewRockwell.com, March 24, 2008

We delivered a new ally to Iran. We lost nearly 4,000 American lives and suffered another 29,000 wounded. We spent $400 billion, by Pentagon accounting. We increased the federal deficit to $9 trillion. We've made the Middle East more, not less, unstable. American prestige is in the trash can. Oil is more than $100 a barrel. The military is strained to the breaking point, so we are now recruiting high-school dropouts and people with criminal records. The American economy is on the tipping point of disaster. Bush's disapproval rating is at 65 percent.

~ Charley Reese, "The Bungled War," LewRockwell.com, March 24, 2008

Mar 22, 2008

John McCain: Invasion of Iraq "will not be very difficult" (2002)

I am very certain that this military engagement will not be very difficult. It may entail the risk of American lives and treasure, but Saddam Hussein is vastly weaker than he was in 1991. He does not have the support of his people.

And I'd ask one question: What member of the Iraqi army is willing to die for Saddam Hussein when they know he's going to be taken out? So I don't think it's going to be nearly as difficult as some assume.

~ Senator John McCain, as appeared on CNN, September 12, 2002

And I'd ask one question: What member of the Iraqi army is willing to die for Saddam Hussein when they know he's going to be taken out? So I don't think it's going to be nearly as difficult as some assume.

~ Senator John McCain, as appeared on CNN, September 12, 2002

Bill Fleckenstein on Greenspan's attempts to eliminate risk

I know I've said it before, but it bears repeating: Capitalism involves booms and busts. There is a phenomenon known as the business cycle that loosely revolves around those booms and busts. The policies of Greenspan and the Fed suppressed those busts, and "risk" was more or less struck from the lexicon of the English language (while linguists have pronounced "subprime" their word of the year).

Bill Fleckenstein, Contrarian Chronicles, MSN.Money, January 14, 2008

Bill Fleckenstein, Contrarian Chronicles, MSN.Money, January 14, 2008

Mar 21, 2008

Bill Mahar on blowback and the war on terror

You know, we are one terrorist attack away from John McCain I'm sure rising in the polls by ten points because people think, oh, yeah, he is tougher. He is not tougher about the war. He's dumber about the war.

He's dumb about the war because he thinks by keeping troops in the heart of the Muslim world that's going to help the war on terror. That's exactly what started the war on terror. . .

That is why young Muslim men want to come here and blow themselves up and kill us. It is not about what happens in Iraq. We need to get out of Iraq not build bases there.

~ Bill Mahar, as appeared on Hardball with Chris Matthews, March 18, 2008

He's dumb about the war because he thinks by keeping troops in the heart of the Muslim world that's going to help the war on terror. That's exactly what started the war on terror. . .

That is why young Muslim men want to come here and blow themselves up and kill us. It is not about what happens in Iraq. We need to get out of Iraq not build bases there.

~ Bill Mahar, as appeared on Hardball with Chris Matthews, March 18, 2008

Labels:

Iraq War,

people - McCain; John,

war on terror

Glenn Greenwald on media bias in reporting John McCain's foreign policy credentials

The reality is that John McCain's understanding of foreign policy and his approach to national security has proven to be simplistic, destructive and idiotic. Nobody spewed more pre-invasion falsehoods and confused and misleading claims about Iraq than John McCain did. And he's been the Prime Cheerleader for one of the most destructive wars in U.S. history. The notion that he has expertise in foreign policy or sound judgment is a total myth, yet it's one that his press fans accept and enforce as orthodoxy.

McCain's simple-minded militarism, his ignorance about national security, and his moronic view that the U.S. should run the world through endless wars ought to be one of the most intensely debated issues in the campaign. But it won't be because... the media has already decided that McCain is a Serious Expert in these matters and that national security is his strength, and evidence to the contrary won't be reported.

~ Glenn Greenwald, "The media's special relationship with John McCain," Salon.com, March 20, 2008

McCain's simple-minded militarism, his ignorance about national security, and his moronic view that the U.S. should run the world through endless wars ought to be one of the most intensely debated issues in the campaign. But it won't be because... the media has already decided that McCain is a Serious Expert in these matters and that national security is his strength, and evidence to the contrary won't be reported.

~ Glenn Greenwald, "The media's special relationship with John McCain," Salon.com, March 20, 2008

Mar 15, 2008

Former Justice on expanding the Constitution

This Court is forever adding new stories to the temples of constitutional law, and the temples have a way of collapsing when one story too many is added.

~ Former Supreme Court Justice Robert Jackson, who served on the Court from 1941 to 1954

~ Former Supreme Court Justice Robert Jackson, who served on the Court from 1941 to 1954

Mar 13, 2008

Kevin Duffy on persuasion

You can lead a horse to water, but you can't put a gun to its head.

~ Kevin Duffy

~ Kevin Duffy

President George W. Bush on government intervention in the economy

I'm always open for good ideas, but what I'm not open for is a lot of government intervention into our economy that will be counterproductive in the long run.

~ President George W. Bush, interview with Susie Gharib of PBS' "Nightly Business Report,” March 12, 2008 (from "Tough times, but no recession, Bush says," MarketWatch, March 13, 2008, by Rex Nutting)

~ President George W. Bush, interview with Susie Gharib of PBS' "Nightly Business Report,” March 12, 2008 (from "Tough times, but no recession, Bush says," MarketWatch, March 13, 2008, by Rex Nutting)

Mar 11, 2008

Bryn Dolan on Eliot Spitzer's downfall

The irony and the hypocrisy is almost too good to be true. If he had any shame, he would've already resigned.

~ Bryn Dolan, a fundraiser who works with many Wall Street employees, "Spitzer May Have Spent Big on Call Girls," Associated Press, March 11, 2008, by Michael Gormley

~ Bryn Dolan, a fundraiser who works with many Wall Street employees, "Spitzer May Have Spent Big on Call Girls," Associated Press, March 11, 2008, by Michael Gormley

Ken Langone on Eliot Spitzer being implicated in prostitution ring

We all have our own private hells. I hope his private hell is hotter than anyone else's.

~ Ken Langone, as interviewed by CNBC, March 11, 2008

~ Ken Langone, as interviewed by CNBC, March 11, 2008

James Madison on the control of money

History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible, to maintain their control over governments, by controlling money and its issuance.

~ James Madison

~ James Madison

Mar 9, 2008

Michael S. Rozeff on the GSEs: Let them fail

The stock price of Fannie Mae, which almost hit $90 in December of 2000 is down to $22. It fell over 10 percent on March 6 alone. I hope this company goes bankrupt along with Freddie Mac, which is down to $20 after being north of $70 a share. The government has no business butting into the mortgage business, so if Fannie Mae and Freddie Mac fail, good riddance.

Although I’d enjoy seeing a complete debacle occur in these two government-created monsters, quite possibly the government will prevent or otherwise forestall their bankruptcies should they ever be imminent. The government provides no explicit guarantees to these companies, and the companies state that there are no guarantees. Nevertheless, investors have acted as if the companies had some implicit guarantees. They have good reason. Congress clearly wants these companies around so that they can buy up mortgages. The political fallout from their failures would be severe.

Investors therefore have lent money to Fannie Mae and Freddie Mac at (low) rates not in accord with their risk. This has allowed these companies to create and dominate a secondary market in mortgages. They bought up mortgages originated by banks, packaged them up, and resold them... These securities have been turning sour because the mortgages in them are defaulting. As a result, the yields on these debts are running 3 percent higher than Treasury bond yields, as compared with a more typical 1 percent. And even that premium is not as high as other troubled mortgage-related debts.

~ Michael S. Rozeff, "Let the Bankruptcies Roll," LewRockwell.com, March 8, 2008

Although I’d enjoy seeing a complete debacle occur in these two government-created monsters, quite possibly the government will prevent or otherwise forestall their bankruptcies should they ever be imminent. The government provides no explicit guarantees to these companies, and the companies state that there are no guarantees. Nevertheless, investors have acted as if the companies had some implicit guarantees. They have good reason. Congress clearly wants these companies around so that they can buy up mortgages. The political fallout from their failures would be severe.

Investors therefore have lent money to Fannie Mae and Freddie Mac at (low) rates not in accord with their risk. This has allowed these companies to create and dominate a secondary market in mortgages. They bought up mortgages originated by banks, packaged them up, and resold them... These securities have been turning sour because the mortgages in them are defaulting. As a result, the yields on these debts are running 3 percent higher than Treasury bond yields, as compared with a more typical 1 percent. And even that premium is not as high as other troubled mortgage-related debts.

~ Michael S. Rozeff, "Let the Bankruptcies Roll," LewRockwell.com, March 8, 2008

Michael S. Rozeff on reaching for yield

Investors who over-reached for yield and over-reached for yield spreads are learning the hard way that this was a risky policy. When yields on short-term money market funds fell drastically, the number of ultra-short bond funds doubled. These bring in extra current yield by, among other things, investing in mortgage and other asset-backed securities. Although they seem like money-market funds, they are not. A fund like Fidelity’s Ultra-Short Bond Fund maintained a $10 value for over 4 years, only suddenly to drop to $8.61.

~ Michael S. Rozeff, "Let the Bankruptcies Roll," LewRockwell.com, March 8, 2008

~ Michael S. Rozeff, "Let the Bankruptcies Roll," LewRockwell.com, March 8, 2008

Richard Fisher on Fed policy

We reacted with very deliberate actions. That shouldn't lead markets to expectations that we will continue to react in that manner. I would discourage you from thinking that simply because of a significant action in the credit markets, that suddenly we're going to move Fed funds rates in response.

~ "US Fed Pins Economic Hope On $200 billion Liquidity Boost", Telegraph UK, March 9, 2008

~ "US Fed Pins Economic Hope On $200 billion Liquidity Boost", Telegraph UK, March 9, 2008

Mar 8, 2008

Theodore Roosevelt on criticism vs. patriotism

To announce that there must be no criticism of the president, or that we are to stand by the president, right or wrong, is not only unpatriotic and servile, but is morally treasonable to the American public.

~ Theodore Roosevelt, 1918

~ Theodore Roosevelt, 1918

Aldous Huxley on propaganda

In their propaganda today's dictators rely for the most part on repetition, suppression and rationalization – the repetition of catchwords which they wish to be accepted as true, the suppression of facts which they wish to be ignored, the arousal and rationalization of passions which may be used in the interests of the Party or the State.

~ Aldous Huxley, Propaganda in a Democratic Society

~ Aldous Huxley, Propaganda in a Democratic Society

Marechal de Saxe on war

The human heart is the starting point of all matters pertaining to war.

~ Marechal de Saxe, from the Preface of Reveries on the Art of War (1732)

~ Marechal de Saxe, from the Preface of Reveries on the Art of War (1732)

Robert Higgs on the congressional investigation into alleged steroid use of Roger Clemens

Where in the Constitution does it say that Congress may interfere in the internal affairs of a private baseball league or its players? How exactly have these vainglorious congressional publicity hounds come by the idea that their jurisdiction has no limits?

~ Robert Higgs, “There's a Time and a Place for a Beanball” LewRockwell.com, March 3, 2008

~ Robert Higgs, “There's a Time and a Place for a Beanball” LewRockwell.com, March 3, 2008

|

| Centennial of Baseball 1839-1939 |

Mar 6, 2008

Marc Faber on Bernanke's flawed monetary policy

In the U.S., they pursue essentially economic policies that target consumption, which in my opinion is misguided. They should pursue economic policies that stimulate capital investment and capital formation.

~ Marc Faber, "Bernanke Policy to `Destroy' U.S. Dollar," Bloomberg, March 3, 2008

~ Marc Faber, "Bernanke Policy to `Destroy' U.S. Dollar," Bloomberg, March 3, 2008

Lew Rockwell: Cancel the election

[W]e should propose the unthinkable: cancel the election. This has never before been so urgent. Neither party will cut government in a way that is desperately needed. Instead, they offer a left- or right-tinged Americanized socialism or fascism. One promises domestic expansion and foreign reduction; the other promises foreign expansion and domestic reduction. The inevitable compromise: expand both domestically and internationally.

In addition, whatever the new president does will make our growing economic problems worse. The economic interventions they propose will add to our troubles, whether that means expanding inflation, taxes, controls, or debt. Another war is unthinkable, but probably inevitable. You can already detect it in the aggressive trajectory towards Iran. More business regulation can only dampen the fires of free enterprise, which are our saving grace today.

The best solution would be a government that would destroy itself. The second best solution would be a government that does nothing at all – then, at least, matters will not get worse. This is what canceling the election would do. It would introduce enough confusion and chaos to keep government from acting either domestically or internationally, which would be a wonderful thing.

~ Lew Rockwell, "Cancel the Presidential Election!," LewRockwell.com, March 6, 2008

In addition, whatever the new president does will make our growing economic problems worse. The economic interventions they propose will add to our troubles, whether that means expanding inflation, taxes, controls, or debt. Another war is unthinkable, but probably inevitable. You can already detect it in the aggressive trajectory towards Iran. More business regulation can only dampen the fires of free enterprise, which are our saving grace today.

The best solution would be a government that would destroy itself. The second best solution would be a government that does nothing at all – then, at least, matters will not get worse. This is what canceling the election would do. It would introduce enough confusion and chaos to keep government from acting either domestically or internationally, which would be a wonderful thing.

~ Lew Rockwell, "Cancel the Presidential Election!," LewRockwell.com, March 6, 2008

Labels:

elections,

left vs. right,

people - Rockwell; Lew

Patrick Henry on the principles of civilized society

A great part of that order which reigns among mankind is not the effect of government. It had its origin in the principles of society, and the natural constitution of man. It existed prior to government, and would exist if the formality of government was abolished. The mutual dependence and reciprocal interest which man has in man and all the parts of a civilized community upon each other create that great chain of connection which holds it together. The landholder, the farmer, the manufacturer, the merchant, the tradesman, and every occupation prospers by the aid which each receives from the other, and from the whole. Common interest regulates their concerns, and forms their laws; and the laws which common usage ordains, have a greater influence than the laws of government. In fine, society performs for itself almost everything that is ascribed to government.

~ Patrick Henry

~ Patrick Henry

Labels:

anarchy,

government,

people - Henry; Patrick,

society

Mar 5, 2008

Desiderius Erasmus on war

War is sweet to those who don't know it.

~ Desiderius Erasmus, Adagia (1508)

~ Desiderius Erasmus, Adagia (1508)

Mar 4, 2008

Mahatma Gandhi on retribution

An eye for an eye makes the whole world blind.

~ Mahatma Gandhi

~ Mahatma Gandhi

Labels:

forgiveness,

people - Gandhi; Mahatma,

retribution

Mar 3, 2008

Martin Luther on war

War is the greatest plague that can afflict humanity; it destroys religion, it destroys states, it destroys families. Any scourge is preferable to it.

~ Martin Luther, Table-Talk, DCCCXXI (1569)

~ Martin Luther, Table-Talk, DCCCXXI (1569)

George H.W. Bush's famous campaign pledge

Read my lips: No new taxes.

George H.W. Bush, 1988

George H.W. Bush, 1988

Labels:

lies,

people - Bush; George H.W.,

quotes - lies,

taxation

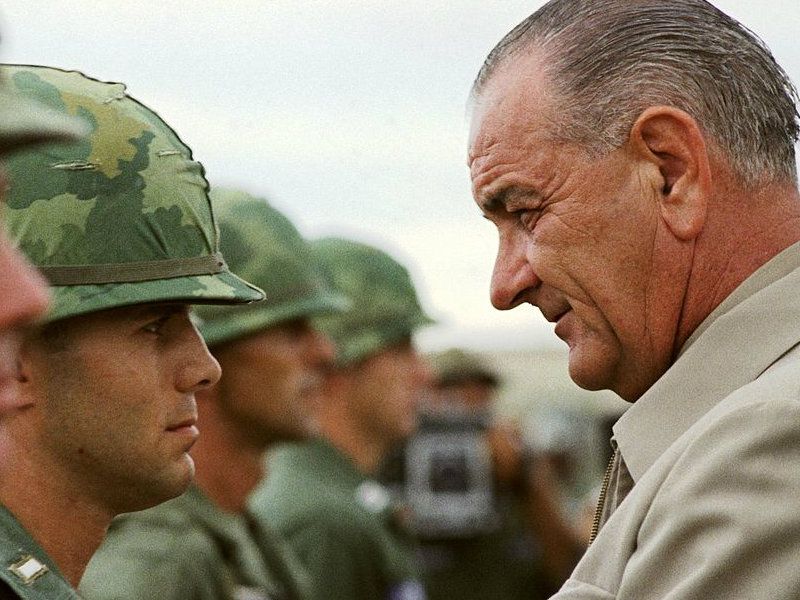

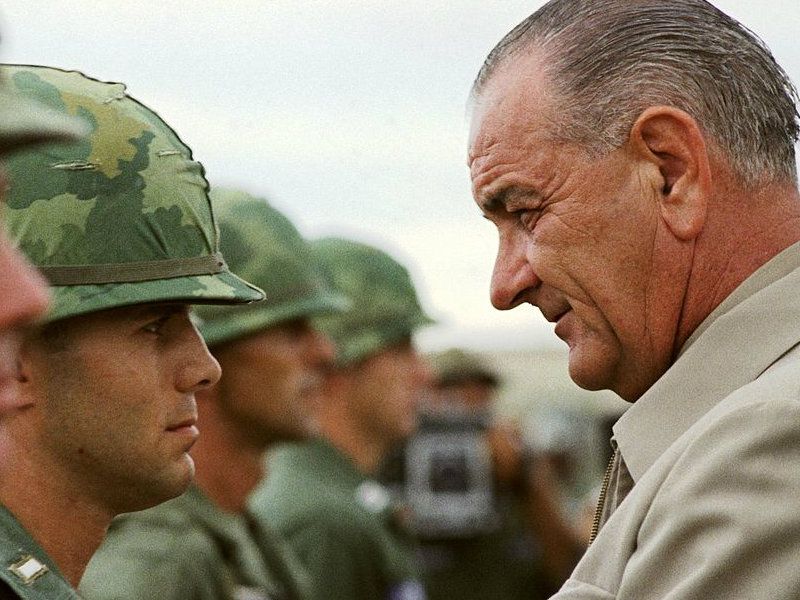

LBJ on entry into the Vietnam War

We are not about to send American boys nine or ten thousand miles away from home to do what Asian boys ought to be doing for themselves.

~ Lyndon Baines Johnson, 1964

~ Lyndon Baines Johnson, 1964

FDR on entry into World War II

I have said this before, but I shall say it again and again: Your boys are not going to be sent into any foreign wars.

~ Franklin D. Roosevelt, shortly before the election of 1940

~ Franklin D. Roosevelt, shortly before the election of 1940

Warren Buffett on economic forecasting

I've never made money on economic forecasting. I've made money by staying out of trouble.

~ Warren Buffett, as appeared on CNBC, March 3, 2008

~ Warren Buffett, as appeared on CNBC, March 3, 2008

Mar 2, 2008

Calvin Coolidge on living within your means

There is no dignity quite so impressive, and no independence quite so important, as living within your means.

~ Calvin Coolidge

~ Calvin Coolidge

|

| Calvin Coolidge (1923-1929) 1938 |

Subscribe to:

Posts (Atom)