~ John Hussman

Feb 28, 2020

John Hussman on bubbles

The problem with bubbles is that they force one to decide whether to look like an idiot before the peak, or an idiot after the peak.

~ John Hussman

~ John Hussman

Kevin Duffy on the popping of the everything bubble

It looks like we're finally out of road.

~ Kevin Duffy, February 28, 2020

~ Kevin Duffy, February 28, 2020

Warren Buffett on Berkshire Hathaway's 5.5% stake in Apple

[Apple is] probably the best business I know in the world.

~ Warren Buffett, interview with CNBC's Becky Quick, February 24, 2020

(AAPL closed that day at 298.18, valuing the company at $1.328 trillion.)

~ Warren Buffett, interview with CNBC's Becky Quick, February 24, 2020

(AAPL closed that day at 298.18, valuing the company at $1.328 trillion.)

Labels:

Apple,

Berkshire Hathaway,

people - Buffett; Warren

Warren Buffett on U.S. T-bonds

It makes no sense to lend money at 1.4% to the U.S. government, when it’s government policy to have 2% per year inflation. The government is telling you we’re going to give you 1.4% and tax you on it, and on the other hand we’re going to presumably devalue that money at 2% per year. So these are very unusual conditions.

~ Warren Buffett, interview with CNBC's Becky Quick, February 24, 2020

~ Warren Buffett, interview with CNBC's Becky Quick, February 24, 2020

Kevin Duffy on the everything bubble and sharp selloff from all-time highs

This will be very interesting to watch play out. I am clearly in the “everything bubble” camp, have been for some time.

Short-term we’re in panic mode and due for a bounce… at some point. But long-term, we’re just a week into unwinding the greatest financial bubble in history..

At the end of this bubble was a classic funneling into stocks like Amazon, Microsoft, Apple, Tesla… really the S&P 500 as fund flows went massively into passive U.S. funds the past 5 years. At the same time, we got what appears to be an anti-bubble in stocks that don’t neatly fit into the indexes. These stocks appear to be quite cheap, not just compared to their overvalued index cousins, but on an absolute basis. The real question – and it’s a question I’m asking myself: to what extent are the earnings of these companies a fiction because the global economy has been propped up by artificially low rates for a decade? Are these value traps? I don’t know the answer, but we’re about to find out.

One way to protect yourself from economic risk is to avoid highly cyclical companies. Another is to avoid those with high balance sheet leverage.

Gold has held up well while gold stocks are more volatile and act like stocks. Yesterday I think gold was basically flat while gold stocks sold off later in the day. I like both, but won’t be surprised by volatility. Keep in mind, we appear to be on the verge of a debt collapse which means investors (especially those who employed healthy doses of margin) will be liquidating assets to get a hold of scarce currency to pay off their creditors. At the end of the day, however, central bankers are hell-bent on printing much more of that currency. Many people are now in a position where they can be run over twice: first in a massive asset deflation, second by a hyperinflation.

We live in unprecedented times where everything in the everything bubble is magnified.

~ Kevin Duffy, note to friend, February 28, 2020

At the end of this bubble was a classic funneling into stocks like Amazon, Microsoft, Apple, Tesla… really the S&P 500 as fund flows went massively into passive U.S. funds the past 5 years. At the same time, we got what appears to be an anti-bubble in stocks that don’t neatly fit into the indexes. These stocks appear to be quite cheap, not just compared to their overvalued index cousins, but on an absolute basis. The real question – and it’s a question I’m asking myself: to what extent are the earnings of these companies a fiction because the global economy has been propped up by artificially low rates for a decade? Are these value traps? I don’t know the answer, but we’re about to find out.

One way to protect yourself from economic risk is to avoid highly cyclical companies. Another is to avoid those with high balance sheet leverage.

Gold has held up well while gold stocks are more volatile and act like stocks. Yesterday I think gold was basically flat while gold stocks sold off later in the day. I like both, but won’t be surprised by volatility. Keep in mind, we appear to be on the verge of a debt collapse which means investors (especially those who employed healthy doses of margin) will be liquidating assets to get a hold of scarce currency to pay off their creditors. At the end of the day, however, central bankers are hell-bent on printing much more of that currency. Many people are now in a position where they can be run over twice: first in a massive asset deflation, second by a hyperinflation.

We live in unprecedented times where everything in the everything bubble is magnified.

~ Kevin Duffy, note to friend, February 28, 2020

Feb 26, 2020

Leon Cooperman on the threat of Bernie Sanders or Elizabeth Warren as president

I don’t think the country is so leftist in its orientation that a Bernie Sanders or Elizabeth Warren will be elected president.

~ Leon Cooperman

Billionaire Leon, "Cooperman says he just ‘lost a lot of money’ in a selloff sparked by a ‘blemish’ on a ‘beautiful lady’," MarketWatch.com, February 26, 2020

~ Leon Cooperman

Billionaire Leon, "Cooperman says he just ‘lost a lot of money’ in a selloff sparked by a ‘blemish’ on a ‘beautiful lady’," MarketWatch.com, February 26, 2020

Jeff Bezos on change

I very frequently get the question: "What’s going to change in the next 10 years?" That’s a very interesting question.

I almost never get the question: "What’s not going to change in the next 10 years?" And I submit to you that that second question is actually the more important of the two.

~ Jeff Bezos

(As quoted by Ryan Krueger in "Driving Around the Change Machine," Krueger & Catalano blog

~ Jeff Bezos

(As quoted by Ryan Krueger in "Driving Around the Change Machine," Krueger & Catalano blog

Feb 22, 2020

Kevin Duffy on the passive bubble vs. active anti-bubble

Besides bonds, there is plenty of herding into private investments by the wealthy, especially venture capital and private equity. Away from the top 1%, the obvious crowding is into passive investing. After a decade when U.S. large cap stocks outperformed most active managers, the typical investor is pouring money into funds that mimic an index, like the S&P 500, that charge very little in fees.

While I applaud being frugal and holding active managers’ feet to the fire, the crowd is very likely looking in the rearview mirror at this point. In general, stocks in the S&P 500 have become quite expensive while many across the “index divide” are actually fairly cheap. The latter area is where we need to hunt for bargains.

~ Kevin Duffy, The Coffee Can Portfolio, February 18, 2020

While I applaud being frugal and holding active managers’ feet to the fire, the crowd is very likely looking in the rearview mirror at this point. In general, stocks in the S&P 500 have become quite expensive while many across the “index divide” are actually fairly cheap. The latter area is where we need to hunt for bargains.

~ Kevin Duffy, The Coffee Can Portfolio, February 18, 2020

Malcolm Forbes on inheritance

I made my money the old-fashioned way. I was very nice to a wealthy relative right before he died.

~ Malcolm Forbes

~ Malcolm Forbes

Malcolm Forbes on writing

Putting pen to paper lights more fire than matches ever will.

~ Malcolm Forbes

~ Malcolm Forbes

Malcolm Forbes on "all work and no play"

All work and no play makes jack. With enough jack, Jack needn't be a dull boy.

~ Malcolm Forbes

~ Malcolm Forbes

Dylan Grice on the skill set of central bankers

The only thing central banks are good at is blowing the bubbles that cause the crashes which are used to justify their existence.

Market prices only reflect fair value by accident and in passing.

~ Dylan Grice

Market prices only reflect fair value by accident and in passing.

~ Dylan Grice

Feb 19, 2020

Paul Samuelson on the 1990s

An intriguing paradox is that the 1990s isn't called a decade of greed.

~ Paul Samuelson

~ Paul Samuelson

Joe Nocera on the Michael Milken pardon

[O]f all the pardons handed out by Trump, I can’t think of one that is more deserved. In his best-selling book about Milken, “Den of Thieves,” James B. Stewart described the junk-bond king as being at the center of “the greatest criminal conspiracy the financial world has ever known.” Well, that’s certainly what Giuliani wanted people to think, but it was never true. Giuliani perp-walked executives whom he never ended up charging. He put firms out of business for no good reason. A number of his highly publicized convictions

were reversed on appeal.

As for Milken, he agreed to the plea bargain only after Giuliani indicted his brother and sent the FBI to interrogate his 92-year-old grandfather. Before sentencing, Judge Kimba Wood held an unusual hearing to allow prosecutors to lay out the case they would have brought had Milken gone to trial. It was far from a slam dunk; even Wood acknowledged that some of the testimony was ambiguous as to whether Milken had manipulated stock or committed insider trading. It was clear from the hearing that had Milken gone to trial, he had a decent chance of winning. Although Wood originally sentenced Milken to 10 years in prison, she eventually reduced it to two.

In her remarks before sentencing Milken, Wood noted that many of the letters she received said that Milken should be punished because

~ Joe Nocera, "Michael Milken Deserved a Pardon, But He Didn't Need One," Bloomberg.com, February 19, 2020

As for Milken, he agreed to the plea bargain only after Giuliani indicted his brother and sent the FBI to interrogate his 92-year-old grandfather. Before sentencing, Judge Kimba Wood held an unusual hearing to allow prosecutors to lay out the case they would have brought had Milken gone to trial. It was far from a slam dunk; even Wood acknowledged that some of the testimony was ambiguous as to whether Milken had manipulated stock or committed insider trading. It was clear from the hearing that had Milken gone to trial, he had a decent chance of winning. Although Wood originally sentenced Milken to 10 years in prison, she eventually reduced it to two.

In her remarks before sentencing Milken, Wood noted that many of the letters she received said that Milken should be punished because

We as a society must find those responsible for the alleged abuses of the 1980s, economic harm caused savings and loan associations, takeover targets and those allegedly injured by the issuance of junk bonds as well as by insider trading and other alleged abuses, and punish these criminals in proportion to the losses believed to have been suffered. These writers ask for a verdict on a decade of greed.Such sentiments, while understandable, could not be the basis for sentencing Milken, Wood concluded; she had to focus on the crimes to which he had pleaded guilty. And yet, it has always seemed to me that Milken was punished for these much broader transgressions.

~ Joe Nocera, "Michael Milken Deserved a Pardon, But He Didn't Need One," Bloomberg.com, February 19, 2020

Kevin Duffy on minimum wage laws

Wages, like any price, are determined by supply and demand. Not happy with what you're making? Develop skills where they're needed and difficult to develop (or even unpleasant). E.g., most younger people want cushy desk jobs so there is a shortage of trade skills. Really want to make a ton of money without getting a 4-year degree? Try underwater welding. Here's another skill that pays A LOT: simultaneous translation (very few people can do this).

Of course, you have to start somewhere and typically that begins with a low wage job. Heck, I remember working in an art gallery hanging paintings and sweeping the parking lot in high school. My brother flipped burgers at the local Burger King. Then we built a deck for our parents, developed some carpentry and design skills, and realized there was plenty of demand. Just like that, we were our own bosses, making decent money, and having all the work we could handle during the summers.

What happens when you impose a minimum wage? Does it give everyone below that wage a raise? Unless you can repeal the law of supply and demand, "no." You will instead make that employment agreement illegal, hurting the very people you purport to help, the relatively unskilled starting at the bottom and trying to gain skills so they can move up the economic ladder.

~ Kevin Duffy, Facebook response, February 18, 2020

Of course, you have to start somewhere and typically that begins with a low wage job. Heck, I remember working in an art gallery hanging paintings and sweeping the parking lot in high school. My brother flipped burgers at the local Burger King. Then we built a deck for our parents, developed some carpentry and design skills, and realized there was plenty of demand. Just like that, we were our own bosses, making decent money, and having all the work we could handle during the summers.

What happens when you impose a minimum wage? Does it give everyone below that wage a raise? Unless you can repeal the law of supply and demand, "no." You will instead make that employment agreement illegal, hurting the very people you purport to help, the relatively unskilled starting at the bottom and trying to gain skills so they can move up the economic ladder.

~ Kevin Duffy, Facebook response, February 18, 2020

Kevin Duffy on full employment and low wage growth

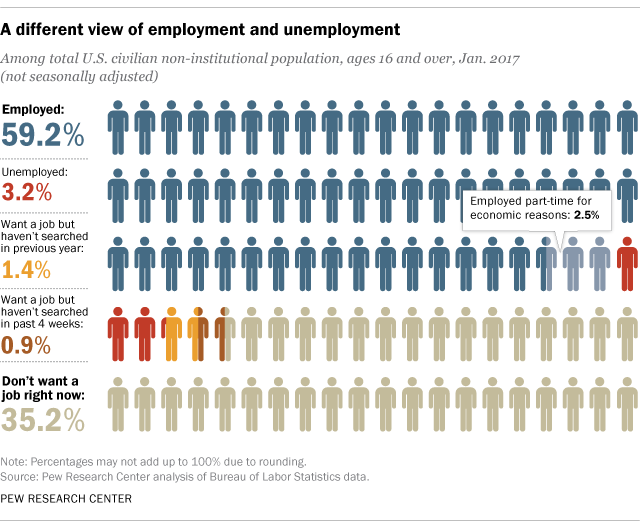

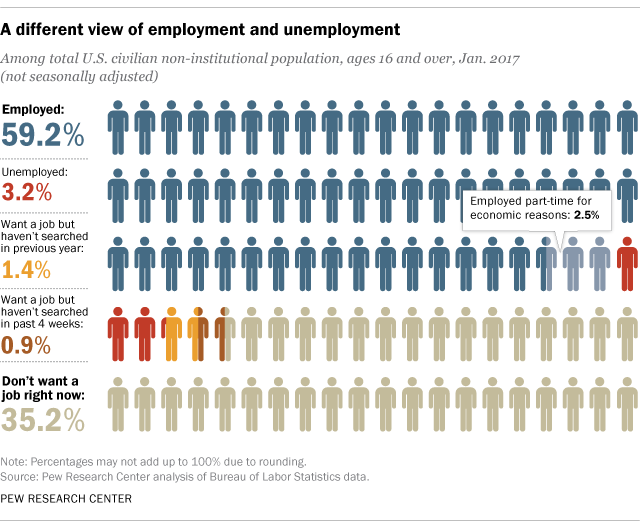

Q: Why do we have full employment, but very low wage growth?

A: No one can honestly answer this because the economy is too complex. Beware those who try to explain this with soundbites (like politicians). They're either liars or lying to themselves.

Economic principles are a different matter. These don't change. Beware economic explanations (and prescriptions) that fly in the face of economic principles.

Just because we can't know everything about an economy, doesn't mean we shouldn't try to learn what we can and speculate about different causes. Ok, the official unemployment rate is low. Why? Is this a good indication of the overall happiness that people have with their jobs? If so, why is Bernie Sanders so popular? I suspect there is a large segment of the population that is not happy with their economic situation.

Statistics often give a false sense of knowledge. The so-called labor participation rate is low, which means many people are simply not counted. Should they be? Are these people happily retired at an early age, living on welfare, living in a friend's basement, or earning a lucrative living in the black market?

On the other side, there are clearly a lot of employers who aren't happy. They have positions to fill, but can't find skilled workers. Tighter immigration policies that impact high-skilled workers may be exacerbating this situation. Our socialized education system is not helping.

Then there's this nasty thing call the boom-bust cycle. It happens when the central bank artificially lowers rates, causing asset bubbles and an unsustainable boom. Sound familiar? The official unemployment rates is ALWAYS low when this happens. That of course reverses with the bust.

It's complicated...

~ Kevin Duffy, answer to Facebook question, February 19, 2020

A: No one can honestly answer this because the economy is too complex. Beware those who try to explain this with soundbites (like politicians). They're either liars or lying to themselves.

Economic principles are a different matter. These don't change. Beware economic explanations (and prescriptions) that fly in the face of economic principles.

Just because we can't know everything about an economy, doesn't mean we shouldn't try to learn what we can and speculate about different causes. Ok, the official unemployment rate is low. Why? Is this a good indication of the overall happiness that people have with their jobs? If so, why is Bernie Sanders so popular? I suspect there is a large segment of the population that is not happy with their economic situation.

Statistics often give a false sense of knowledge. The so-called labor participation rate is low, which means many people are simply not counted. Should they be? Are these people happily retired at an early age, living on welfare, living in a friend's basement, or earning a lucrative living in the black market?

On the other side, there are clearly a lot of employers who aren't happy. They have positions to fill, but can't find skilled workers. Tighter immigration policies that impact high-skilled workers may be exacerbating this situation. Our socialized education system is not helping.

Then there's this nasty thing call the boom-bust cycle. It happens when the central bank artificially lowers rates, causing asset bubbles and an unsustainable boom. Sound familiar? The official unemployment rates is ALWAYS low when this happens. That of course reverses with the bust.

It's complicated...

~ Kevin Duffy, answer to Facebook question, February 19, 2020

Feb 18, 2020

Nick Gillespie on the big spending Trump administration

Last week, The New York Times published an eye-opening tally of how much more the federal government is spending on each of us since Donald Trump was elected president. "Total federal spending has increased by $1,441 per person since 2016,"... to a grand total of $14,652 per person per year. They came to their numbers by looking at actual federal outlays "for the 2016 fiscal year, adjusting for inflation and population changes" and comparing them to the budgeted amounts for the current fiscal year, which ends on September 30.

This revelation—which has generated a scant 45 comments as of this writing on five days after publication—should discomfit both Republicans and Democrats and conservatives and liberals/progressives. And it should absolutely enrage libertarians who believe in smaller government...

~ Nick Gillespie, "How Much More Should Trump be Spending on You?," Reason.com, February 16, 2020

This revelation—which has generated a scant 45 comments as of this writing on five days after publication—should discomfit both Republicans and Democrats and conservatives and liberals/progressives. And it should absolutely enrage libertarians who believe in smaller government...

~ Nick Gillespie, "How Much More Should Trump be Spending on You?," Reason.com, February 16, 2020

Feb 14, 2020

NY Fed's John Williams on the U.S. economy

[The U.S. economy is in a] very, very good place.

~ John Williams, New York Fed president, "New York Fed's Williams Sees Economy in 'Very, Very Good Place'," The New York Times, February 14, 2020

~ John Williams, New York Fed president, "New York Fed's Williams Sees Economy in 'Very, Very Good Place'," The New York Times, February 14, 2020

Feb 13, 2020

Fred Hickey on Apple's recent earnings release

Apple handily bested estimates with better than expected iPhone sales but weaker services growth ($400 million less than expected). On the conference call CEO Tim Cook was asked which services segments caused the shortfall. He avoided answering the analyst's question. It's important because Apple's services businesses are supposed to pick up the slack from the no growth (and highly competitive) smartphone market.

~ Fred Hickey, The High-Tech Strategist, February 4, 2020

~ Fred Hickey, The High-Tech Strategist, February 4, 2020

Doris Kearns-Goodwin on Abraham Lincoln's racial bigotry

Armies of scholars, meticulously investigating every aspect of [Lincoln's] life, have failed to find a single act of racial bigotry on his part.

~ Doris Kearns-Goodwin, Team of Rivals: The Political Genius of Abraham Lincoln, p. 207

~ Doris Kearns-Goodwin, Team of Rivals: The Political Genius of Abraham Lincoln, p. 207

Fred Hickey on Tesla's parabolic rise and $165 billion market cap

Tesla's insane stock price explosion is all about three things: money, momentum and mania. It has absolutely nothing to do with fundamentals. Even before this week's multi-hundred point upward explosion, Tesla's stock last week was "valued" by "investors" (speculators) at more than the stock values of the entire U.S. domestic auto industry (GM, Ford and Fiat-Chrysler) combined...

TSLA's stock is currently valued at $165 billion. For comparison purposes, Ford Motor is valued at $36 billion, General Motors at $49 billion, and Fiat-Chrysler at $26 billion. Germany's Volkswagen (which delivered almost 11 million cars in 2019 versus Tesla's 370,000) is at $92 billion - a valuation 44% less than the great money-losing Tesla.

~ Fred Hickey, The High-Tech Strategist, February 4, 2020

TSLA's stock is currently valued at $165 billion. For comparison purposes, Ford Motor is valued at $36 billion, General Motors at $49 billion, and Fiat-Chrysler at $26 billion. Germany's Volkswagen (which delivered almost 11 million cars in 2019 versus Tesla's 370,000) is at $92 billion - a valuation 44% less than the great money-losing Tesla.

~ Fred Hickey, The High-Tech Strategist, February 4, 2020

Feb 12, 2020

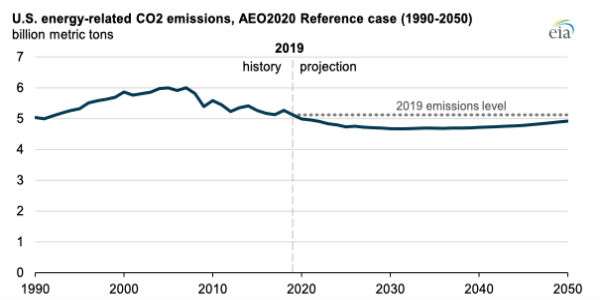

Ronald Bailey on falling carbon emissions in the U.S.

Overall carbon dioxide emissions from the U.S. energy sector peaked at 5.9 gigatons in 2007 and have now dropped 19 percent to 4.8 gigatons in 2019.

~ Ronald Bailey, "Peak Carbon Emissions?," Reason.com, February 12, 2020

~ Ronald Bailey, "Peak Carbon Emissions?," Reason.com, February 12, 2020

Jim Grant on liquidity

Liquidity is a psychological construct, perhaps as much as an arithmetic one. Without a minimum quotient of speculative hope, even objectively liquid markets can malfunction. It's confidence - in the future, in the dollar, in "the authorities," in the earning power of a business, in something or other - that makes the waters run... In the dollar world, the fount of liquidity is the Federal Reserve... Of course, the Fed merely proposes. It's the "markets" - people changing their minds about price and value and buying and selling, lending and borrowing, accordingly - that dispose.

~ Jim Grant, "Gale-force liquidity," Grant's Interest Rate Observer, February 7, 2020

~ Jim Grant, "Gale-force liquidity," Grant's Interest Rate Observer, February 7, 2020

Labels:

confidence,

Federal Reserve,

liquidity,

people - Grant; Jim,

speculation

Peter Atwater on manic behavior: The Beatles, Beanie Babies and Tesla

Many will suggest that manias and panics routinely come and go, but history strongly cautions that they cluster. The Beanie Baby Bubble coincided with the peak of the dot.com bubble, and Beatlemania marked the mid-1960s market and mood peaks...

While Tesla may be followed by an even more extreme investor flash mob ahead, the recent clustering of manic behavior cautions not only that sentiment is topping, but that the current peak is extreme. Based on crowd behavior, 2020 could easily bookend the major 2011 low.

~ Peter Atwater, Financial Insyghts, "Tesla: A Flash Mob With Money," February 10, 2020

While Tesla may be followed by an even more extreme investor flash mob ahead, the recent clustering of manic behavior cautions not only that sentiment is topping, but that the current peak is extreme. Based on crowd behavior, 2020 could easily bookend the major 2011 low.

~ Peter Atwater, Financial Insyghts, "Tesla: A Flash Mob With Money," February 10, 2020

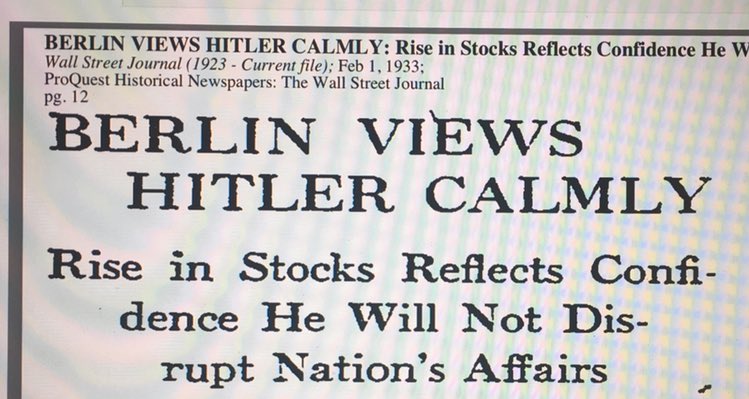

Wall Street Journal: "Rise in stocks reflects confidence in Hitler" (1933)

Headline: Berlin views Hitler calmly; rise in stocks reflects confidence he will not disrupt nation's affairs

~ Wall Street Journal, February 1, 1933

~ Wall Street Journal, February 1, 1933

Robert Murphy on the warlord objection to anarcho capitalism

When dealing with the warlord objection, we need to keep our comparisons fair. It won’t do to compare society A, which is filled with evil, ignorant savages who live under anarchy, with society B, which is populated by enlightened, law-abiding citizens who live under limited government. The anarchist doesn’t deny that life might be better in society B. What the anarchist does claim is that, for any given population, the imposition of a coercive government will make things worse. The absence of a State is a necessary, but not sufficient, condition to achieve the free society.

[...]

The standard objection that anarchy would lead to battling warlords is unfounded. In those communities where such an outcome would occur, the addition of a State wouldn’t help. Indeed, the precise opposite is true: The voluntary arrangements of a private property society would be far more conducive to peace and the rule of law, than the coercive setup of a parasitical monopoly government.

~ Robert Murphy, "But Wouldn't Warlords Take Over?," Mises.org, July 7, 2005

[...]

The standard objection that anarchy would lead to battling warlords is unfounded. In those communities where such an outcome would occur, the addition of a State wouldn’t help. Indeed, the precise opposite is true: The voluntary arrangements of a private property society would be far more conducive to peace and the rule of law, than the coercive setup of a parasitical monopoly government.

~ Robert Murphy, "But Wouldn't Warlords Take Over?," Mises.org, July 7, 2005

Feb 11, 2020

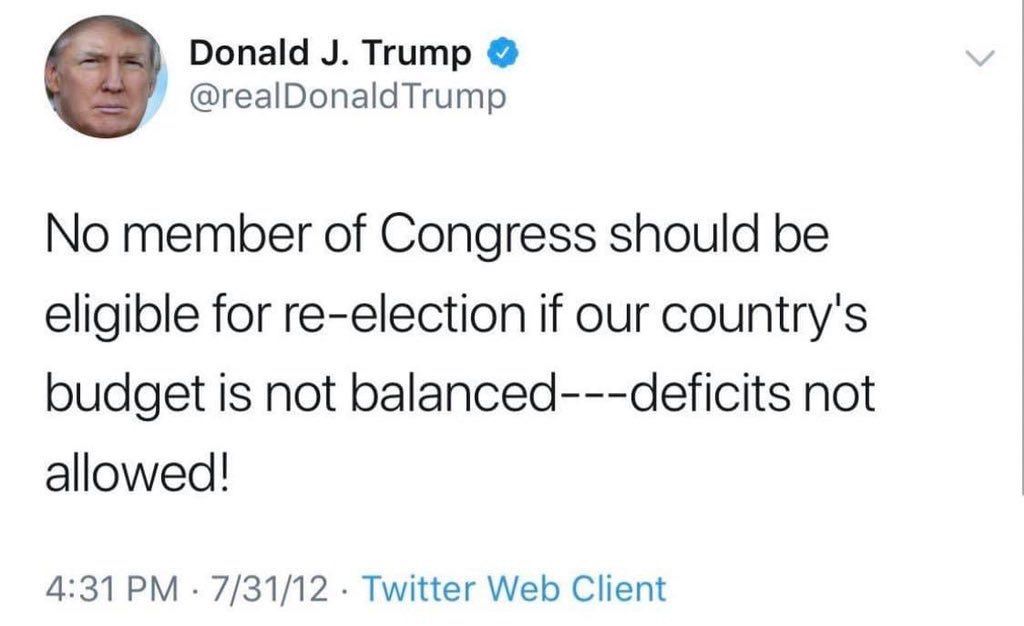

Donald Trump on budget deficits

No member of Congress should be eligible for re-election if our country's budget is not balanced --- deficits not allowed!

~ Donald Trump, Twitter, July 31, 2012

(The federal budget deficit was $586 billion when Trump was inaugurated president in January, 2017. Today it stands at $1.022 trillion.)

~ Donald Trump, Twitter, July 31, 2012

(The federal budget deficit was $586 billion when Trump was inaugurated president in January, 2017. Today it stands at $1.022 trillion.)

Jordan Peterson on individual rights

I've been trying to identify 100 percent truths, let's say, that sit at the bottom of our societies. And one of the things that I believe to be true is that the individual is properly sovereign. I believe is as true as any idea that human beings have ever come up with.

~ Jordan Peterson, "The HIDDEN TRUTH About Politics," 9:00 mark, YouTube, February 10, 2020

~ Jordan Peterson, "The HIDDEN TRUTH About Politics," 9:00 mark, YouTube, February 10, 2020

Feb 10, 2020

Jeffrey Tucker on the discovery process

But what kind of society do we need in order to maximize the potential of this form of spontaneous development of individuals and societies? A society hobbled by preset agendas emanating from fixed regulations and laws presume the opposite of a trial-and-error society. They indulge the illusion of knowledge, the myth of certainty, the fantasy that a static order with known solutions can be forced on everyone.

~ Jeffrey Tucker, "Shakira’s Musical Disquisition on Uncertainty, Creativity, and Entrepreneurship," American Institute For Economic Research, February 4, 2020

~ Jeffrey Tucker, "Shakira’s Musical Disquisition on Uncertainty, Creativity, and Entrepreneurship," American Institute For Economic Research, February 4, 2020

Feb 9, 2020

Kevin Duffy on exploitation

Quora: How do libertarians address the issue of exploitation?

Duffy: Libertarians differ from most when addressing the issue of exploitation in two fundamental ways. First, they view exchange at the individual level vs. the abstract level. E.g., the “U.S.” doesn’t trade with “China.” Apple engages in various exchanges with Chinese employees, suppliers, consumers and shareholders. Second, they focus on the nature of the exchange. Is it coerced or voluntary? If coerced, exploitation exists; one party benefits at the expense of the other. If voluntary, both parties enter into the exchange because they expect to benefit. The operative word, of course, is “expect.” There are no guarantees and people often look back at decisions with regret. All part of the learning process. The future is uncertain and always will be.

Through the libertarian lens, what are some examples of exploitation? At the individual level, the answer is clear: rape, murder, robbery, fraud.

Greedy capitalists

What about at the abstract level? Do "greedy capitalists" exploit "helpless workers?" As long as no one is putting a gun to anyone’s head, no. If an employer and employee agree to an exchange, both parties expect to benefit. The employer prefers the labor services of the employee over the wage he’s willing to pay. The employee prefers the money he receives above the time spent doing the work. Win-win. If either party feels they are no longer benefiting, they are free to walk away (unless there is a contract that commits both to a certain amount of time).

Trade deficit with China

Is China exploiting the U.S. because they run a large trade surplus? Again, no. Since the exchanges involved are all voluntary, they must be mutually beneficial. Apple sells iPhones to Chinese consumers. Apple receives money (they have a money surplus and goods deficit) while the buyer receives an iPhone (they have a money deficit and goods surplus). Walmart buys products from Chinese suppliers. Even though they run a money deficit, they do so willingly… because they benefit. Walmart's Chinese suppliers run money deficits with their employees. Again, both parties benefit. Trade surpluses and deficits are an accounting fiction. Do you worry about running a chronic trade deficit with your local grocery store?

Sweatshops

Does a multinational firm setting up a factory in a poor country exploit its workers? If entered into freely and peacefully, the exchange only takes place if both parties benefit. E.g., if Nike builds a sneaker factory in Bangladesh, they must make the wages and work environment enticing enough to attract workers from their current jobs. They have to give them a better deal. They have to improve their lives. Some call this “unfair.” Libertarians call it heroic.

Taxation

How does a libertarian judge taxation? Is this a voluntary, mutually beneficial exchange or is it coercive and exploitative? The question answers itself.

~ Kevin Duffy, Quora answer, February 9, 2020

Duffy: Libertarians differ from most when addressing the issue of exploitation in two fundamental ways. First, they view exchange at the individual level vs. the abstract level. E.g., the “U.S.” doesn’t trade with “China.” Apple engages in various exchanges with Chinese employees, suppliers, consumers and shareholders. Second, they focus on the nature of the exchange. Is it coerced or voluntary? If coerced, exploitation exists; one party benefits at the expense of the other. If voluntary, both parties enter into the exchange because they expect to benefit. The operative word, of course, is “expect.” There are no guarantees and people often look back at decisions with regret. All part of the learning process. The future is uncertain and always will be.

Through the libertarian lens, what are some examples of exploitation? At the individual level, the answer is clear: rape, murder, robbery, fraud.

Greedy capitalists

What about at the abstract level? Do "greedy capitalists" exploit "helpless workers?" As long as no one is putting a gun to anyone’s head, no. If an employer and employee agree to an exchange, both parties expect to benefit. The employer prefers the labor services of the employee over the wage he’s willing to pay. The employee prefers the money he receives above the time spent doing the work. Win-win. If either party feels they are no longer benefiting, they are free to walk away (unless there is a contract that commits both to a certain amount of time).

Trade deficit with China

Is China exploiting the U.S. because they run a large trade surplus? Again, no. Since the exchanges involved are all voluntary, they must be mutually beneficial. Apple sells iPhones to Chinese consumers. Apple receives money (they have a money surplus and goods deficit) while the buyer receives an iPhone (they have a money deficit and goods surplus). Walmart buys products from Chinese suppliers. Even though they run a money deficit, they do so willingly… because they benefit. Walmart's Chinese suppliers run money deficits with their employees. Again, both parties benefit. Trade surpluses and deficits are an accounting fiction. Do you worry about running a chronic trade deficit with your local grocery store?

Sweatshops

Does a multinational firm setting up a factory in a poor country exploit its workers? If entered into freely and peacefully, the exchange only takes place if both parties benefit. E.g., if Nike builds a sneaker factory in Bangladesh, they must make the wages and work environment enticing enough to attract workers from their current jobs. They have to give them a better deal. They have to improve their lives. Some call this “unfair.” Libertarians call it heroic.

Taxation

How does a libertarian judge taxation? Is this a voluntary, mutually beneficial exchange or is it coercive and exploitative? The question answers itself.

~ Kevin Duffy, Quora answer, February 9, 2020

Labels:

exploitation,

libertarianism,

people - Duffy; Kevin,

Quora,

trade,

trade deficit

Feb 8, 2020

Athletes and Coaches

Baseball:

Football:

- Berra, Yogi (May 12, 1925 - Sep 22, 2015)

- Clemens, Roger (Aug 4, 1962 - ?)

- Ruth, George Herman "Babe" (Feb 6, 1895 - Aug 16, 1948)

- Barkley, Charles (Feb 20, 1963 - ?)

- Bryant, Kobe (Aug 23, 1978 - Jan 26, 2020)

- Jordan, Michael (Feb 17, 1963 - ?)

- O'Neal, Shaquille (Mar 6, 1972 - ?)

- Olajuwon, Hakeem (Jan 21, 1963 - ?)

Boxing:

- Ali, Muhammad (Jan 17, 1942 - Jun 6, 2016)

- Lombardi, Vince (Jun 11, 1913 - Sep 3, 1970)

- Madden, John (Apr 10, 1936 - ?)

Golf:

- Woods, Tiger (Dec 30, 1975 - ?)

Tennis:

- Evert, Chris (Dec 21, 1954 - ?)

Jane Lancaster on W.T. Sherman's lessons from the Second Seminole War

Sherman gradually developed his own ideas about war. He thought that the War Department should fill Florida with troops, declare martial law, and fight to exterminate the enemy. According to Sherman, this was the most economical plan.

~ Jane F. Lancaster, "William Tecumseh Sherman's Introduction to War, 1840-1842: Lesson for Action," Florida Historical Quarterly, 72: 1 (July 1993), pp. 65-66

(as cited by Joseph Stromberg, "Sherman in the Swamp," LewRockwell.com, February 21, 2003)

~ Jane F. Lancaster, "William Tecumseh Sherman's Introduction to War, 1840-1842: Lesson for Action," Florida Historical Quarterly, 72: 1 (July 1993), pp. 65-66

(as cited by Joseph Stromberg, "Sherman in the Swamp," LewRockwell.com, February 21, 2003)

Tom DiLorenzo on Whig Party hatred towards John Tyler

John Tyler also became the first president to be subjected to Articles of Impeachment, which were filled with rather hilarious political bluster. He was accused of “arbitrary and despotic abuse of the veto power”; “open hostility to the Legislative department of the Government,” as though that was a bad thing; and “vacillation, weakness, and folly,” among other absurdities. The Articles of Impeachment were ultimately rejected.

You know John Tyler was a good man, and that Ivan Eland [author of Recarving Rushmore] is probably spot on in ranking him as America’s best president (he reduced the size of the army by one-third, among other things) since he elicited the hatred of such a cabal of political gangsters, rent seekers, idiots and tyrants led by Lincoln’s “beau ideal of a statesman” Henry Clay.

~ Tom DiLorenzo, "The President Who Was Expelled from His Own Party," LewRockwell.com, February 8, 2020

You know John Tyler was a good man, and that Ivan Eland [author of Recarving Rushmore] is probably spot on in ranking him as America’s best president (he reduced the size of the army by one-third, among other things) since he elicited the hatred of such a cabal of political gangsters, rent seekers, idiots and tyrants led by Lincoln’s “beau ideal of a statesman” Henry Clay.

~ Tom DiLorenzo, "The President Who Was Expelled from His Own Party," LewRockwell.com, February 8, 2020

John Tyler on vetoing Henry Clay's bank bill

The power of Congress to create a national bank to operate over the Union has been a question of dispute from the origin of the Government.... [M]y own opinion has been uniformly proclaimed to be against the exercise of any such power by this Government.

~ John Tyler, 10th president, August 16, 1841

~ John Tyler, 10th president, August 16, 1841

|

| John Tyler (1841-1845) 1938 |

Tom DiLorenzo on president John Tyler's place in history

In his book Recarving Rushmore: Ranking the Presidents on Peace, Prosperity, and Liberty, Ivan Eland ranked John Tyler as the best American president of all time. (The Marxist Left that dominates the American academic history profession usually ranks him near the bottom). Eland’s ranking is so at odds with the hard-Left history profession because their criteria give higher scores to presidents who spend and tax the most, consolidate the most power in Washington, D.C., oppress civil liberties the most, centrally plan the economy the most, and are the most belligerent in foreign wars. Hence, Lincoln, FDR, and Wilson have long been at the top of their ratings (although Wilson is recently out of favor after the historians finally acknowledged that he re-segregated the U.S. military).

~ Tom DiLorenzo, "The President Who Was Expelled from His Own Party," LewRockwell.com, February 8, 2020

~ Tom DiLorenzo, "The President Who Was Expelled from His Own Party," LewRockwell.com, February 8, 2020

Feb 7, 2020

Kevin Peraino on Lincoln's foreign policy

Q:

I know this is almost an impossible task, but if you had to describe it, what’s the Lincoln Doctrine?

A: Lincoln said it himself: “One war at a time.” And I think that’s the bumper sticker for Lincoln. He just didn’t want to do anything during the Civil War that was going to make his job at home more difficult.

That’s how he led the country, and set the stage for American power in the decades since.

~ Kevin Peraino, historian, "How Abraham Lincoln's foreign policy helped win the Civil War," Vox, February 18, 2019

/cdn.vox-cdn.com/uploads/chorus_image/image/63060545/2642896.jpg.0.jpg)

A: Lincoln said it himself: “One war at a time.” And I think that’s the bumper sticker for Lincoln. He just didn’t want to do anything during the Civil War that was going to make his job at home more difficult.

That’s how he led the country, and set the stage for American power in the decades since.

~ Kevin Peraino, historian, "How Abraham Lincoln's foreign policy helped win the Civil War," Vox, February 18, 2019

/cdn.vox-cdn.com/uploads/chorus_image/image/63060545/2642896.jpg.0.jpg)

Boris Johnson makes the case for global free trade

This country is leaving its chrysalis. We are reemerging after decades of hibernation as a campaigner for global free trade. And frankly it is not a moment too soon. Because the argument for this fundamental liberty is now not being made. We in the global community are in danger of forgetting the insights of those great Scottish thinkers: the invisible hand of Adam Smith, and of course David Ricardo's more subtle, but indispensable, principle of comparative advantage, which teaches that if countries learn to specialize and exchange, then overall wealth will increase and productivity will increase, leading [Richard] Cobden to conclude that,

~ Boris Johnson, U.K. prime minister, "Boris Johnson threatens to collapse Brexit trade talks if EU insist we stick by their rules," 3:00 mark, YouTube, February 3, 2020

free trade is God's diplomacy, the only certain way of uniting people in the bonds of peace, since the more freely goods borders, the less likely it is that troops will ever cross borders.And since these notions were born here in this country, it has been free trade that has done more than any other single economic idea to raise billions out of poverty and incredibly fast.

~ Boris Johnson, U.K. prime minister, "Boris Johnson threatens to collapse Brexit trade talks if EU insist we stick by their rules," 3:00 mark, YouTube, February 3, 2020

Feb 6, 2020

Joe Dugan on Babe Ruth

To understand him, you had to understand this: he wasn't human.

~ Joe Dugan, teammate

~ Joe Dugan, teammate

Babe Ruth on the game of baseball

I won't be happy until we have every boy in America between the ages of six and sixteen wearing a glove and swinging a bat.

~ Babe Ruth

~ Babe Ruth

Tris Speaker on Babe Ruth's future (1921)

Ruth made a grave mistake when he gave up pitching. Working once a week, he might have lasted a long time and become a great star.

~ Tris Speaker, 1921

~ Tris Speaker, 1921

Babe Ruth on earning more than the president

I know, but I had a better year than Hoover.

~ Babe Ruth

(Reported reply when a reporter objected that the salary Ruth was demanding - $80,000 - was more than that of President Herbert Hoover's.)

~ Babe Ruth

(Reported reply when a reporter objected that the salary Ruth was demanding - $80,000 - was more than that of President Herbert Hoover's.)

Subscribe to:

Posts (Atom)